USD/CAD Weekly Forecast: Watching the wells come home

- USD/CAD touches three-week low at 1.2660 on Thursday and 1.2676 on Friday.

- Loonie propelled by rising crude oil prices, untouched by employment losses.

- WTI sets new 13-month high on Friday at $59.73, USD/CAD reverses

- Fed Chairman Powell indicates no plans for rate increases or bond program reductions.

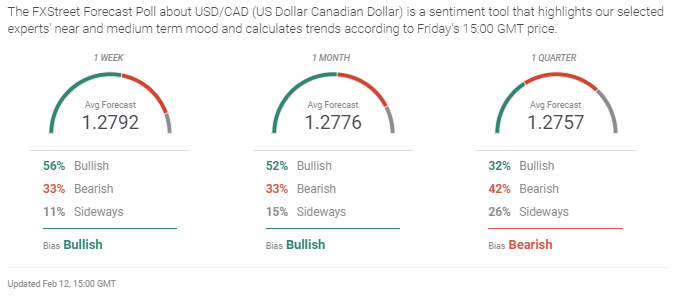

- FXStreet Forecast poll predicts consolidation between 1.2700 and 1.2800

In the current market almost everything for the Canadian dollar starts and stops with the price of oil. West Texas Intermediate (WTI) finished at $52.14 on January 29. The next session, February 1, the USD/CAD closed at 1.2861, the highest it had been and the lowest for the loonie, since December 22.

From that WTI close in January to Tuesday's finish at $58.42 oil jumped 12.04%, and to Thursday's completion at 1.2699 the USD/CAD had lost and the loonie had gained 1.3%. The minor retreat in WTI on Thursday to $57.90, profit-taking on the sharp February gains, led to Friday's initial reversal higher in the USD/CAD. But oil's late surge to $59.72 as London closed (5:00 pm in the UK, noon in NY) and after eliminated all of the USD/CAD gains for the day which dutifully dropped from.12763 to 1.2677 before recovering to 1.2698.

This week's strength in the loonie dollar came despite a terrible Net Change in Employment report for January last Friday. The Canadian economy shed 212,800 jobs more than four times the -47,500 forecast and the second loss in a row.

In the US payrolls rose 49,000 in January. The Canadian unemployment rate climbed to 9.4% in January from 8.9%, in the US it fell to 6.3% from 6.7% and yet the US dollar fell and the Canadian rose. For the loonie, the price of oil and the prospects for the energy market are the strongest components.

The break of the minor descending channel on January 27 has lost its significance as the USD/CAD faltered at 1.2900. The failure on February 1 at 1.2863 to breach the January high of 1.2881 has proven to the deciding point.

American data did not suggest a strengthening recovery with weak consumer prices in January, over 800,000 unemployment claims for the last two weeks and a drop in Consumer Sentiment.

A drop in US Treasury rates mid-week may have help to undermine the USD/CAD. After last Friday's close in the 10-year bond at 1.1700, the highest finish since March 18, yields dipped to 1.157 on Tuesday and 1.1330 on Wednesday. The yield recovered on Friday to 1.195% but could not contest the impact of WTI on the USD/CAD.

US 10-year Treasury yield

The US stimulus package wending its way through Congress had been one source of recent dollar strength with the logic that whatever its final composition and amount it will boost consumer spending which was dismal in the fourth quarter. Its delay may have added to the USD/CAD decline. Even though January Nonfarm Payrolls were on target at 49,000, the much stronger ADP report and the continuing strength of the Purchasing Managers' Indexes had given a lift to late expectations, and the status quo report in that light was a disappointment.

