Global Markets

The lingering impact of Draghi’s dovish rhetoric on the health of the Eurozone economy continues to haunt the currency markets with the Euro under pressure as expectations mount around the ECB taking action in March. Increased downside risks highlighting emerging market weakness, ongoing China woes and slowing global growth have left the Eurozone vulnerable, while depressed commodity prices continue to obstruct the central bank's 2% inflation target. With the possibility of the ECB reconsidering its policy stance in March amid the turmoil in the global markets, investors may speculate on the likelihood of the central bank unleashing further stimulus measures in the near-term and this should leave the Euro open to further losses.

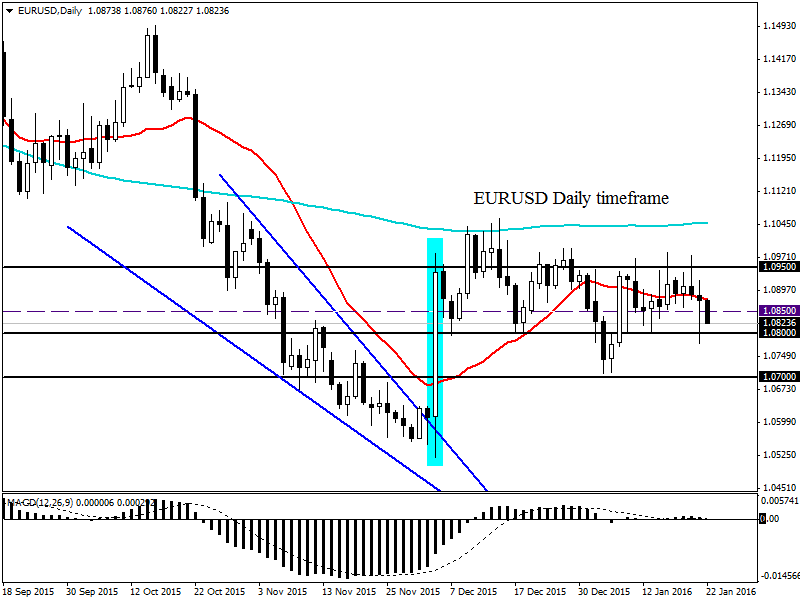

Euro bears received inspiration from the ECB doves during trading on Thursday, and as such this has offered an opportunity for bearish investors to send the EURUSD to fresh weekly lows at 1.077. From a technical standpoint, this currency is tilting towards the path of the bears as prices are trading below the daily 20 SMA while the MACD has crossed to the downside. Previous support at 1.085 should act as a dynamic resistance which should encourage a further decline towards 1.080 and possibly lower.

Stock markets receive a lifeline

Global equity markets were offered a lifeline during trading on Thursday with most major stocks bouncing back amid the sharp rebound in oil prices which restored some global confidence. This positivity installed a wave of risk appetite in the Asian equity arena which sent prices higher and also complimented the growing speculations that the central banks will expand stimulus measures. European equities managed to claw back losses on Thursday closing positive with expectations high that American equity markets will follow the same positive trajectory when the US session opens. Despite these short-term gains viewed in the stock markets, confidence in the overall global economy still remains low while elevated concerns around slowing global growth and declining commodity prices weigh heavily on global sentiment. Markets may be experiencing a relief rally which may come to an abrupt end when commodity markets resume their declines and risk appetite sours.

Sterling rebounds ahead of Retail sales

The Sterling experienced a sharp appreciation across the global currency markets on Thursday and this has nothing to do with an improved sentiment towards the single currency. Sentiment towards the pound remains bearish and with any surviving hopes around the Bank of England raising UK rates in the near term erased, more weakness in prices may be expected. The odds are stacked against the Sterling bulls as domestic concerns around slowing wage growth and tepid inflation levels have pointed to a potential slowdown in economic momentum in the UK, while falling commodity prices and ongoing concerns around slowing global growth have heightened fears that the UK may be exposed to external risks. December’s retail sales report will be released for the United Kingdom on Friday and if it fails to meet expectations then the Sterling may be left vulnerable, which should encourage bearish investors to attack once again.

Despite the bounce the GBPUSD experienced on Thursday, prices are still heavily bearish on the daily timeframe. This relief rally may offer an opportunity for bearish investors to attack prices as long as the 1.4350 previous lower high defends. From a technical standpoint, prices are trading below the daily 20 SMA while the MACD has crossed to the downside. A breakdown back below 1.4150 should open a path towards 1.400.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.