USD/CAD Weekly Forecast: The central bank duet

- WTI falls 10% on Tuesday, USD/CAD regains 1.3000, both partially reverse by Friday.

- Canadian economy sheds jobs for the first time since January, US payrolls are strong.

- FXStreet Forecast Poll highlights range-bound USD/CAD trading.

Traders can be forgiven for wondering what it will take for the USD/CAD to break out of the 1.2850 to 1.3050 range of the past month. The 11.8% plunge in West Texas Intermediate (WTI) from Tuesday’s open to Wednesday’s close as global recession fears overwhelmed the commodity market, prompted a 1.4% jump in Dollar Canada (1.8% low to high). But by Friday’s close at 1.2945, the pair was less than half-a-figure from Monday’s open at 1.2908 even though WTI had regained just half of its early week collapse.

From June 14 to July 8 the USD/CAD lost exactly three points. At the same time the Dollar Index rose 1.3%, the EUR/USD fell 2.2%, the USD/JPY rose 1.2% and the Bloomberg Commodity Index (BCOM) shed 10.2%.

Even WTI, the mainstay of the Canada's resource economy, lost 13.6% through the period to essentially no reaction from the USD/CAD.

Global and US recession fears abated somewhat on Friday with the strong NFP report in the US. The pending 75 basis point increases at the Bank of Canada (BoC) due this week and the Federal Reserve two weeks later and subsequent hikes, designed to quell inflation but sure to have a negative impact on economic growth, will keep the recession meme alive for several months.

Minutes from the Fed’s June meeting said that another 50 or 75 point hike is likely this month, which is hardly news. The minutes also noted that Federal Open Market Committee (FOMC) members “recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist.”

Unless there is a dramatic and unexpected improvement in US or Canadian consumer inflation, rates will continue to increase until stopped by a recession.

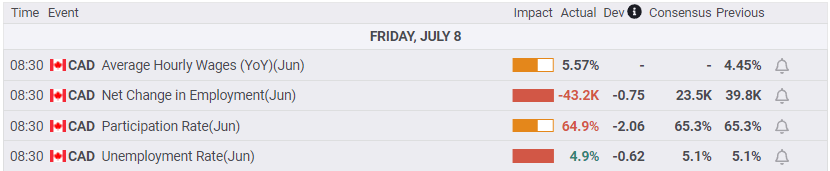

Canadian PMIs from Ivey and S&P Global were weaker than forecast in June though well on the right side of 50. Net Change in Employment at -43,200 was negative for the first time since January, following May’s 39,800 increase. A gain of 23,500 had been predicted. The unemployment rate fell to 4.9% from 5.1%. An unexpected decline in the Participation Rate from 65.3% to 64.9%, indicating a drop in the labor force, explains the loss of jobs as the unemployment rate fell.

In the US, the Services Purchasing Managers Index from the Institute for Supply Management posted a good reading in the general measure at 55.3, but the crucial New Orders Index fell to 55.6 in June from 57.9, much lower than the 62.1 forecast. The Employment Index dropped into contraction at 47.4, from 50.2, also missing its 49.8 estimate. Jobless claims inched higher with the four-week moving average at 232,500 in the July 1 week up from 231,750 for the highest level in almost five months.

Nonfarm Payrolls added 372,000 workers in June, much better than the 268,000 consensus forecast and nearly on par with May’s revised 384,000. The US unemployment rate was stable at 3.6%. Hourly earnings rose 5.1% annually, and May was adjusted to 5.3% from 5.2%, evidence that pressure on wages is unabated. The Labor Force Participation Rate, a measure of worker involvement in the job market, fell to 62.2% from 62.3%. Though the drop was small it is a disconcerting sign that with more than 11 million unfilled positions in the economy, worker connection to the labor market remains well below pre-lockdown levels.

The Atlanta Fed GDPNow model, which has charted the economy’s potential descent into recession, improved after the NFP release. Estimated second quarter GDP rose to -1.2%, up from -1.9% on July 7 and -2.1% previous.

USD/CAD outlook

The USD/CAD finish at 1.2945 on Friday was exactly in the middle of its month-long range. Given the serious provocations this week, a nearly 12% two-day drop in WTI followed by recovery by half, and opposed payrolls reports in Canada and the US, the USD/CAD stasis indicates the balanced forces acting on the pair are unchanged.