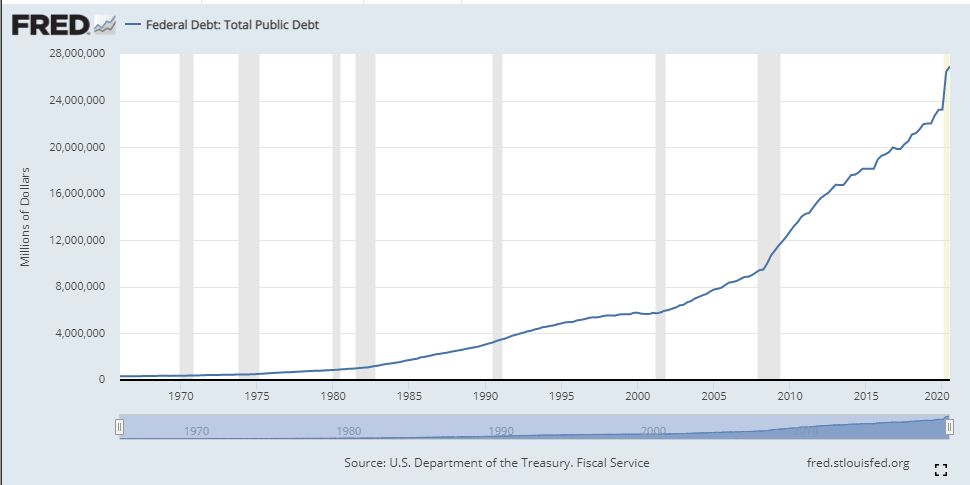

There has also been a minor revival of inflation concerns even though there is no evidence of such and Federal Reserve Chairman Powell has discounted it. The size of the US budget deficits over the past five years and the continual money creation by the government is a classic prelude to inflation.

Finally Chairman Powell's dovish comments in a speech to the Economic Club of New York on Wednesday that the labor market remains weak and the bank is not considering a rate increase or a reduction in the bond purchase program may have detracted from a rising dollar based on higher Treasury rates.

USD/CAD outlook

The competition for supremacy between the Canadian and US dollars is a contest tilting the American economy against the price of oil.

This week oil won with WTI rising, poor US data and a less than optimistic Fed.

Looking ahead to Wednesday January's US Retail Sales will set the stage for first quarter consumption. After three negative months in a row, the forecast modest rise is essential for greenback improvement.

Without better US statistics and a completed stimulus package it will be difficult for the USD/CAD to gain ground against an energized oil market. Even rising US Treasury rates, the 10-year closed at 1.195%, did not deter the oil-fueled gains of the loonie. The dominance of oil pricing on the USD/CAD over the direct evidence of a contracting Canadian labor market in Janaury is not illogical. Nothing can create jobs in Canada as effectively or quickly as the energy sector.

Technically, the eight-month descending channel maintains its grip exhibiting a succession of lower tops with each recovery, even though the five-figure wide channel has ample room for consolidation. Support at 1.2700, the close on Tuesday, Wednesday and Thursday did not hold on Friday in the face of a relentlessly bid WTI.

