Bitcoin Price Forecast: BTC remains in a strong bullish rally according to history

- Bitcoin price has seen a correction but remains in a bull rally according to previous trends.

- BTC could continue dropping in the short term.

- The cryptocurrency market has shifted its momentum toward the bears.

Bitcoin has been under consolidation for the past week after a massive rally to its new all-time high of $64,829. The digital asset continues trading above two robust support levels on the weekly chart.

Bitcoin price will most likely continue trending higher

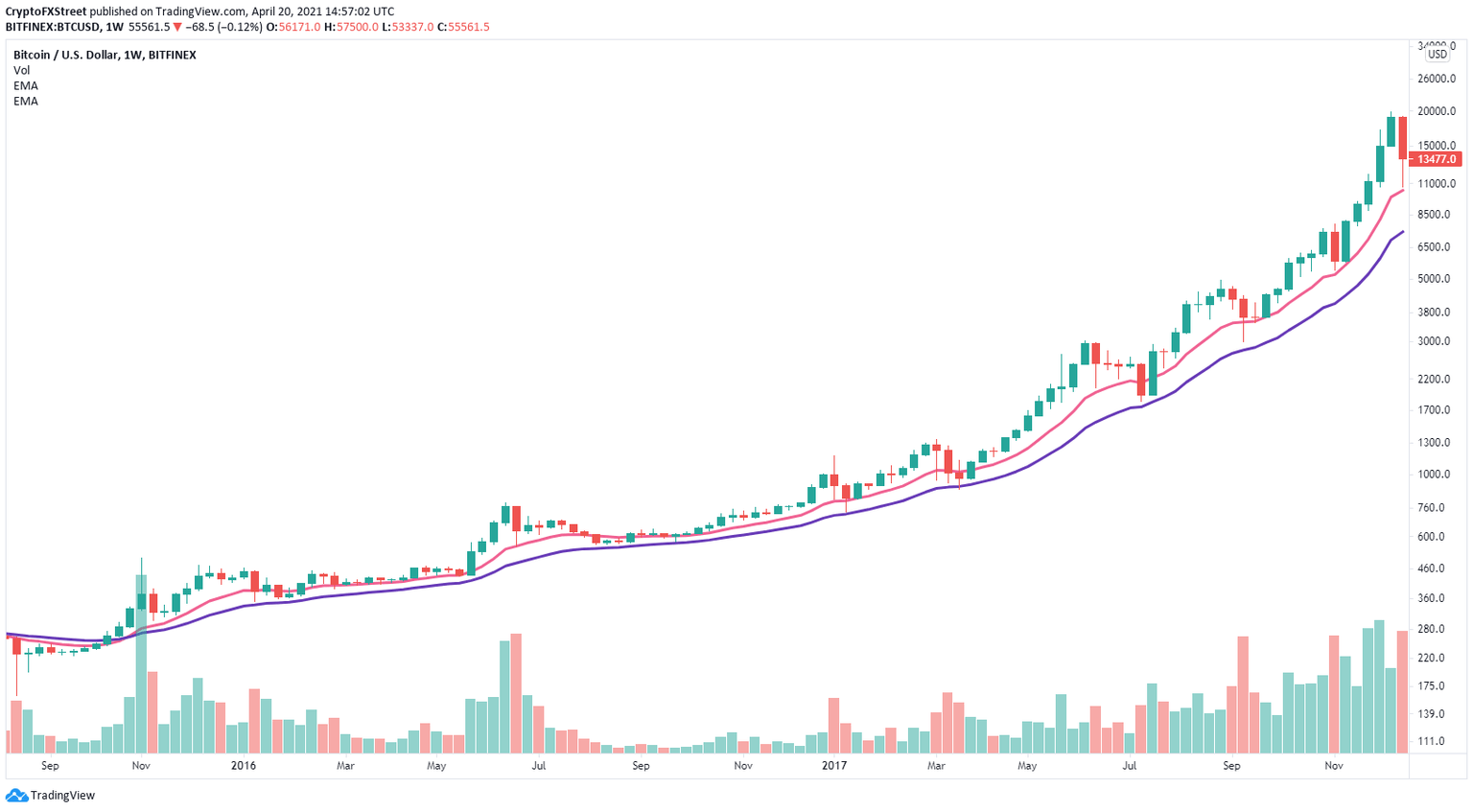

One of the most significant indicators of the previous bull rally was the 12-EMA and the 26-EMA levels on the weekly chart. Throughout the three-year bull rally, these two EMAs were significant support levels from which Bitcoin price rebounded several times.

The 12-EMA was lost several times, however, the 26-EMA held until the end of the run at the beginning of 2018.

