Bitcoin and altcoins recover from DeepSeek shock to AI, crypto

- Bitcoin and cryptocurrency market capitalization recover, back above $3.614 trillion on Tuesday.

- DeepSeek jolted the crypto and AI market over the weekend, triggering a sell-off in major US tech stocks on Monday.

- AI category of crypto tokens, Internet Computer Protocol, Bittensor and Akash Network, recovered in the past 24 hours.

Bitcoin (BTC), Artificial Intelligence (AI) category of crypto tokens and United States (US) tech stocks corrected on Tuesday as traders digested the future implications of China’s DeepSeek release. DeepSeek app was the most downloaded free app on Apple’s US App Store over the weekend of its launch.

The AI chatbot set its sights on the competition, US-based OpenAI’s ChatGPT and its latest releases, ushering a correction in tokens within the Artificial Intelligence category.

Experts highlight two key concerns that catalyzed a crypto bloodbath: the $6 million investment and short timeframe of DeepSeek’s build, and the fact that it has been released as an open source.

Even as OpenAI boss Sam Altman’s Humanity Protocol recently closed a $20 million funding round and raised its valuation to $1.1 billion, its Worldcoin (WLD) token erased over 8% value on Tuesday and noted over 21% decline in the past month.

Bitcoin and AI tokens eye recovery in the aftermath of DeepSeek release

Bitcoin slipped on Monday to a low of $97,777 for the first time since mid-January 2025 as crypto traders digested the news of China’s $6 million open-source AI chatbot rollout. Bitcoin’s market capitalization is back above $2.02 trillion and BTC added nearly 2.5% to its value in the past 24 hours.

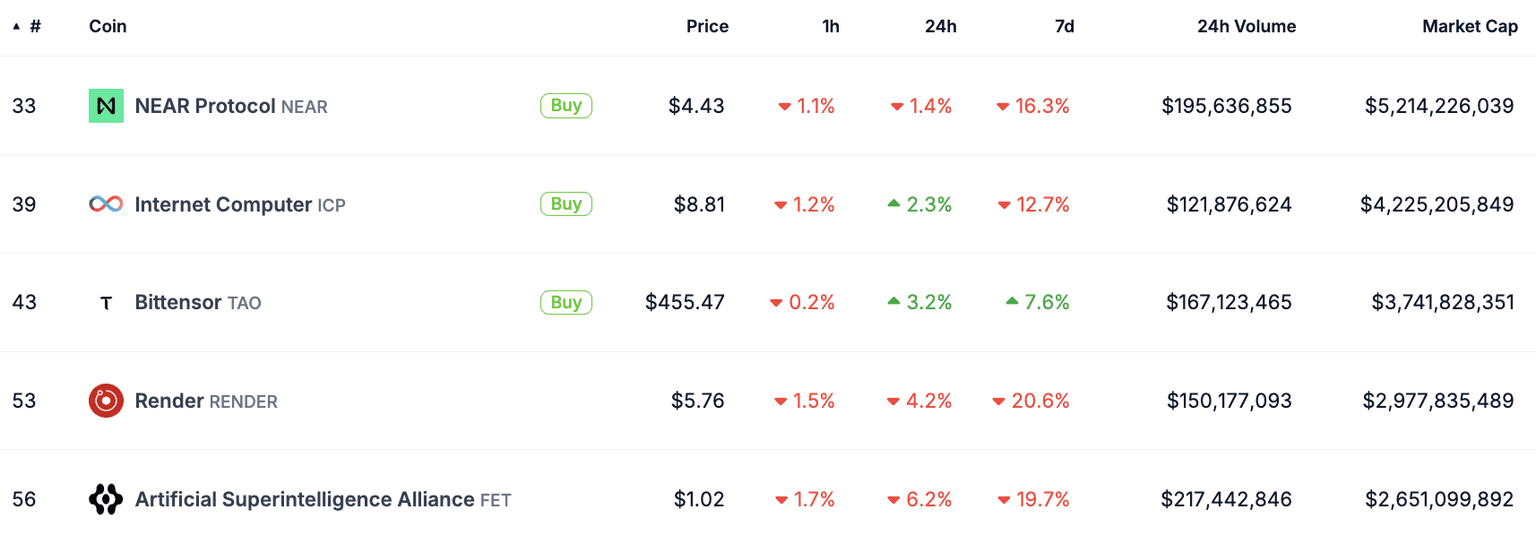

Although AI coins’ market capitalization erased 8% in the last 24 hours, the metric hovered above $37 billion on Tuesday. Three of the top five AI tokens recovered from the correction in the past 24 hours, according to CoinGecko data.

Top 5 AI tokens on CoinGecko

Experts comment on DeepSeek’s reality check to Bitcoin, tech stocks

Kevin Surace, CEO of Appvance, told FXStreet in an exclusive interview:

"Deepseek R1 took only two months and less than $6 million to build and it is outperforming almost all other models which took billions to build. This is mind-blowing to everyone who has developed the current best-in-class models. And it is challenging us today. This is a state-of-the-art model that outperforms years of effort in the US. Any China-backed model provides an unfair advantage. But at a total cost of only $6M, the advantage here isn’t that the government helped to fund it. It’s that the model is so good for being created in months at a thousandth of the cost of the major players. That is mind-blowing."

Surace identifies the low cost of training the Large Language Model (LLM) as one of the key reasons for its popularity.

Forest Bai, Co-founder of Foresight Ventures, shared insights on the stock fund behind the release of DeepSeek:

"A quantitative stock fund in China has released one of the most powerful large language models in the world. However, this quant company is not the best-performing quantitative fund in the Chinese stock market, and its returns were negative during 2022-2023.

It goes to show just how challenging it is to navigate China's stock market. And it was just an example of how even a good company is hard to receive positive feedback in the Chinese stock market. DeepSeek R1 is a versatile and accurate AI model however it has limitations such as a knowledge cutoff, potential biases, and challenges with long-context conversations."

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.