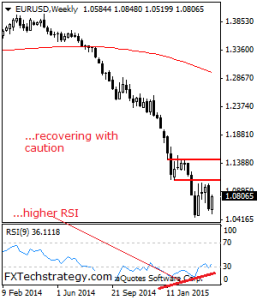

EURUSD: Outlook for EUR remains to the upside after closing higher the past week. However, a mild pullback may occur in the new week as price hesitation signs are now seen on lower level charts. Resistance is seen at 1.0850 level with a cut through here opening the door for more downside towards the 1.0900 level. Further up, resistance lies at the 1.0950 level where a break will expose the 1.1000 level. Conversely, support lies at the 1.0700 level where a violation will aim at the 1.0650 level. A break of here will aim at the 1.0600 level with a turn below that level targeting the 1.0550 level. All in all, EUR remains biased to the upside on recovery.

USDCHF Sets Up For More Weakness

USDCHF: The pair declined the past week reversing its previous week gains and opening the door for further downside pressure in the new. Although, we may see a mild recovery higher before it turns back lower again. On the downside, support comes in at the 0.9467 level. A turn below here will open the door for more weakness to occur towards the 0.9400 level and then the 0.9350 level. Its weekly RSI is bearish and pointing lower supporting this view. Conversely, resistance resides at the 0.9600 level with a breach targeting the 0.9650 level. A breather may occur here and turn the pair lower but if taken out, expect a push higher towards the 0.9700 level. All in all, the pair remains biased to the downside.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold price pullback on Fed hawkish tilt amidst lower US yields, weaker US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s comments of the Fed’s Chair, Jerome Powell, and the US central bank's decision to hold rates unchanged.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.