EUR/USD

Trading sideways.

EUR/USD has consolidated lower but the short-term momentum is now bullish. Hourly resistance can be found at 1.1043 (09/12/2015). Hourly support lies at 1.0796 (07/12/2015 low). Stronger support lies at 1.0524 (03/12/2015 low). Expected to target resistance at 1.1096.

In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD

Short-term bullish.

GBP/USD's medium-term downside momentum remains lively. Yet, the short-term momentum is bullish. . Hourly resistance is given at 1.5242 (13/12/2015 high). Stronger resistance can be found at 1.5336 (19/11/2015 high). Hourly support can be found at 1.4985 (02/12/2015 low). Expected to bounce back at upper bound implied by the downtrend channel.

The long-term technical pattern is negative and favours a further decline towards the key support at 1.5089 , as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY

Momentum reversal.

USD/JPY keeps on weakening. Hourly support at 121.08 (09/12/2015 low) has been broken. Stronger stronger support can be found at 120.07 (28/10/2015 low). Hourly resistance still lies at 123.76 (18/11/2015 high). Expected to pursue declining momentum toward support at 120.07.

A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF

Monitoring support at 0.9806.

USD/CHF is heading downwards toward hourly support at 0.9876 (27/10/2015 low) while hourly resistance is given at 1.0034 (04/12/2015 high). Expected to show further decline.

In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.

