ApeCoin price aims for $6 as retail traders bet short

- ApeCoin price rallied 25% in October.

-

A bullish cross of the 8-day exponential and 21-day simple moving averages is underway.

-

Invalidation of the uptrend potential is a breach below $3.97 thesis can occur if the bulls reconquer $4.65.

ApeCoin price has rallied impressively during the final days of October. Still, an additional 25% rally is possible. Key levels have been defined.

ApeCoin price has potential

ApeCoin price is currently up 25% for the month of October. The Ethereum-based NFT token witnessed a sharp increase in price on October 25 and has been stair-stepping higher ever since.

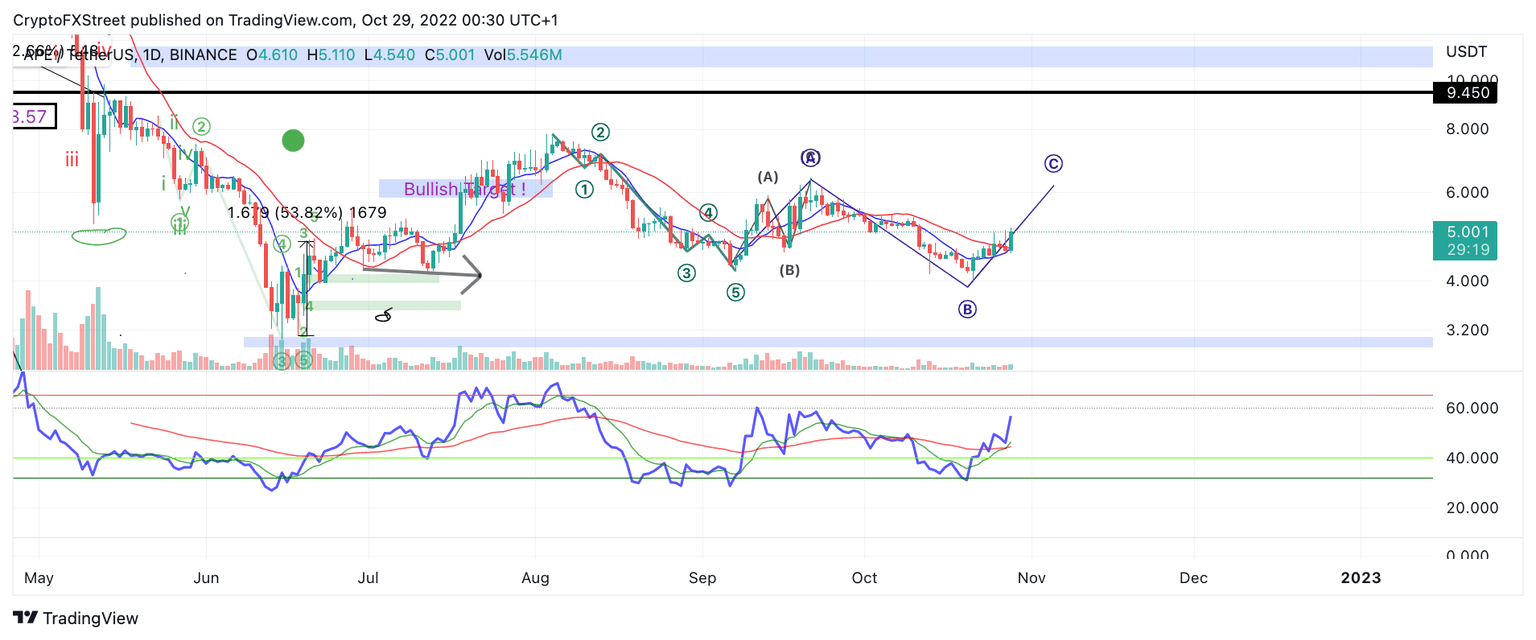

APE price currently auctions at $4.99. The bull has successfully hurdled both the 8-day exponential and 21-day simple moving averages, and now a bullish cross is set to occur while APE auctions are above them. The bullish cross could prompt a rally of equal value to the prior near $6.00 for a 25% gain.

APE/USDT 1-Day Chart

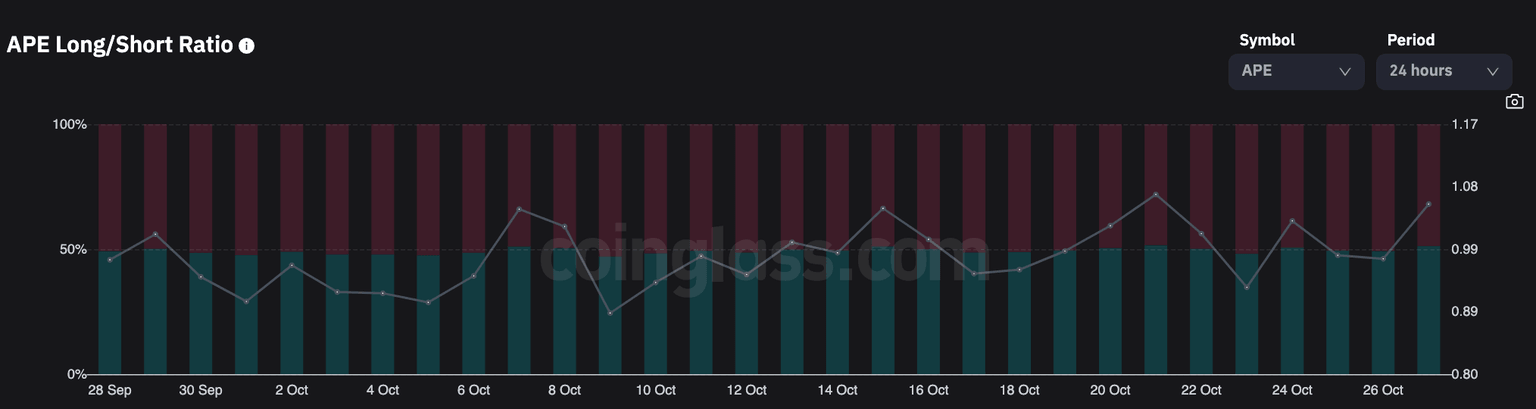

Despite the powerful uptrend signals, retail traders seem to be in disbelief of ApeCoin’s potential. According to CoinGlass’s Long-vs-Short indicator, throughout the 25% hike, most traders have been positioned short. The indicator could be viewed as a contrarian bullish signal. A much larger rally would need to occur to liquidate bears in the market.

Invalidation of the bullish thesis can occur if the bears retag the $4.56 swing low produced on October 27. A latter breach could trigger a selling frenzy targeting liquidity levels near $3.00. Such a move would result in a 40% decrease from the current ApeCoin price.

The video attached below talks about Bitcoin price and its potential outlook, however, this is still relevant as it is likely to influence ApeCoin price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.