Axie Infinity price signals 30% upside potential as AXS ends the downtrend

- Axie Infinity price put an end to the downtrend by setting up a reversal point at $65.12.

- The recent recovery above the weekly support level at $71.69, suggests AXS is due for a 30% ascent to $95.07.

- A breakdown of the $65.12 support level will invalidate the bullish thesis.

Axie Infinity price has been on a constant downtrend since its all-time high on November 6, 2021. However, the brutal downtrend found a support confluence, leading to a bottom and a potential reversal.

Axie Infinity price eyes a higher high

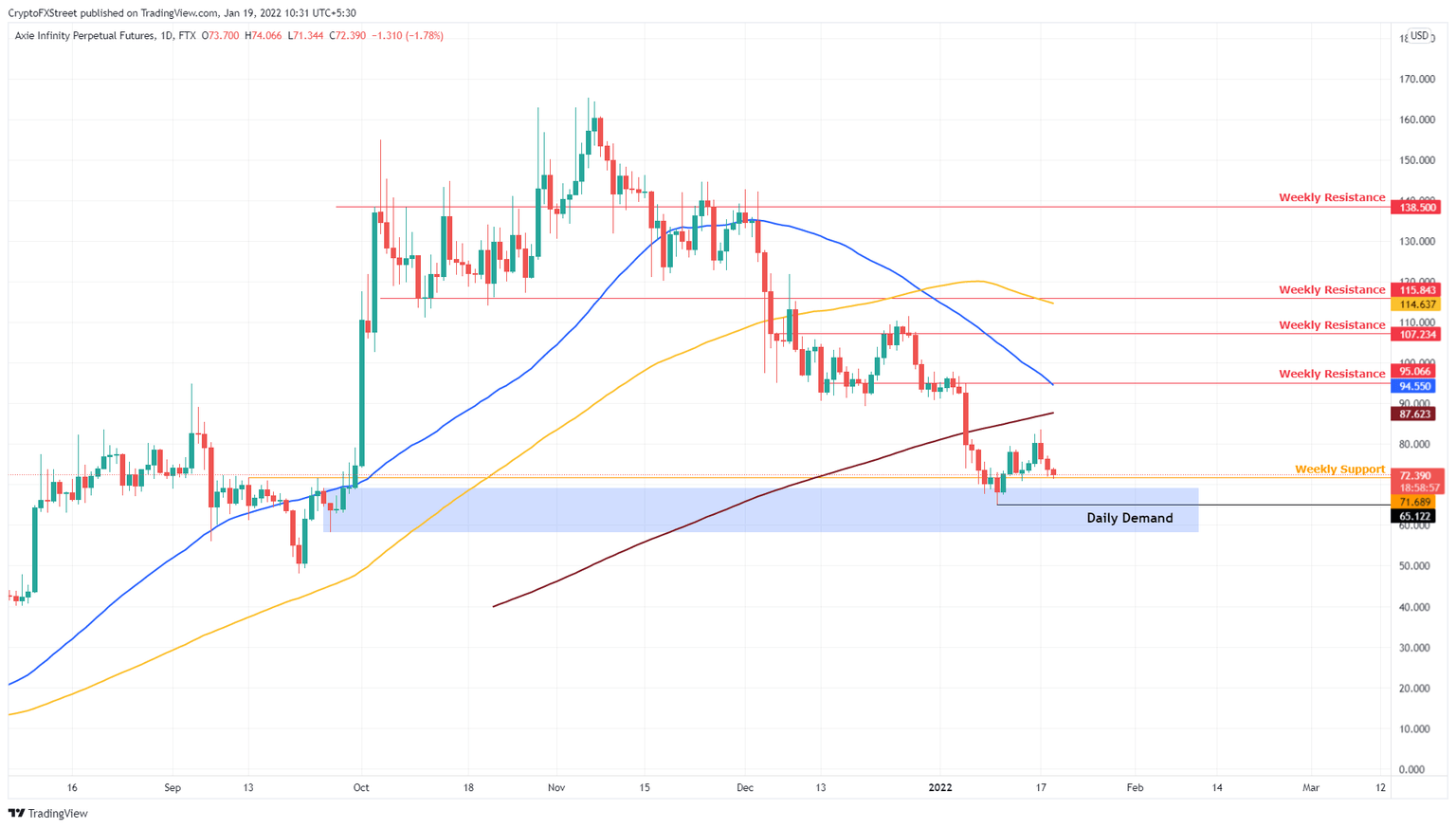

Axie Infinity price dropped nearly 60% from its all-time high at $165.25 on November 6, 2021, and set a swing low at $65.12 on January 10. Interestingly, the bottom formed deep within the daily demand zone, ranging from $58.22 to $69.22, suggesting that an uptrend is around the corner.

