ApeCoin price hints at a 20% rally as crypto markets make a comeback

- ApeCoin price is breaking out of a declining trend line, finalizing its nearly two-month downtrend.

- A daily candlestick close above this resistance level could trigger a 20% upswing to $5.79.

- Invalidation of this bullish outlook will happen on the breakdown of the $4.32 support level.

ApeCoin price shows clear signs of a bullish resurgence as it attempts to break free from its long-standing downtrend. If successful, APE could kick-start a quick rally to retest the immediate hurdle.

ApeCoin price ready to break free

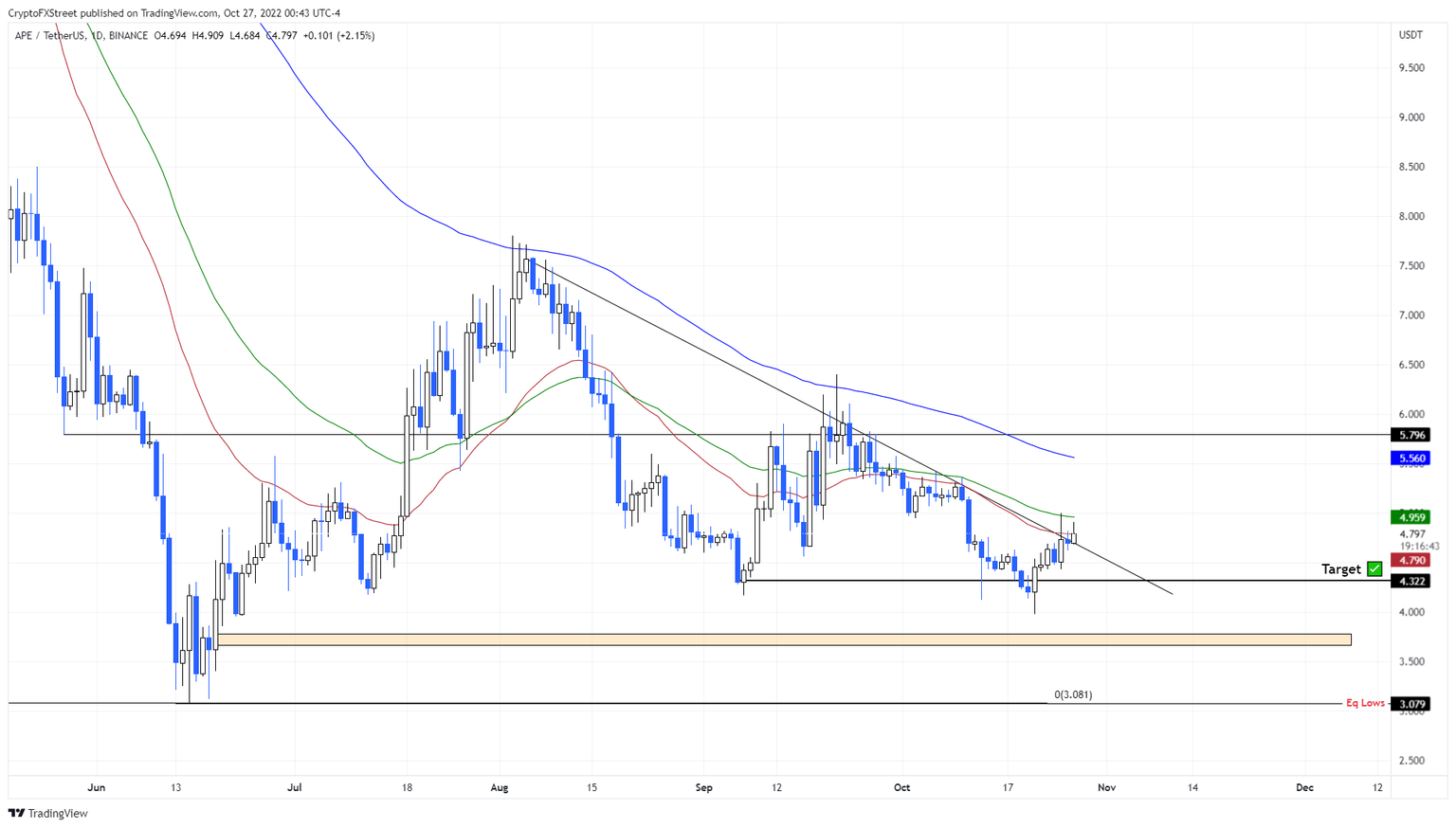

ApeCoin price has produced four lower highs since August 5 and stabilized around the $4.32 support level after September 7. This development created a range tightening for APE, which is currently about to come undone.

So far, ApeCoin price has sliced through this declining trend line connecting the swing highs since August 5. A confirmation of the breakout will come after a decisive daily candlestick close above this hurdle. In such a case, market participants can expect APE to kick-start its journey north.

The 50-day Exponential Moving Average (EMA) at $4.95 will pose a minor threat, but overcoming this barrier will result in a bullish ascent to $5.56, aka the 100-day EMA and $5.79.

In total, this move would constitute a 20% gain for APE holders and is likely where ApeCoin price will form a local top.

APEUSDT 1-day chart

While things are looking up for ApeCoin price, a lack of buying pressure that leads to a move below the aforementioned declining trend line would be an unproductive development. In such a case, if APE buyers back out, the altcoin could slide lower.

If ApeCoin price produces a daily candlestick close below $4.32, it will invalidate the bullish thesis and potentially trigger a correction to the $3.78 to $3.65 support area.

Note:

The video attached below talks about Bitcoin price and its potential outlook, however, this is still relevant as it is likely to influence ApeCoin price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.