Since February 4 the Dollar Index Spot has increased 12.1% while the USD/CAD has gained 2.0%. The overall rise in the US dollar has been mitigated in the USD/CAD by a 15.2% rise in WTI. Alternating rate increases from the Fed and BoC have had no net effect on the USD/CAD. This general disposition remains intact.

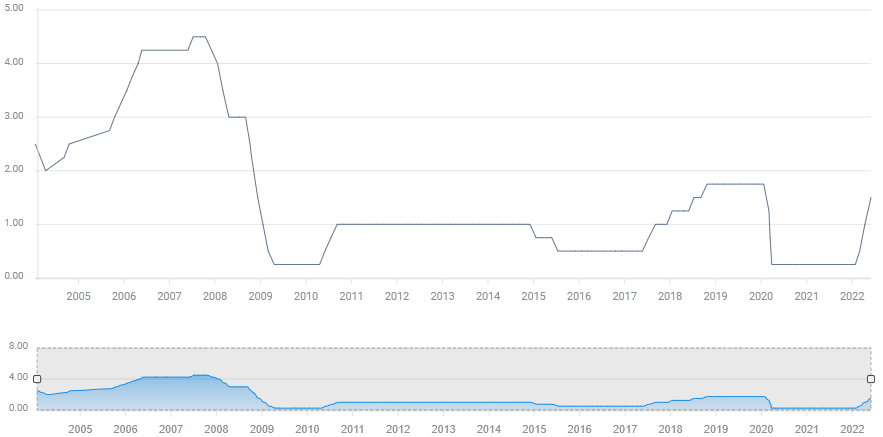

The Bank of Canada meeting on Wednesday is the main event. Governor Tiff Macklem is expected to add another 75 basis points bringing the base rate to 2.25%. This would be the highest for Canada since October 2008 at the onset of the financial crisis. In January 2020 the rate was 1.75%. Any deviation in the hike, 0.5% or 1.0%, will effect the USD/CAD.

Bank of Canada base rate

FXStreet

In the US, the Consumer Price Index (CPI) for June on Wednesday holds center stage followed by producer prices a day later. The expected slight increase in headline CPI to 8.7% would confirm that inflation is still accelerating, a problem that will be unrelieved by a forecast drop in the core rate to 5.7% from 6.0%. The Producer Price Index (PPI) is predicted to be stable at 10.8% for the year. The higher each index comes in the more support it provides for Treasury yields and the dollar. Retail Sales for June on Friday will be scrutinized for the health of the US consumer. Sales are forecast to recover to 0.8% from May's unexpected -0.3%. A weak sales number will revive concern over a US recession.

The USD/CAD outlook is neutral with a slight tendency to drift to the lower portion of the recent range. As always an exception must be made for the inverse impact on the USD/CAD of any pronounced move in crude oil prices.

Canada statistics July 4-–July 8

FXStreet

US statistics July 4–July 8

Canada statistics July 11–July 15

FXStreet

US statistics July 11–July 15

USD/CAD technical outlook

The potential cross of the MACD (Moving Average Convergence Divergence) price line over the signal line, they met on Friday, will need to exhibit substantial deviation before it can be considered a sell signal. The two have crossed twice in the past month to no trend indication.

In confirmation of the neutral aspect, the Relative Strength Index (RSI) slipped toward its mid-point this week. Volatility remains relatively high in the Average True Range (ATR) helped by Tuesday's run higher and Thursday’s loss.

The 21-day and 50-day moving averages (MA) augment the support lines at 1.2930 and 1.2845.

Resistance: 1.2980, 1.3000, 1.3025, 1.3050

Support: 1.2925, 1.2900, 1.2875, 1.2845

Moving averages: 21-day 1.2930, 50-day 1.2846, 100-day 1.2751, 200-day 1.2688

FXStreet Forecast Poll

The FXStreet Forecast Poll is weakly bearish, endorsing the lower side of the range at 1.2850 out to one month and suggesting that the USD/CAD will continue to range trade.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637930615204569002.png&w=1536&q=95)