- Equity markets remain upbeat despite Fed bringing forward likely interest rate hikes.

- Record highs early in the week give way, but Nasdaq remains upbeat.

- Yields slump while the dollar goes on a taper tantrum.

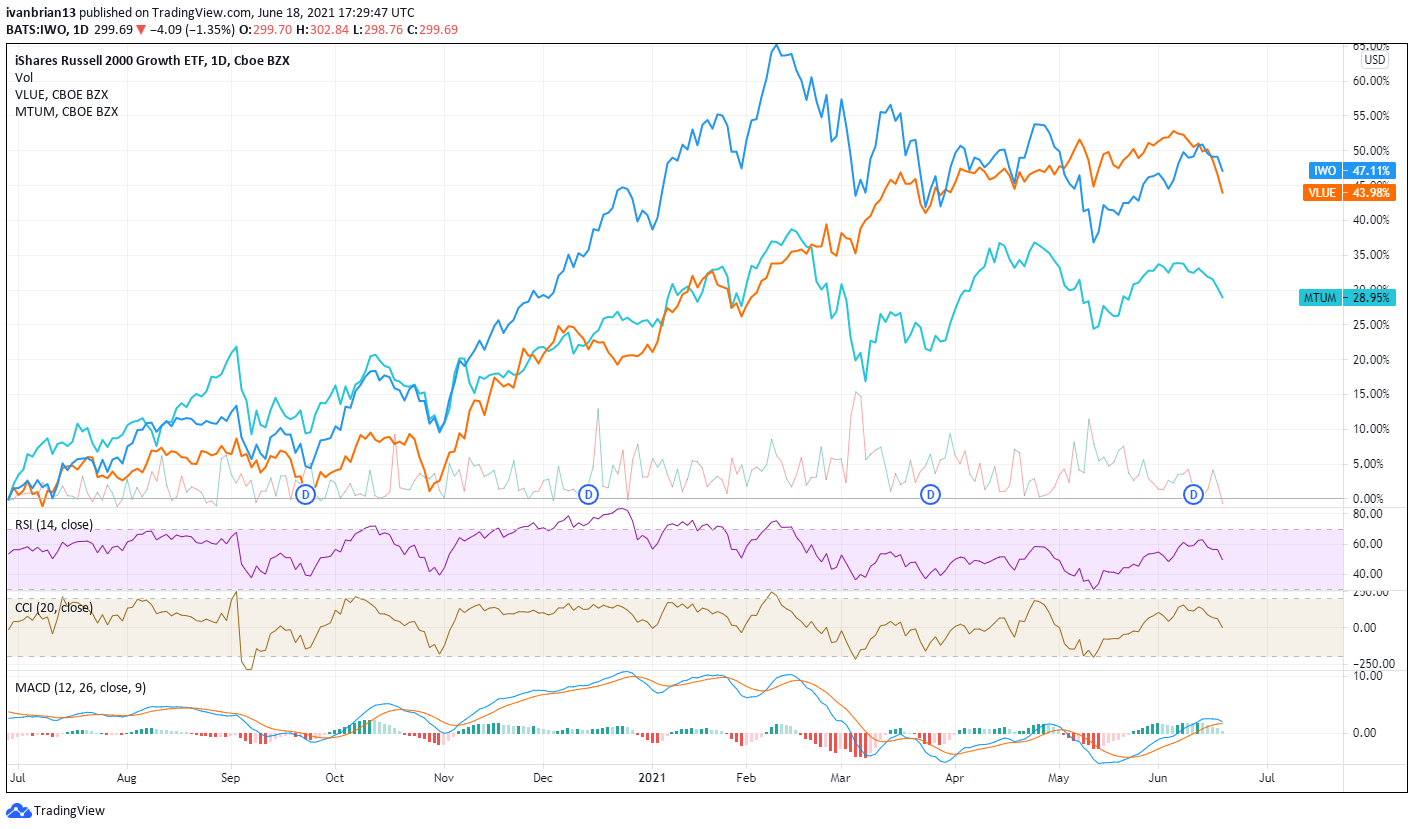

Now that the big Fed meeting is out of the way markets can relax for the summer months ahead. The Fed was in accommodative mood in terms of sentiment if not policy. By bringing forward the likelihood of rate rises from 2024 to 2023 the Fed calmed growing investor fears over runaway inflation. By calming markets the Fed allowed them space to breathe which is exactly what the yield-sensitive Nasdaq did. The tech index setting an intraday record and closing just under its record high close. Investors switched out of some broad market names and into big tech names such as Apple which had been lagging since April. This saw Russell 2000 and S&P 500 close lower on Thursday but not alarmingly so. Value continues to outperform in recent times versus momentum and growth names as the retail space dries up apart from AMC of course! The chart below shows the most popular Growth, Momentum, and Value Exchange Traded Funds (ETF's).

