Equities report: DeepSeek the new AI company on the block

The S&P 500 and NASDAQ 100, have sharply declined during Monday’s trading session. We note that there are significant financial releases stemming from the US this week, in addition to the Fed’s interest rate decision which is set to occur tomorrow. In this report, we will focus on the recent developments surrounding DeepSeek in addition to discussing the Fed’s interest rate decision tomorrow and for a rounder view we provide a technical analysis of the S&P 500’s daily chart.

DeepSeek, the disruptor of the AI world

DeepSeek is a Chinese company that has dominated the airwaves the past few days and has been dubbed as the ChatGPT killer .The company has skyrocketed in popularity after the company launched its free AI assistant last week. The AI model created by DeepSeek is allegedly on par with one of ChatGPT’s models and has flung the US Equities markets into a frenzy, as the DeepSeek AI model was allegedly created for under 6 million dollars, whereas companies such as OpenAI, Microsoft, and Google are currently spending billions in comparison. Needless to say, the announcement of DeepSeek’s AI assistant has caused widespread concern over the US tech sector and their perceived AI dominance, which in turn appears to have weighed specifically on US tech stocks such as NVIDIA which lost roughly $600 billion in market capitalization. NVIDIA’s sell-off during Monday’s trading session has been described as the largest intraday single-stock decline in history and could re-ignite the debate over whether or not we are in an AI bubble. In turn, companies such as Microsoft , Meta and Intel which are set to release their earnings report this week, may face heightened scrutiny from investors for their AI expenditure and profit margins. Hence, in our view we would not be surprised to see tech companies shy away from announcing heavy capital expenditure sums for AI developments in their earnings calls and potentially focusing on frameworks to increase AI profitability margins. In conclusion, the increased competition in the US tech sector may be beneficial in the long run, yet could weigh on the overall tech sector in the short-medium run. Moreover, We should note, that we remain slightly skeptical over the costs incurred by DeepSeek to develop their model.

Fed decision tomorrow

The Fed’s interest rate decision is set to occur tomorrow. The majority of market participants are currently anticipating the bank to remain on hold in their meeting tomorrow, with Fed Fund Futures currently implying a 99.5% probability for such a scenario to materialize. The market also seems to expect the bank to proceed with a rate cut in the June meeting with a second rate cut potentially occurring in October. Nonetheless, with the market’s having almost fully priced in a ‘hold’ by the bank, our attention turns to the bank’s accompanying statement, in addition to Fed Chair Powell’s presser following the decision. Should Powell’s press conference and accompanying statement be interpreted as predominantly hawkish in nature, i.e implying a prolonged period of time in which the bank could remain on hold, we may see the event weighing on US stock markets. On the other hand, should the accompanying statement and Powell’s press conference be perceived as dovish in nature, it could imply a faster easing of financial conditions in the US economy which in turn may aid the US stock markets

Technical analysis

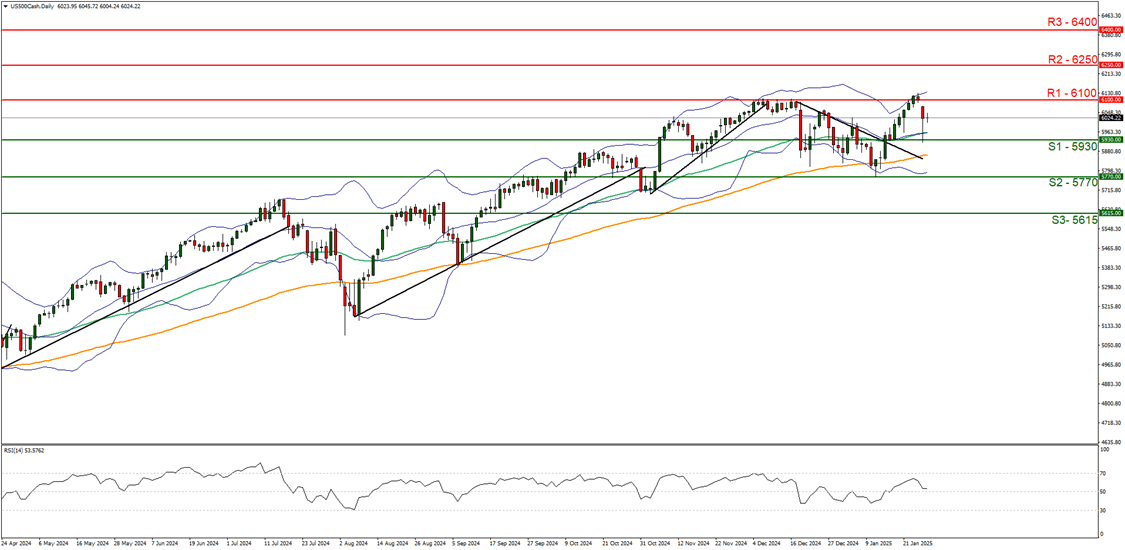

US500 cash daily chart

-

Support: 5930 (S1), 5770 (S2), 5615 (S3).

-

Resistance: 6100 (R1), 6250 (R2), 6400 (R3).

The S&P500 appears to have interrupted its upwards fashion and now appears to be moving in a relatively sideways fashion. We opt for a neutral outlook for the index and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. Moreover, the sharp decline during Monday’s trading session may have stopped the bulls in their tracks. For our sideways bias to continue, we would require the index’s price to remain confined between the 5930 (S1) support level and the 6100 (R1) resistance line. On the flip side, for a bearish outlook we would require a clear break below the 5930 (S1) support level, with the next possible target for the bears being the 5770 (S2) support line. Lastly, for a bullish outlook we would require a clear break above the 6100 (R1) resistance line with the next possible target for the bulls being the 6250 (R2) resistance level.

Author

Phaedros Pantelides

IronFX

Mr Pantelides has graduated from the University of Reading with a degree in BSc Business Economics, where he discovered his passion for trading and analyzing global geopolitics.