Recommendations:

Medium: sell the EURUSD at 1.3550, SL 1.3610, targets 1.3500, 1.3450, 1.3400.

High risk: sell the USDJPY at 97.90, SL 98.20, targets 97.00, 95.00, 93.50.

Low risk: sell the USDJPY at 98.95, SL 99.40, targets 98.00, 95.00, 93.50.

Analysis:

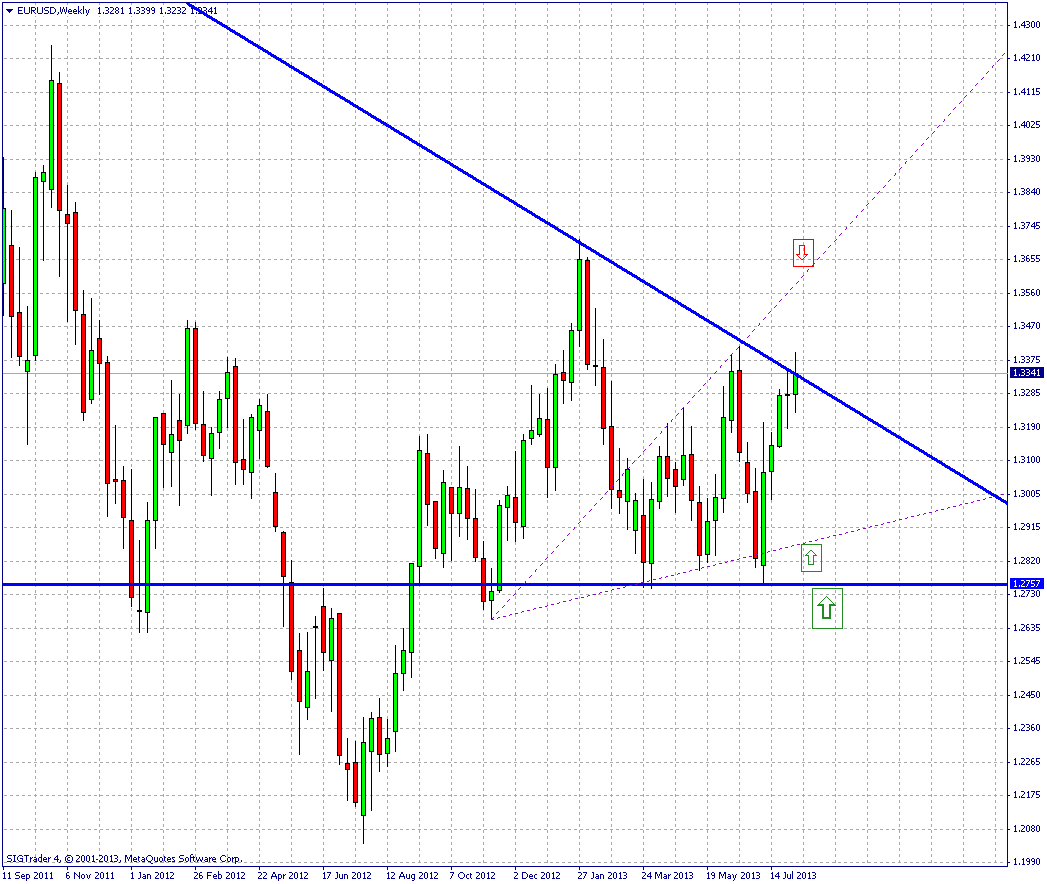

The EURUSD has closed the week right on the trend line resistance. It is unclear whether a breakout occurred or not. If this is a breakout, then its mildness might be related to summer holidays. Anyhow, we expect the EURUSD to reach 1.35 in the coming days/weeks. Revisiting the lower side at 1.28x/1.27x seems very unlikely at this point and buying at the resistance seems irrational. This is why the only trade remaining is to short the EURUSD on further advances, at around 1.3550 if it is reached next week.

The Australian dollar made a large correction last week which allowed EURAUD to breath a bit. The move was mostly driven by “a buyer the rumor sell the news” regime related to the interest rate cut. However, we expect the AUD to resume its decline and the EURAUD to continue its growth toward 1.50.

USDJPY is now clearly in bearish territory and will most probably continue its decline at least towards 93. We would attempt a short entry in between the previous historic low around 97.70 and the 61.8% Fibonacci retrace of the last move down at around 98.00. Should the pair come up to retest its down trending resistance, we would recommend to short it (around 99.00).

EURUSD Weekly Chart

USDJPY 4H Chart

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.