Assessing fair value for Hedera Hashgraph price amid growing tail risks

- Hedera Hashgraph is pushing for $0.08538374 to the upside on a stream of positive headlines.

- HBAR added Dell to the governance council after Ubisoft, IBM, Google, Boeing, and Deutsche Telekom had already confirmed.

- Outside tail risks could throw a spanner in the works and trigger an aggressive knee-jerk reaction.

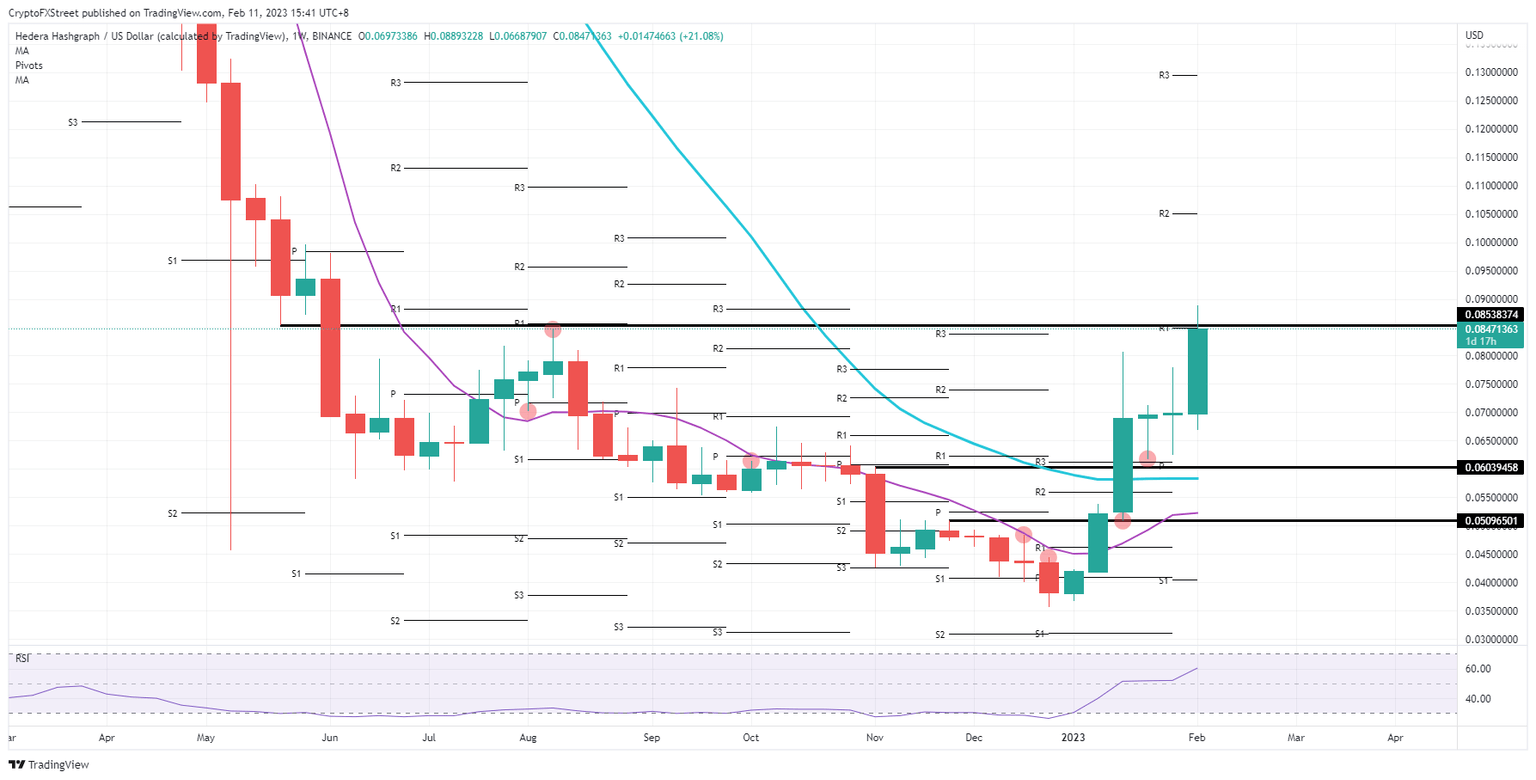

Hedera Hashgraph (HBAR) price is pushing for a 10% for the week with $0.08538374 as a target to the upside, which was a key level back in August of last year. The price action in HBAR is puzzling traders as it is nearly the only cryptocurrency firmly rallying against every other crypto that is lagging. The biggest reason for the outstanding victory comes after the latest addition of Dell to the governance council as Ubisoft, IBM, Google, Boeing, and Deutsche Telekom already teamed up, and the Dell addition will help clients in their transition towards Web 3.0.

Hedera Hashgraph against the tide, but for how long

Hedera Hashgraph price is exponentially at risk of a sharp decline in a knee-jerk reaction as outside pressures and tail risks emerge. This week alone, central banks came out with harsh warnings of tighter and more challenging trading conditions, while in Ukraine, the Russians have started the first chapter of their second offence to gain control. And if that is not enough, energy, rent, and used car prices in the US are picking up again, adding to higher inflation and a possible inflation spike.

HBAR, thus could, at any given point, see a huge bear run coming in hard from global markets. Should a shocking event occur, for example, a Russian missile hitting a NATO country, nuclear weapon usage or, in the case of data, US inflation on Tuesday jumping higher instead of declining. All those elements are enough to flip the momentum and see HBAR drop towards $0.06039458 near the monthly pivot with 20% losses out of it.

HBAR/USD weekly chart

As long as bulls can maintain their ecosystem in HBAR, all is fine. But then, more positive headlines must overcome the current bearish sentiment rolling through the markets. From a technical point of view, the Relative Strength Index is starting to overheat, but there is still room to get to $0.08538374 in time for a break and close above that level if possible.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.