UK PMI Preview: GBP/USD bulls to target 1.35 handle on improved data

- UK Services and Manufacturing PMIs in the spotlight.

- Bulls seeking a continuation of a recovery in the data to lift the pound.

- Traders will consider the UK elections for and the MPCs forecasts for growth and subsequent gradually tightening of MP.

- Bulls to target 1.35 handle, bears to target 1.33/20 support area.

For the key events from the economic calendar, the week will kick-off with Preliminary UK Purchasing Managers Index (PMIs) today. The data is scheduled to be released at 0930 GMT and will be the first data since the UK election result which has lifted the uncertainty around whether the Brexit Withdrawal Agreement, (WAB), would be passed.

Market Manufacturing and Services PMIs could be the first in a series of key data from the UK for the week ahead that will draw two-way business for sterling crosses. There is a particular interest in the PMIs for December considering it will be the final data that had been collected before the UK elections where there is bound to still be some weakness due to the broad concerns about political uncertainty.

UK PMIs climbing there way back towards expansion

- Markit Manufacturing PMI:

- Markit Services PMI:

BoE will be playing close attention to UK election outcome on PMIs

We have started to see some improvements in the data. This time around, there would have been a sense that the Tories would win a UK election which should be reflected in a slight improvement in today's release.

The market is looking for the Manufacturing PMI to rise from 48.9 to 49.4 and for the Services PMI to rise from 49.3 to 49.6. Such outcomes would be positive for the pound, although markets will prefer to wait for the January numbers a month from now as these will be more significant as they'll be the first ones that incorporate the general election results.

Some analysts have argued that Markit’s survey had been excessively influenced by general concerns among businesses about the Brexit and political outlook and so had become a poor indicator of day-to-day economic activity. Nonetheless, the Bank of England had warned that the lifting of political uncertainty would unleash a wave of pent-up demand, so the markets will be watching closely here for determining what the Old Lady's next move is going to be.

Bank of England's Governor, Mark Carney, in a speech made in early November at a conference in London about the uncertainty surrounding Brexit and global trade tensions and the outlook for the UK economy, stated that "the picture in the UK could change", in relation to prospects in a pick-up in UK growth due to a recent UK/EUWDA.

Carney stated that the pace of growth recovery will depend critically on to the extent to which uncertainty over the future of EU UK trading relationship dissipates, and to a much lesser degree, by how much the global economy actually picks up – both are assumed in the Monetary Policy Committee's (MPC) projections, nither are assured.

"Monetary Policy will have to be carefully recalibrated to support a sustainable recovery".

Carney stated.

Considerations for the pound

Mark Carney followed up the mentioned statements made in his November speech by arguing that growth will pick up due to the Brexit uncertainty facing UK businesses and households will decline gradually and subsequently, the MPC was forecasting the fastest pace of fourth-quarter business investment growth picks up materially from current negative rates to around 4.5% at the fastest pace since the referendum.

Carney also noted an increase in fiscal spending and stronger external demand when forecasting UK growth to pick up 1% this year, to 1.6% in 2020, 1.8% in 2021 and 2.1% in 2022. While this is good news for sterling, it is not something that the pound can run away on immediately.

Firstly, the BoE's remit is to achieve the UK Government's 2% inflation target. Carney stated that if global growth fails to stablise, (big focus on US/China trade deal developments), or if Brexit uncertainties remain entrenched, (we are watching trade negotiations now) monetary policy may need to reinforce the expected recovery in UK GDP and inflation.

The BoE Governor recently summed up the situation by saying risks to the outlook are “skewed to the downside.” In fact, in the last BoE meeting, two policymakers wanted to cut interest rates immediately, though they were outvoted by the majority, at least for now.

Surprise MPC Split

November’s BOE decision saw the biggest dovish dissent of Carney era:

However, Carney also stated that some gradual tightening of policy would be warranted if the UK economy expands as the MPC has projected and for now, the level of accommodation is appropriate. So long as the PMI continue to improve, global trade, including the EU/UK trade negotiations develop positively, a less dovish BoE will support the pound and as such, Monday's moves will reflect the market's expectations, one way or the other.

