USD/JPY Forecast: Dollar’s bullish potential is intact

USD/JPY Current price: 106.86

- US Treasury yields remain stable, but the greenback keeps rallying.

- Equities struggle to post gains as optimism has somehow receded.

- USD/JPY has room to extend its gains to new 2021 highs.

The dollar maintains its strength and USD/JPY trades just shy of the 107.00 level. Optimism somehow receded, although European indexes trade with modest gains. US Treasury yields remain stable, with the yield on the benchmark 10-year note around 1.43%. Investors paused ahead of definitions on the upcoming US stimulus package and first-tier event scheduled later this week.

Earlier in the day, Japan published the January Unemployment rate, which remained at 2.9% against expectations of an uptick to 3%. The February Monetary Base was up 19.6%, missing the 20.1% forecast. The US session will include a speech from Fed’s Lael Brainard, the February ISM-NY Business Conditions Index and March IBD/TIPP Economic Optimism.

USD/JPY short-term technical outlook

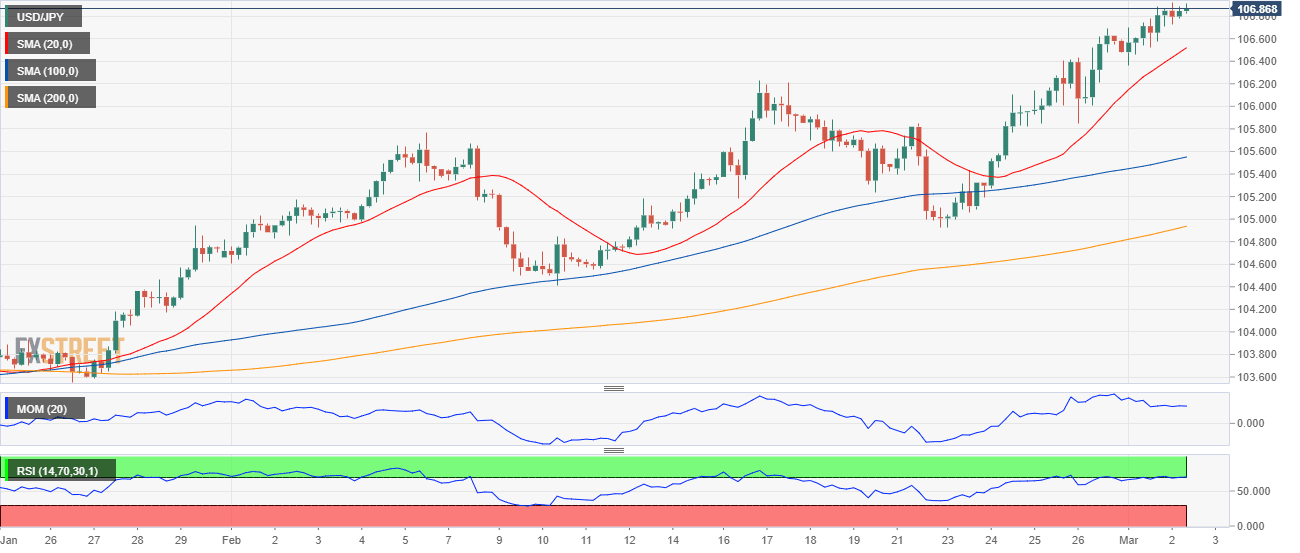

The USD/JPY pair trades in the 106.80 area, and it’s neutral-to-bullish in the near-term. In the 4-hour chart, the RSI indicator remains flat around 65, while the Momentum remains well above its midline, directionless. The 20 SMA advances above the larger ones, providing dynamic support around 106.50. Another leg higher seems likely on a clear break above 106.95, the immediate resistance level.

Support levels: 106.50 106.10 105.75

Resistance levels: 106.95 107.30 107.65

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.