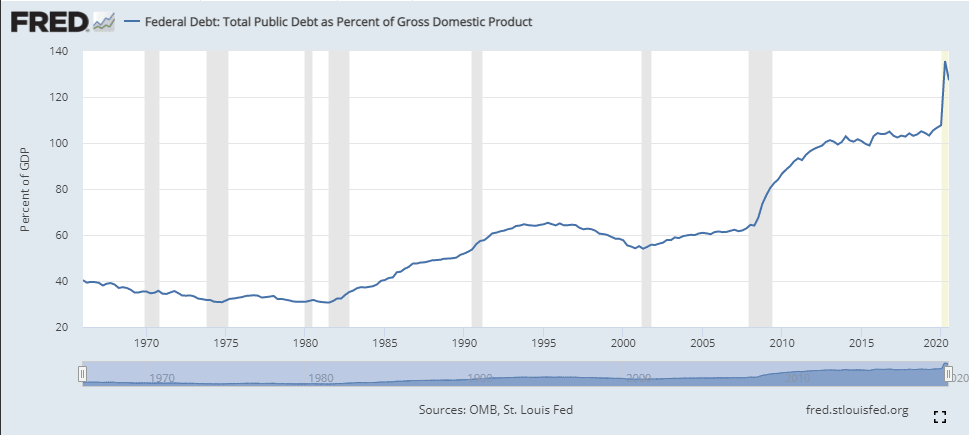

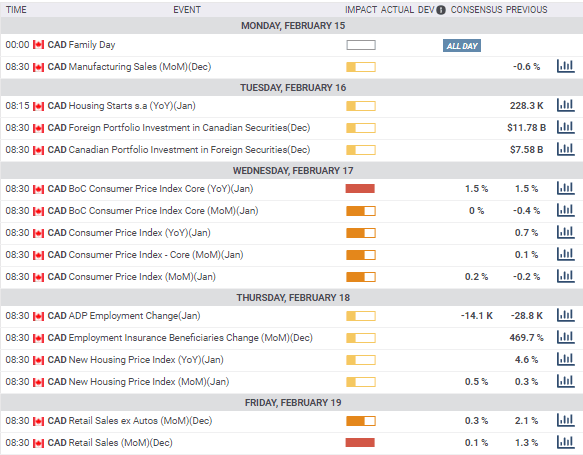

Canada statistics February 8-February 12

Friday

Wholesale Sales dropped 1.3% in December, on a -1.6% forecast and November's 0.7% increase.

FXStreet

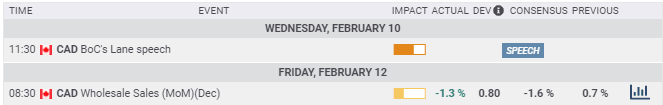

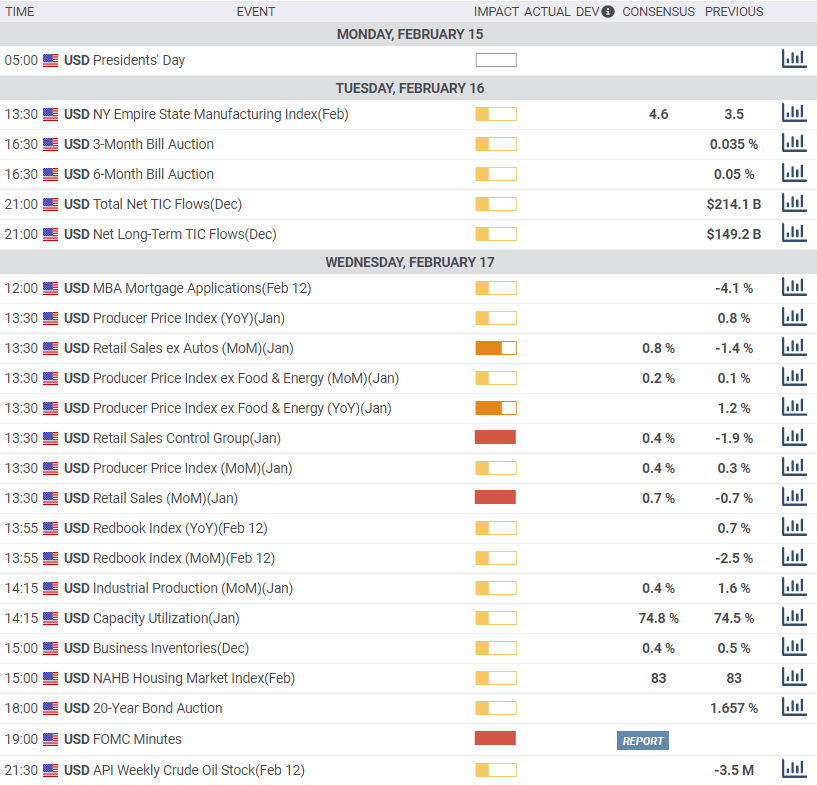

US statistics February 8-February 12

In a speech to the Economic Club of New York on Wednesday, Federal Reserve Chairman Jerome Powell was neutral on the state of the US economy and stresssed the need for continuing monetary policy and fiscal support. He said that the job market remained weak though improved from the worst of the recession. He indicated that the central bank isn't considering an increase in the fed funds rate or a reduction in the $120 billion of monthly credit purchases designed to keep interest rates low.

