Binance Coin price under siege after UK bank TSB reveals plans to ban crypto

- UK's TSB is looking to block British customers from sending and receiving money to Binance.

- Security issues with e-wallets make it possible for hackers to easily steal money.

- The largest exchange for crypto across the world says it is making the necessary changes.

UK bank TSB announced the possible block on money flows to and from Binance. The crypto exchange's founder Changpeng Zhao already said Binance is addressing the security issues and we seek to stop the ban.

The bigger they get….

Zhao probably did not think he would ever have to tackle security issues with his platform when he founded Binance in 2017. The exchange quickly became the largest trading venue for crypto where users could set up an e-wallet, fund their wallet with native currencies, and trade those for stakes in Bitcoin, Ethereum and other well-known cryptocurrencies and assets.

However, there are now clouds hanging over Binance as TSB is looking to ban the service by blocking the possibility for British people to send and receive British pounds from the exchange. It would mean that just shy of 5 million users would suddenly be unable to use their Binance e-wallets

The restrictions come after a flood of complaints from more than 800 users who had been hacked or scammed and had lost most of their money. Binance says it will address the necessary security issues and is making improvements.

Binance Coin price under pressure

Binance Coin price is holding up quite nicely for now, however, although negative news is hanging over the exchange in general. By holding BNB on the exchange, traders can reduce their trading fees.

If you trade USD/BTC for example against BNB/BTC, you save 25% on trading fees when using the Binance Coin. This way the coin safeguards its value since it is used for buying and selling a number of other cryptocurrencies.

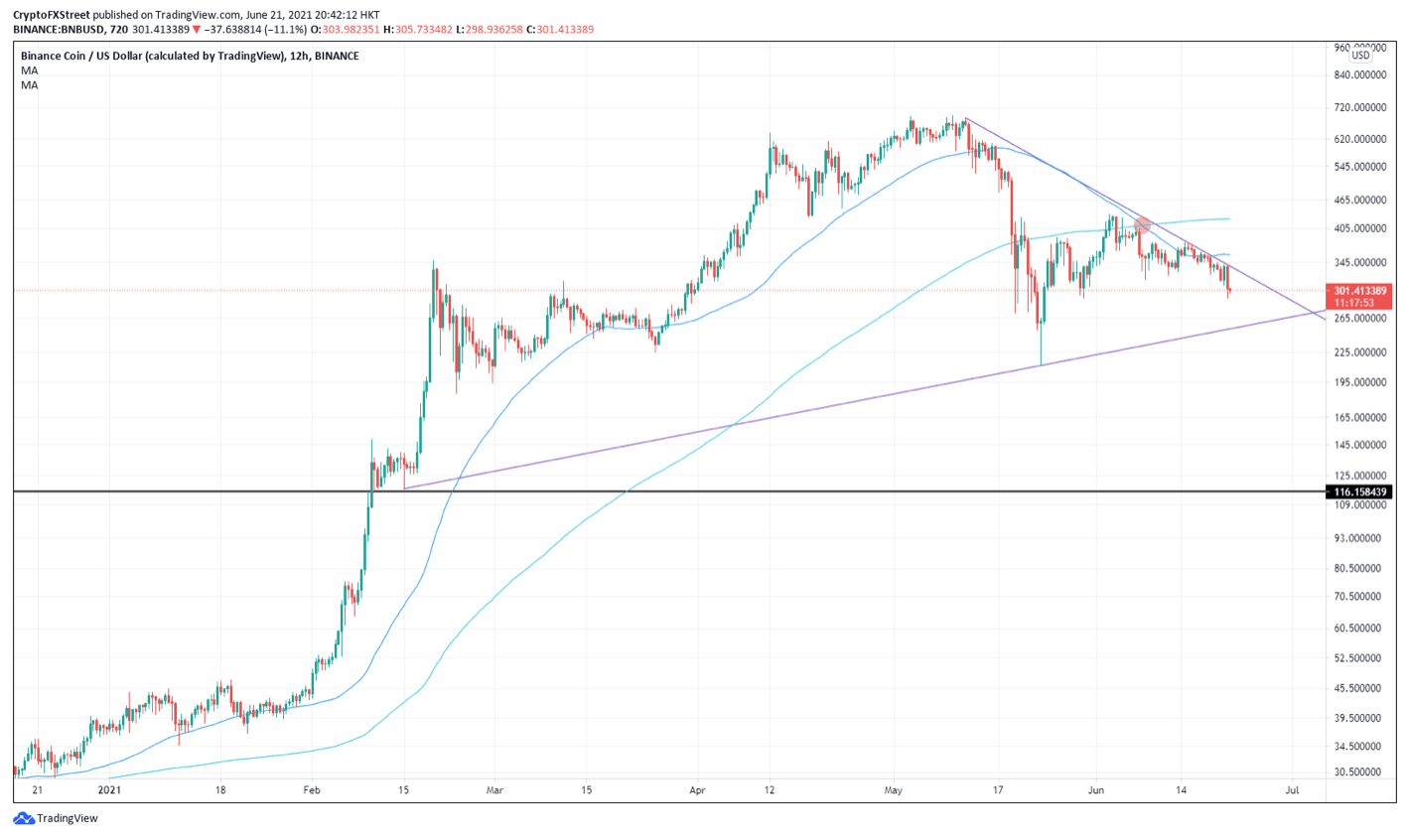

Binance Coin 12-hour chart

From a technical play, we see a consolidation forming. Seeing as the 55-day versus the 200-day Simple Moving Average (SMA) is not diverging further, a break of the downward trend line could signal higher Binance Coin prices toward $465.

Author

FXStreet Team

FXStreet