US Dollar Index outlook: Dollar remains under strong pressure and extends weakness on Friday

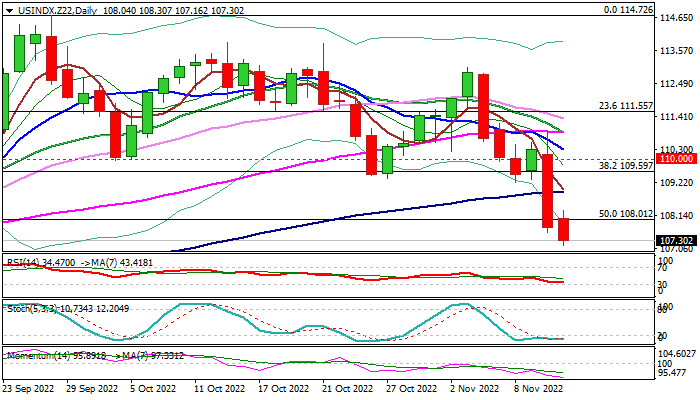

US Dollar Index

The dollar index remains under strong pressure and extends weakness in European session on Friday, following 2.2% fall previous day, when the greenback was deflated by lower than expected US inflation rise in October that adds to hopes that strong price pressures have started to ease, and the US central bank may start softening its aggressive stance in tightening monetary policy to bring high inflation under control.

The dollar is also on track for the biggest weekly loss since the third week of March 2020 that adds to signals of reversal, which is developing on weekly chart.

Daily studies turned to bearish setup as fresh bearish acceleration have so far retraced over 50% of 101.29/114.72 upleg) after Thursday’s sharp fall broke through pivotal support at 109.59 (Fibo 38.2% / base of thick daily cloud) and bearish momentum continues to strengthen.

Bears focus next target at 106.42 (Fibo 61.8% of 101.29/114.72), violation of which would risk extension towards rising 200DMA (104.68), as dollar’s sentiment has weakened significantly.

However, bears may take a breather on oversold conditions and week-end profit taking, with upticks to ideally stay capped under broken 100DMA (108.93) which guards pivotal barriers at 109.59/110.00 (broken Fibo 38.2% / psychological).

Res: 108.30; 108.93; 109.59; 110.00.

Sup: 107.16; 106.42; 105.42; 104.68.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.