Consistent with the Fed's focus on employment, Mr Powell observed that four million jobless workers have dropped out of the labor force and are not counted in the standard (U-3) unemployment rate at 6.3%. Were these workers included the rate would be close to 10%. He noted that among the highest-earning quarter of the population job loses have been 4%, while layoffs among the bottom quarter were 17%.

The 'Underemployment Rate' (U-6) which counts discouraged and part-time workers was 11.1% in January, the lowest of the pandemic era and down from 11.7% in December. It's peak was 22.8% in April 2020.

Tuesday

Job Openings and Labor Turnover Survey (JOLTS), a measure employment vacancies report from the Bureau of Labor Statistics, registered 6.646 million available posts in December, more thanthte 6.5 million forecast and November's 6.572 million.

Wednesday

The Consumer Price Index in January rose 0.3% as expected, down from 0.4% in December. Annual CPI climbed 1.4% as in December on a 1.5% estimate for January.

Core CPI was flat in January missing the 0.2% prediction, after a 0.1% gain in December. The annual rate was 1.4%, under the 1.5% prediction and December's 1.6% rate. Wholesale Inventories rose 0.3% in December more than the 0.1% estimate and November rate.

Thursday

Initial Jobless Claims were 793,000 in the February 5 week, down from the revised 812,000 prior result, (initially 779,000) but worse than the 757,00 forecast. Claims were 4.545 million in the January 29 week, just over the 4.49 million estimate and lower than the 4.69 million previous week.

Friday

The Michigan Consumer Sentient Index slipped to 76.2 in February from 79 in January. A reading of 80.8 had been forecast.

FXStreet

Canada statistics February 15-February 19

Retail Sales for December and Housing Starts for January have the most potential for impact.

Monday

Manufacturing Sales for December are due. They fell 0.6% in November.

Tuesday

Housing Starts (YoY) in January are scheduled, they were 228,300 in December.

Wednesday

The Consumer Price Index for January is listed. December's results were -0.2% (MoM) and 0.7% (YoY). The Bank of Canada Core CPI was -0.4% (MoM) and 1.5% (YoY) in December.

Thursday

ADP Employment Change for January is out. December shed 28,800 positions.

Friday

Retail Sales in December are expected to rise 0.1% after gaining 1.3% in November. Sales ex autos are forecast to add 0.3% following a 2.1% increase in December.