USD/CAD

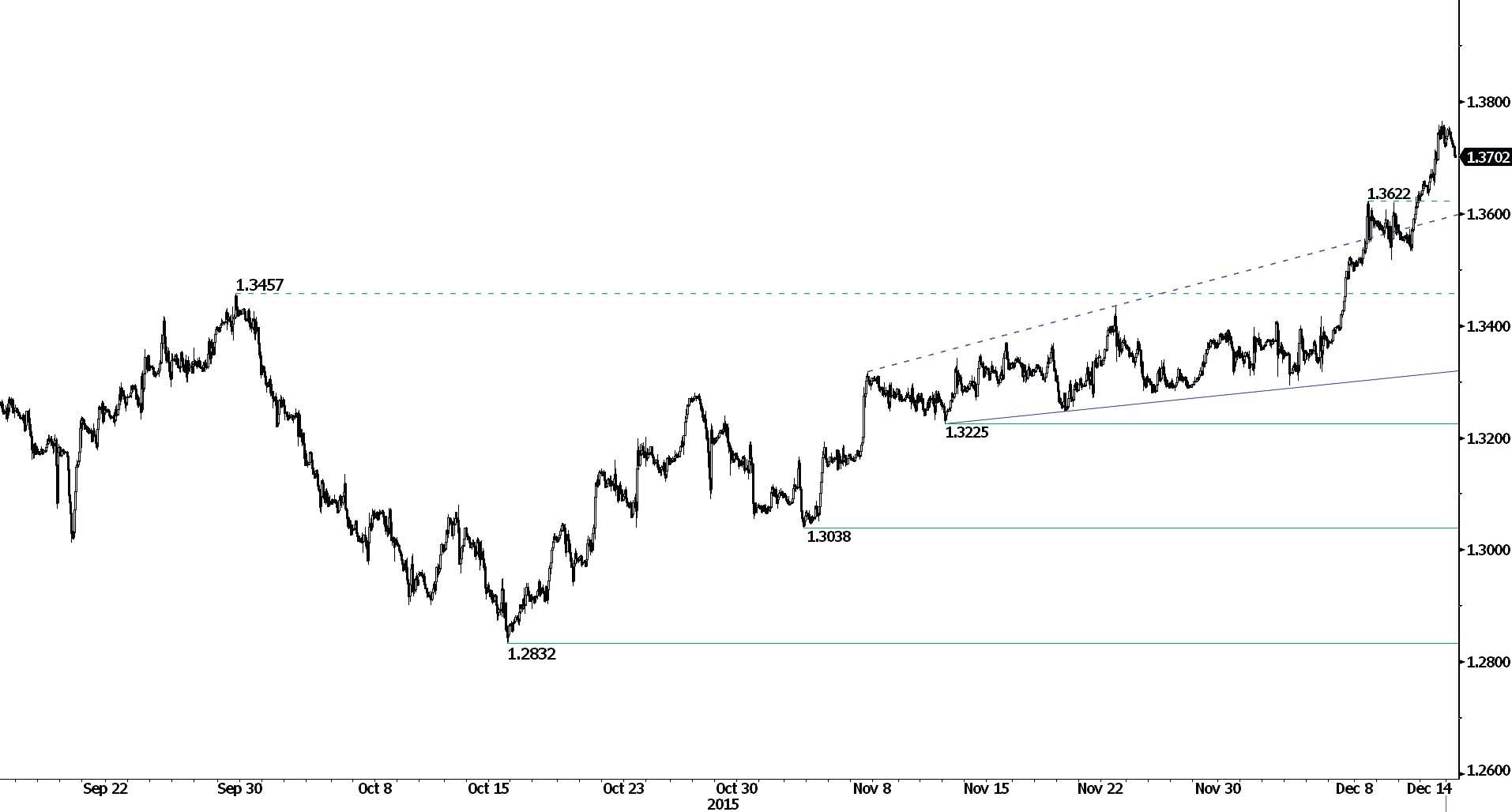

Consolidating around 1.3700.

USD/CAD's bullish momentum is still very strong as every intraday resistance is broken the day after. Significant support stands at 1.3225 (12/11/2015 low). Expected to show continued bullish momentum as uptrend is still in play.

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Support can be found at 1.2832 (15/10/2015 low) then 1.1731 (06/01/2015 low).

AUD/USD

Consolidating.

AUD/USD is moving sideways. The technical structure suggests that the pair has entered into a trading in range phase between hourly support at 0.7160 (intraday high) and hourly resistance at 0.7385 (12/04/2015 high). Expected to show further decline.

In the long-term, we are waiting for further signs that the current downtrend is ending. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair remains well below the 200-dma which confirms selling pressures.

EUR/CHF

Fading on support at 1.0789.

EUR/CHF is pausing around hourly support at 1.0789 (18/11/2015 low) while still moving sideways from 1.0800 to 1.0950. Stronger resistance can be found at 1.0982 (25/09/2015 high). Expected to show further weakness on the short-term.

In the longer term, the technical structure remains negative as long as prices remain below the resistance at 1.1002 (02/09/2011 low). The ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

EUR/JPY

Bearish move.

EUR/JPY is consolidating lower. Hourly resistance lies at 134.60 (04/12/2015 high). Stronger resistance is located at 137.45 (17/09/2015 high). Hourly support lies at 129.67 (27/11/2015 low). The technical structure still suggests a downside momentum. Expected to show further decline.

In the longer term, the break of the support at 130.15 validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key supports stand at 124.97 (13/06/2013 low) and 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Moving sideways.

EUR/GBP is consolidating. Hourly resistance lies at 0.7279 (08/12/2015 high) and hourly support is given at 0.7164 (07/12/2015 low). The technical structure suggests that an upside momentum may be gaining some traction. Expected to show further consolidation.

In the long-term, prices are in an underlying declining trend. The general oversold conditions suggest a limited medium-term downside potential. A key resistance lies at 0.7592 (03/02/2015 high).

GOLD (in USD)

Weakening.

Gold is moving slowly on the short-term. Hourly support lies at 1044 (05/02/2015 low). Hourly resistance is given at 1110 (06/11/2015 high). Expected to show further weakness.

In the long-term, the underlying downtrend (see declining channel) continues to favour a bearish bias. A break of the resistance at 1223 is needed to suggest something more than a temporary rebound. A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Downside traction.

Silver keeps heading toward strong support at 13.51 (19/08/2009 low). The metal is oriented to decline below 14.00. Hourly resistance can be found at 15.45 (declining channel) seems way too far. Expected to see back further weakness toward hourly support at 13.51.

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Strong support can be found at 11.75 (20/04/2009). A key resistance stands at 18.89 (16/09/2014 high).

Crude Oil (in USD)

Where will it stop?

Crude oil keeps on weakening amid very high volatility. Hourly support now lies at 35.16 (intraday low). The medium-term technical structure is clearly negative in a context of oil oversupply. Expected to show continued weakness.

In the long-term, crude oil has not shown signs of recovery. Strong support lies at 37.75 (24/08/2015) has been broken and 32.40 (18/08/2015 low) is now on target. Nonetheless, crude oil is holding way below its 200-Day Moving Average (setting up at 50). An very unlikely break of the resistance at 60.72 (05/07/2015) would confirm an underlying uptrend.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.