Sell in May and go away did not exactly work out and now we enter the last two weeks of June, historically the worst performing period for US stocks. That is followed by the first two weeks of July which are one of the best performing periods. Yields remain accommodative for equity investors and in particular the Nasdaq as already mentioned. The US 10-Year yield dropped below 1.5% on Friday setting the scene for further Nasdaq appreciation next week. This despite Fed hawk James Bullard talking tough and hitting equities on Friday.

The dollar confounded recent bearish sentiment by taking the rate hike talk and running with it. In the process the dollar triggered stops below 1.20 with position reversals and general pain for the majority who had increasingly positioned themselves as dollar bears. The dollar wobble had knock-on effects across the commodity spectrum with many suffering steep falls on Thursday and Friday. Gold and Silver dropped heavily on Thursday and Oil lost nearly 5%. Not surprisingly oil and commodity stocks were the biggest losers on Thursday and again on Friday.

Equity fund flow data

Fund flows are still positive for equities and with the Nasdaq hitting new records this trend looks set to continue. Equity Exchange Traded Funds (ETF's) attracted net inflows of over $8 billion last week according to the latest data from Refinitiv Lipper Alpha. For the first time nearly 6 months, international equity ETF's did not receive net inflows. However, US ETF's continue to see strong flows with the Q's (NASDAQ ETF QQQ) seeing $2.3 billion inflows and the S&P 500 Core (IVV) receiving $1.9 billion.

S&P 500 and Nasdaq technical analysis

Buy the dip, buy the dip. That has been the theme of equity markets since this pandemic began and investors get another chance now as the S&P heads for trendline support. Above is chart analysis using the S&P E-Mini futures contract, the major route used to trade the S&P 500 Index. That or the SPY (S&P 500 ETF) but it will be a carbon copy. Currently, the S&P 500 sits on strong support from the trendline and the point of control. To those not familiar the point of control is based on volume profile and is the price with the highest volume over the period shown. A break will test 4050 and this needs to hold as the volume profile bars on the right show a sharp drop in volume below 4050 meaning support is thin.

The Nasdaq below looks healthier now, ironic since it has been lagging both the Dow and S&P500. A strong uptrend channel is holding nicely and the 9-day moving average is guiding short-term trends higher. 13,462 holds the short-term pivot for the bullish trend, 12,950 holds the medium-term pivot. Below is a strong support zone with the long-term trend line and the 200-day moving average.

Wall Street Week Ahead

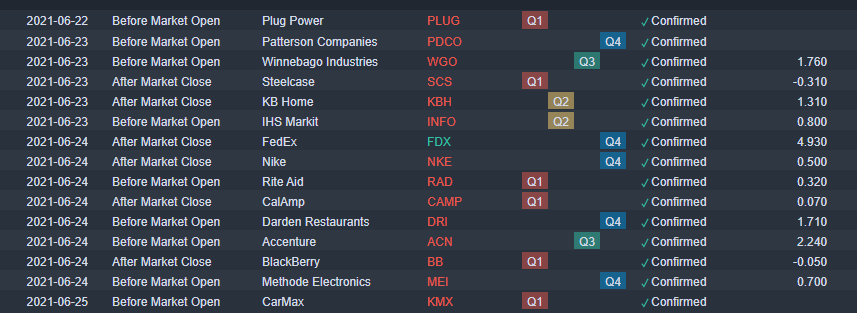

Earnings are getting thinner on the ground but Plug Power (PLUG) will be well watched by retail traders as this is a favourite. Blackberry (BB) is also a retail darling and one of the original meme stocks. Bigger names reporting are limited but Nike (NKE) and FedEx (FDX) are notables.

Source: Benzinga Pro

Economic releases

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.