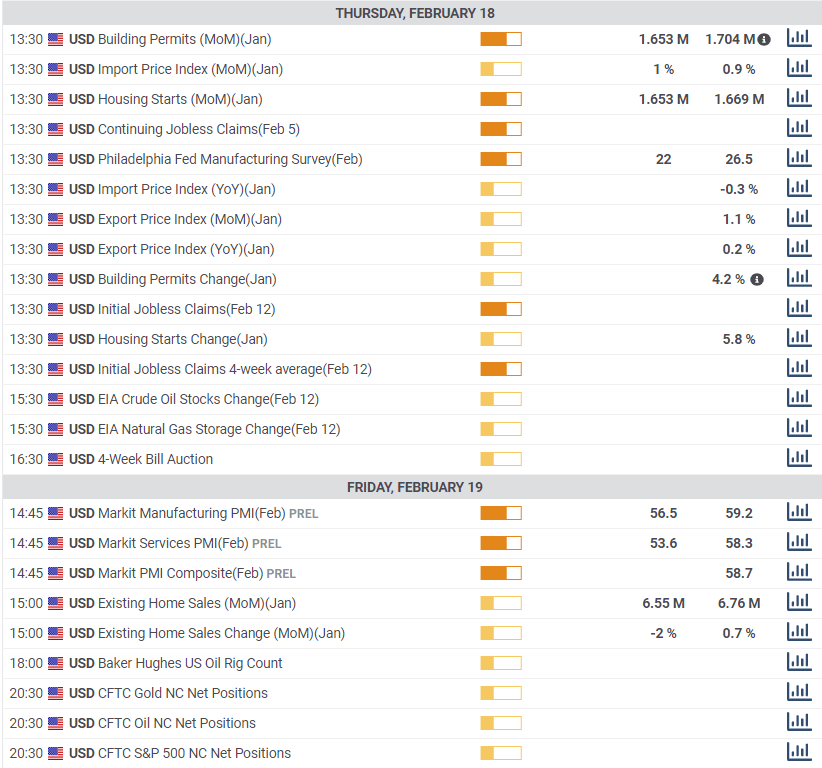

US statistics February 15-February 19

Retail Sales for January predominate. After three unusual negative months markets want to know if the fourth quarter decline in sales has ended now that the California lockdown is over. Variation will translate to the dollar.

Monday

US Holiday President's Day

Wednesday

Retail Sales are expected to rise 0.7% in January after an equivalent negative in December. Retail Sales ex-Autos are forecast to rise 0.8% after falling 1.4% in December. The Retail Sales Control Group is projected to gain 0.4% following the 1.9% plummet I December. The Producer Price Index (PPI) is expected to add 0.4% in January after a 0.3% increase in December. The annual rate rose 0.8% in December. Core PPI is predicted to rise 0.2% in January after 0.1%in December. The annual Core rate was 1.2% in December. Industrial Production is forecast to gain 0.4% in January subsequent to 1.6%in December. Capacity Utilization is forecast to rise ti 74.8% in January from 74.5% prior. The National Association of Home Builders (NAHB) Housing Market Index is anticipated to be unchanged at 83 in February.

Thursday

The Philadelphia Fed Manufacturing Survey is expected to drop to 20 in February from 26.5 in January. Initial Jobless Claims are forecast to be 775,000 in the February 12 week. Continuing claims are projected to rise to 4.575 million. Housing Starts are expected to rise 0.6% in January to 1.654 million following 5.8% and 1.669 million previous. Building Permits are estimated to drop to 1.654 million after 1.704 million in December.

Friday

Existing Home Sales are forecast to drop 2.7% in January to 6.56 million annualized after 0.7% and 6.76 million in December. Markit Services PMI for February is projected to drop to 57.5 from 58.3 in January. Markit Manufacturing PMI is expected to fall to 58.5 in February from 59.2

USD/CAD technical outlook

The reactive collapse in USD/CAD on Friday as WTI raced to a new 13-month high into the London close took no notice of the formerly steady support at 1.2700 and the close below leaves a heavy flavor on the pair to start the new week.

With its run to nearly $60 on Friday WTI is about at the half-way point of its range from January 2019 to the start of the pandemic in the US in March 2020. If, as expected, the US and global economies begin to show signs of revival, WTI should trade higher, especially as the range for 2018 was above $65 for most of the year and reached $76.80. Given WTI's demonstrated link to the Canadian dollar the bias for the USD/CAD is lower.

Recent support for the USD/CAD is limited and does not extend below 1.2640. The three year low of 1.2590 on Janaury 21 is too transient to provide more than a pause. The 21-day moving average at 1.2743 was crossed on Wednesday and is now part of resistance at 1.2740. The 100-day at 1.2945 would back the line at 1.2925 were the USD/CAD rise that far. The 200-day at 1.3205 is in abeyance. The Relative Strength Index at 43.45 though not far from neutral is a sell given Friday's action.

Resistance: 1.2740; 1.2825; 1.2860; 1.2925

Support: 1.2660; 1.2640; 1.2590

USD/CAD Forecast Poll

The FXStreet Forecast Poll is mildly bullish out to one quarter. It is not a rising trend but a consolidation near the middle of the descending channel. The reaction of the USD/CAD to rising crude oil prices makes further losses a distinct posibility.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.