BTC/USD weekly chart

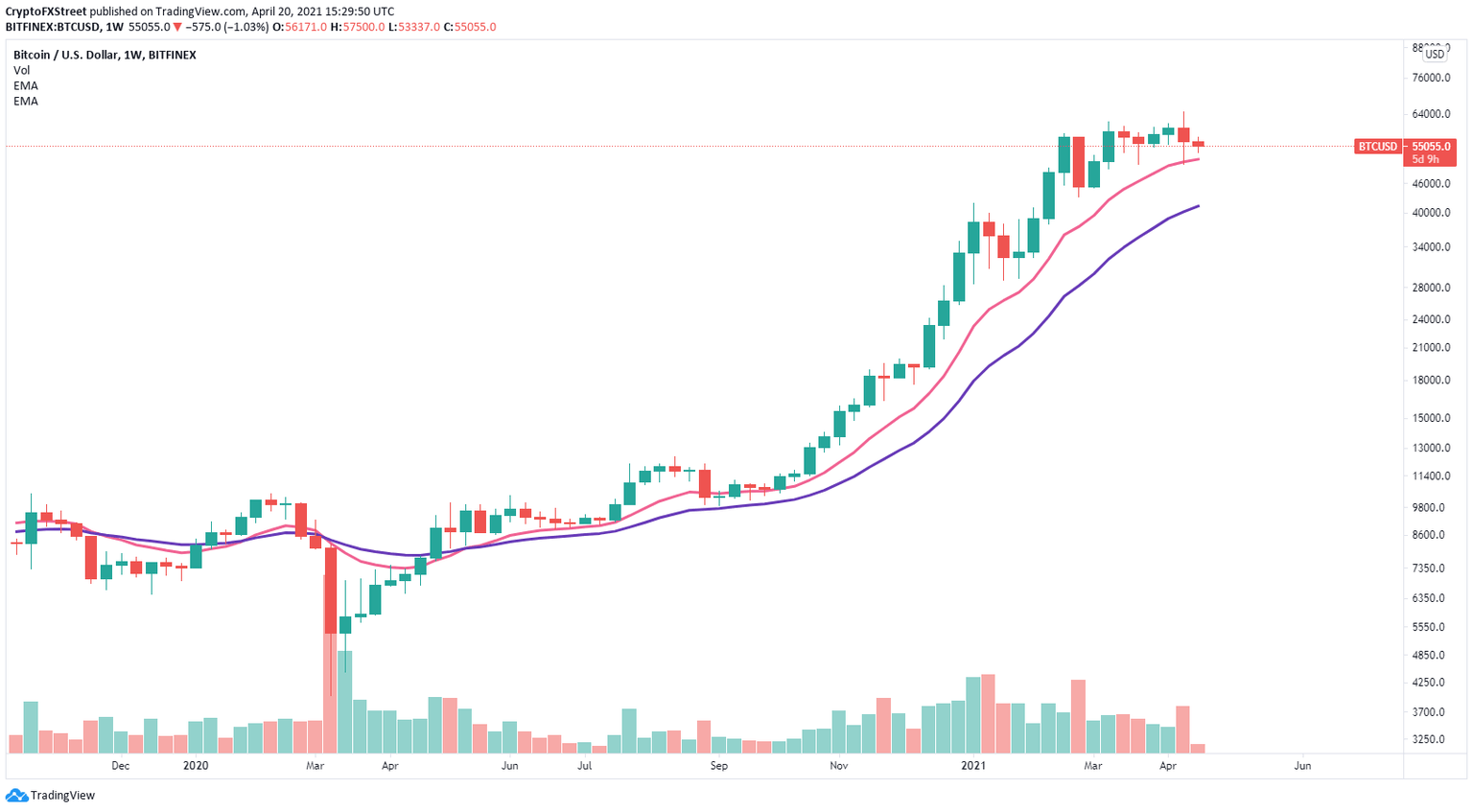

The most recent Bitcoin fall was around 20%, but the digital asset only managed to briefly touch the 12-EMA and bounced back up. The 26-EMA is currently located at $41,400 which is still 24% away from the current price.

As long as BTC holds the 26-EMA, the rally should remain stable but there is still a lot of room for the bears to push the flagship cryptocurrency further down.

BTC/USD weekly chart

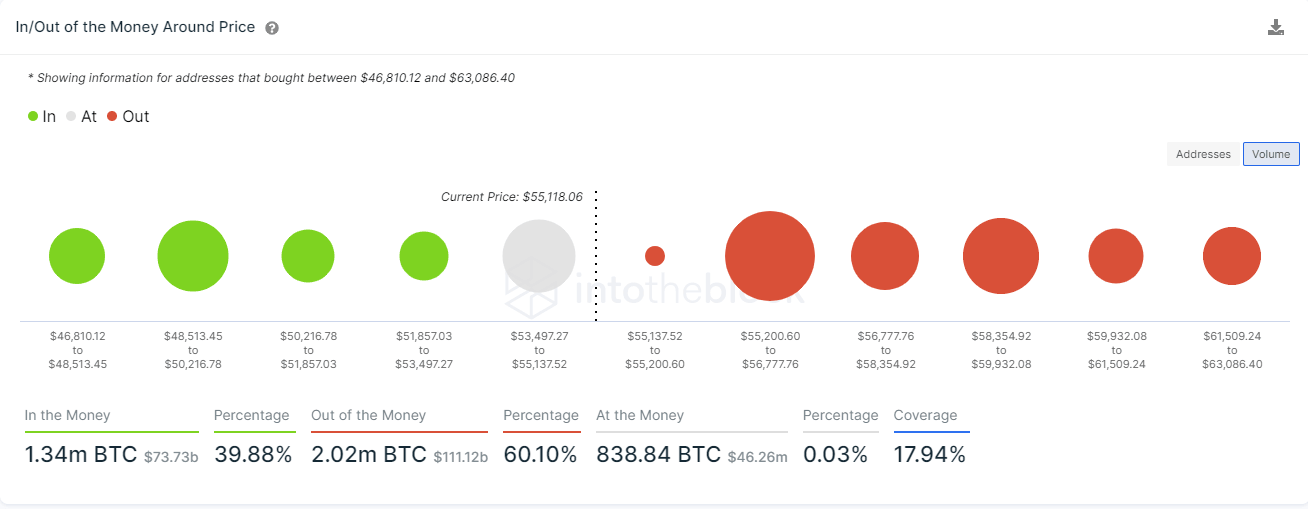

The In/Out of the Money Around Price (IOMAP) chart shows steep resistance above $55,200 but lower support below in comparison.

BTC IOMAP chart

The next potential bearish price target would be the area between $48,513 and $50,217 where 565,460 purchased 400,000 BTC. This range will pose a great threat to the bulls as it can absorb a lot of selling pressure.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.