US Dollar Forecast: Near-term outlook hinges on the Fed

- The US Dollar Index faces increased selling pressure.

- President Donald Trump advocated for lower interest rates.

- The Federal Reserve is expected to keep rates intact next week.

The Greenback’s correction continues

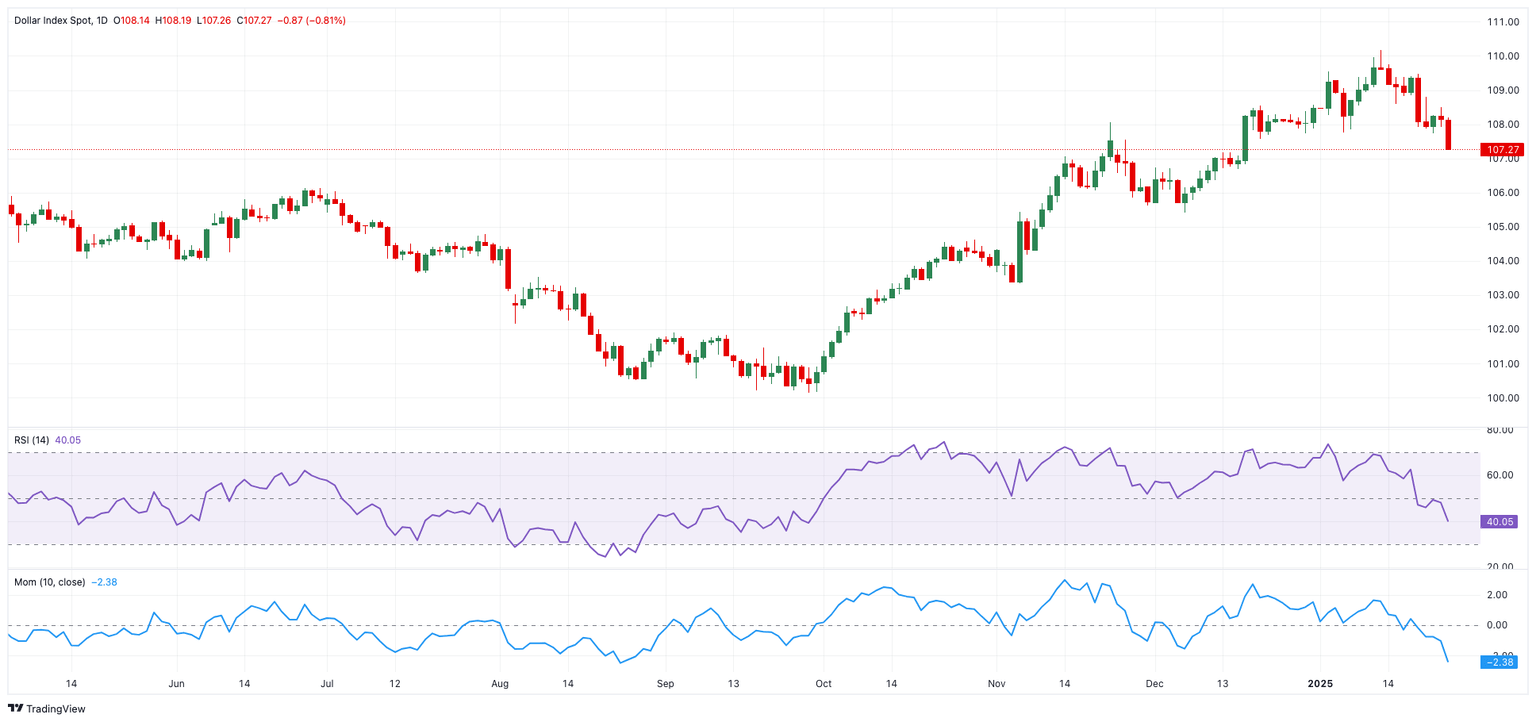

Another negative week saw the US Dollar lose further ground, with the US Dollar Index (DXY) dropping to five-week lows in the sub-107.00 region. The index extended its pullback from the previous week, continuing its retreat from the cycle highs above the 110.00 mark seen earlier in the month.

Trump’s lack of clarity on trade keeps the Dollar depressed

The Dollar weakened immediately after Inauguration Day, following President Donald Trump's inconclusive remarks regarding the implementation of tariffs, a central theme of his presidential campaign.

Compounding the renewed sour sentiment around the Greenback, Trump’s recent comments revealed a preference for lower interest rates. At the same time, he appeared to soften his stance on China, prompting market participants to speculate that tariffs on imports from the Asian economy might ultimately fail to materialise.

The White House has also indicated intentions to impose tariffs on imports from the European Union, Canada, and Mexico. However, no further discussions or details have been provided on these plans so far.

No changes expected at the FOMC gathering

Moving forward, the Federal Reserve (Fed) is expected to keep its interest rates unchanged in the 4.25%-4.50% range at its January 28–29 meeting. Meanwhile, investors continue to believe that the central bank will reduce rates by no more than 50 basis points this year, a scenario underpinned by strong economic fundamentals and the overall resilience of the US economy.

Despite President Trump’s failure to provide clear direction on his trade policies, the recent weakness in the Greenback is likely to be temporary. Stronger underlying factors are expected to support a constructive outlook for the US Dollar throughout the year.

As for the Federal Reserve, remarks from officials prior to the blackout period highlighted cautious optimism regarding inflation and its implications for monetary policy. Richmond Fed President Thomas Barkin noted that December’s inflation data aligns with the trend of prices gradually moving closer to the Fed’s 2% target. Similarly, New York Fed President John Williams emphasised that future policy decisions will remain data-dependent, given the ongoing uncertainties in the economic landscape. Fed Governor Chris Waller suggested that inflation might ease enough to justify faster-than-expected rate cuts, while Chicago Fed President Austan Goolsbee pointed to signs of a stabilising labour market as a positive development.

Key events on the horizon

Looking at next week’s US calendar, the FOMC meeting will be the salient event, seconded by US inflation measured by the PCE, the usual weekly report on the labour market, and an estimate of the US GDP Growth Rate in Q4.

US Dollar index technical outlook

The DXY recently peaked at 110.17 (January 13) and faces its next significant resistance at the 2022 high of 114.77 (September 28).

On the downside, there is initial contention at the 2025 bottom of 106.87 (January 24), ahead of the December 2024 low of 105.42 (December 6), and the critical 200-day SMA at 104.35.

As long as the DXY remains above the latter, its bullish trend is likely to stay intact.

The daily RSI tumbles to around 41, indicating further loss of momentum, while the ADX near 26 signals a moderate strength of the current trend.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.