While this is in and of itself, a bullish signal, AXS also managed to recover above the weekly support level at $71.69, adding credence to the optimistic outlook. Going forward, market participants can expect Axie Infinity price to make a run for the $95.07 weekly resistance barrier, coinciding with the 50-day Simple Moving Average (SMA).

This run-up would constitute a 30% ascent and is likely where the bulls will set a local top. However, there is a chance for AXS to make a run for the next hurdle at $107.23, bringing the total gain to 47%.

AXS/USDT 1-day chart

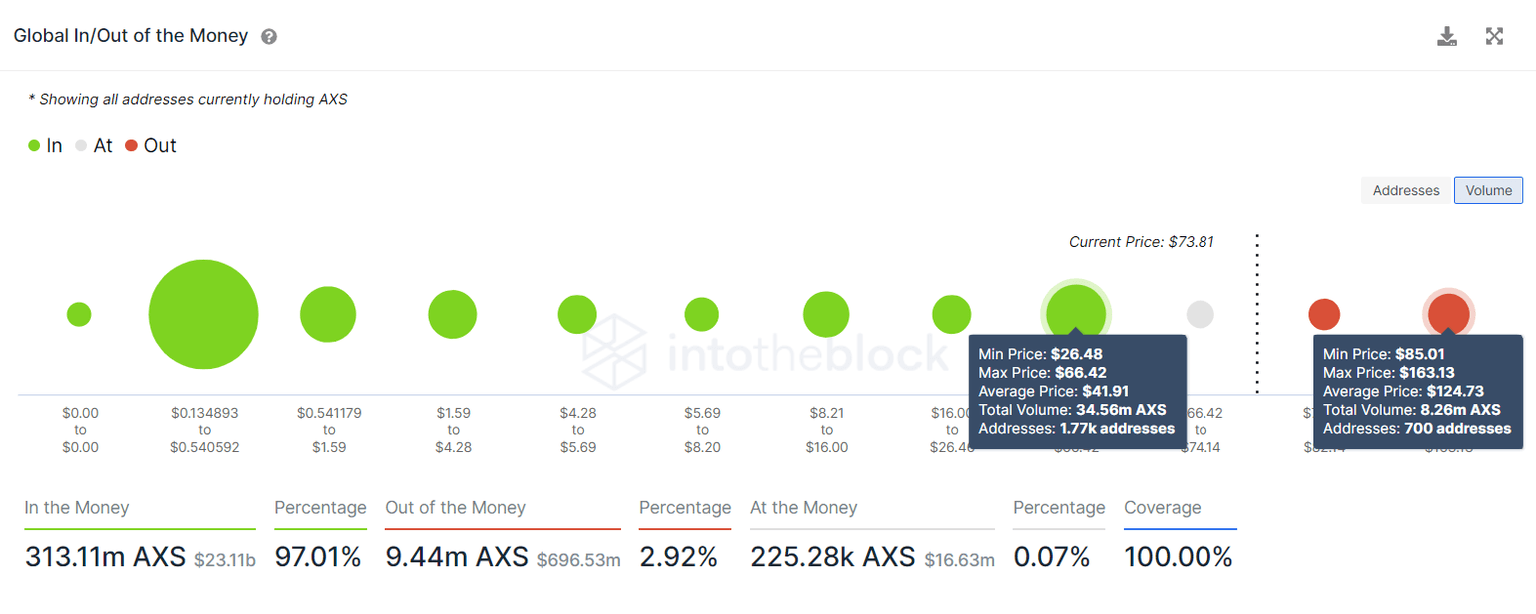

Supporting this bullish outlook for Axie Infinity price is IntoTheBlock’s Global In/Out of the Money (GIOM) model, which shows that a significant amount of resistance is present at $124.73.

Here, 700 addresses that purchased roughly 8.26 million AXS tokens are “Out of the Money” and are likely to sell their holdings to break even if Axie Infinity price ever rises to that level.

AXS GIOM

Lastly, the Market Value to Realized Value (MVRV) model shows that the short-term holders have spent the latter part of the last three months in the negative or underwater territory.

This on-chain metric is used to determine the average profit/loss of investors that purchased AXS over the past month.

A negative value represents that short-term investors are at a loss and is where the long-term holders tend to accumulate since the risk of a sell-off is low. Moreover, this value has recovered from -24% on January 6 to -8% on January 18, signaling the accumulation from long-term holders.

AXS 30-day MVRV

Regardless of the bullishness, if Axie Infinity price slices through the $58.22 to $69.22 demand zone and produce a daily candlestick close below $58.22, it will create a lower low.

This development will skew the odds in the bears’ favor and invalidate the bullish thesis. Such a situation could see Axie Infinity price retrace to $48.06.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%20%5B08.22.53%2C%2019%20Jan%2C%202022%5D-637781661663976493.png&w=1536&q=95)