Axie Infinity struggles to maintain bullish momentum, AXS may return to $65

- Axie Infinity price fails to follow through with more buying activity.

- Selling pressure retraces nearly all of Wednesday’s gains.

- Price action swing structure suggests lower moves ahead.

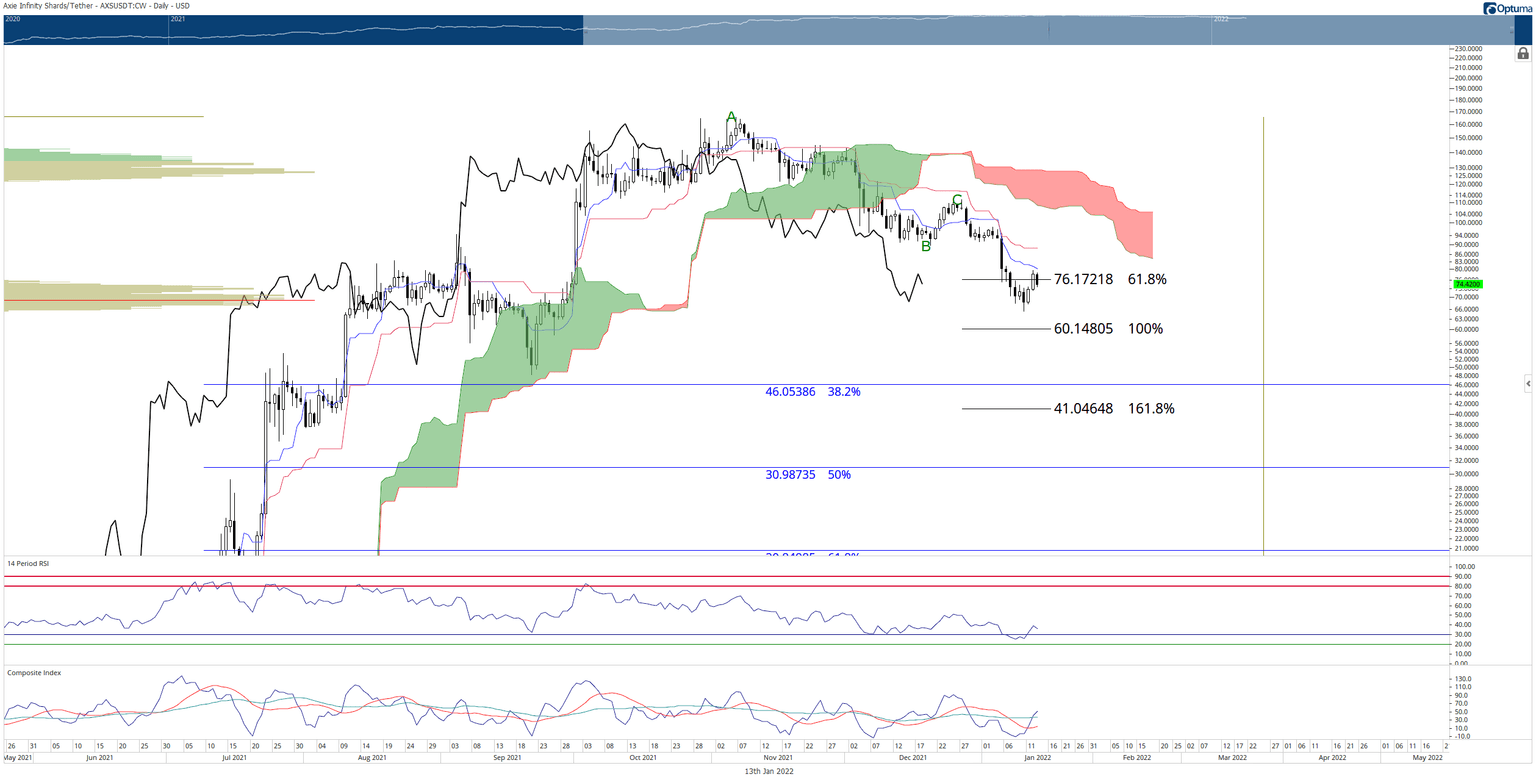

Axie Infinity price stalls against the daily Tenkan-Sen, generating a new lower swing high and setting up AXS for another push south.

Axie Infinity price relief rally likely terminated as bears look to take over

Axie Infinity price had a nice 22% bounce from the Monday lows, but sellers came in at the Tenkan-Sen and thus prevented AXS from moving above the Tenkan-Sen. As a result, further bearish warning signs exist within the oscillators.

The Relative Strength Index (RSI) remains in bear market conditions, with the first oversold level at 30 and the second oversold level at 20. The current slope of the RSI is pointing down, forwarning of another test of 30 or 20. Additionally, hidden bearish divergence exists between the candlestick chart and the Composite Index. The Composite Index printed higher highs, but the candlestick chart printed lower highs.

AXS/USDT Daily Ichimoku Kinko Hyo chart

The combination of the rejection against the Tenkan-Sen and the hidden bearish divergence with the Composite Index provides significant weight for a bearish bias in the near term. Sellers may push Axie Infinity price to a shared support zone between the 100% Fibonacci extension at $60 and the Volume Point Of Control at $67.

If bulls want to deny Axie Infinity price any lower movement, then they will first need to push for a close slightly above the Tenkan-Sen at $80. After that, a close above the Kijun-Sen, currently at $90. The ideal setup for Axie Infinity to display a clear and undeniable uptrend is a close above the Cloud with the Chikou Span in open space. The earliest that this can occur is at $127, not an insignificant move that would need to occur.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.