Key scenarios for GBP/USD (Services PMI)

The UK's economy is more reliant on the service sector than any other G7 country. There is usually more of a focus on services data over manufacturing. A 20 pip move, either way, can occur on the data on the 15-min time frame. Over a 4-hour trade, however, cable can move as far as 60 pips.

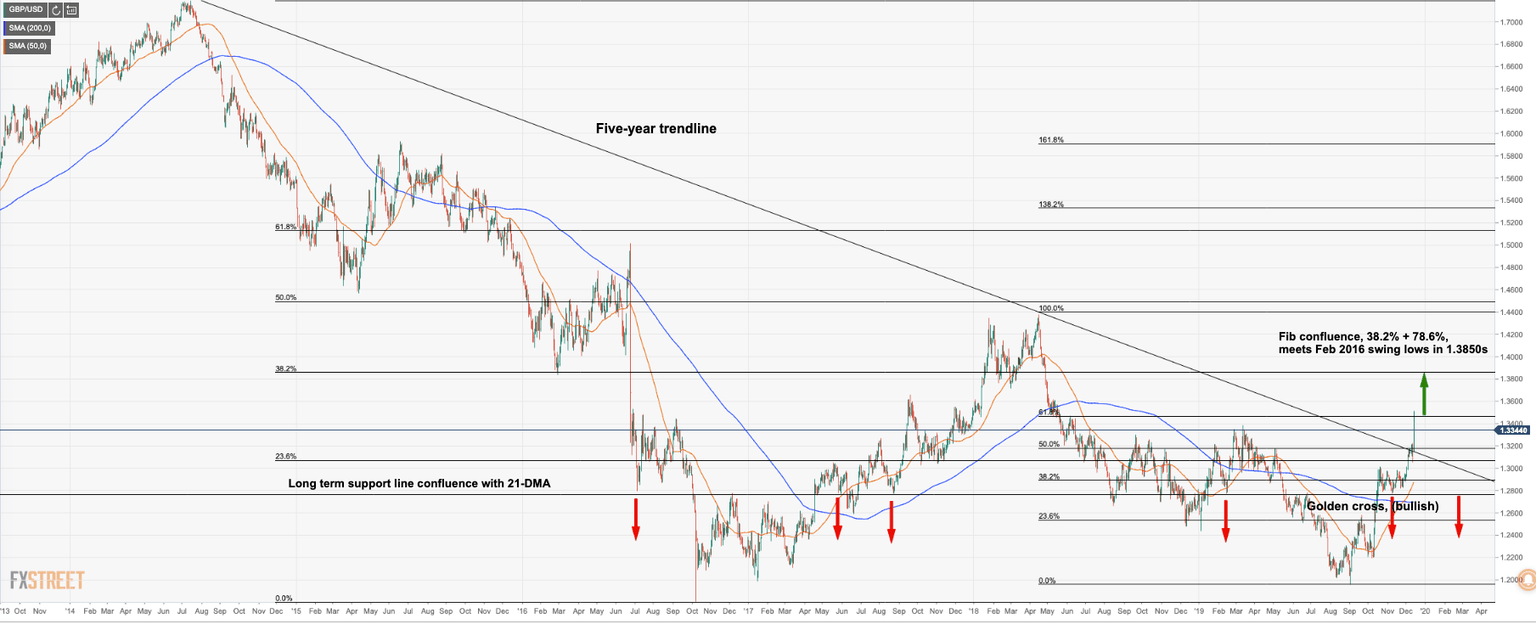

- Cable daily chart: (Bullish above long-term support, golden cross, five-year downtrend resistance, capped at 61.8% Fibo).

The key pivot levels are as follows:

- Support levels: 1.3305 1.3270 1.3225

- Resistance levels: 1.3365 1.3400 1.3440

Price action conclusion

On a positive outcome, and so long as the week's other data for the UK is positive, based on an ATR of over 100 pips, while considering Octobers 145 pip ATR highs, bulls can target a break of 1.35 handle and recent highs of 1.3514 and hold above there. On the downside, the 21-day moving average is located in the low 1.30s which meet the 21 October highs of 1.3012 and S1 at 1.3305 as a key support area.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.