Global Markets

The growing optimism over the increased likelihood of a US interest rate rise in December has given the global financial markets a sense of positivity. Investors have acquired some clarity from the mildly hawkish FOMC meeting minutes concerning the potential interest rate hike timings, and as a result global equity markets have rallied. Asian and European equities enjoyed a day of gains on Thursday and this may leak into the New York session propelling American equities even higher. The confidence markets have received may be reflected in the Fed futures which show a near 70% probability of the Fed acting to raise rates, and such metrics should empower the Dollar bulls in the longer term.

Whilst American equities surged on Wednesday around the swelling expectations of a December hike, the Dollar decided to unwind across the board. Regardless, a dominant Dollar remains the recurrent theme in the global currency markets and this depreciation may simply be a relief rally. Dollar sensitivity to interest rate expectations remains potent and this may be viewed in the USD index which is currently trading towards 100. The next major event for the US economy will be the unemployment claims on Thursday, and if the release exceeds expectations then USD bulls may be offered an opportunity to send the Dollar Index back towards the daily highs of 99.60.

Technically speaking, the Dollar Index is heavily bullish as there have been consistently higher highs and higher lows. Prices comfortably trade above the daily 20 SMA and the MACD has crossed to the upside. The candlesticks may bounce from the respected bullish channel or use the 98.40 support to gain momentum for a drive back towards 100.

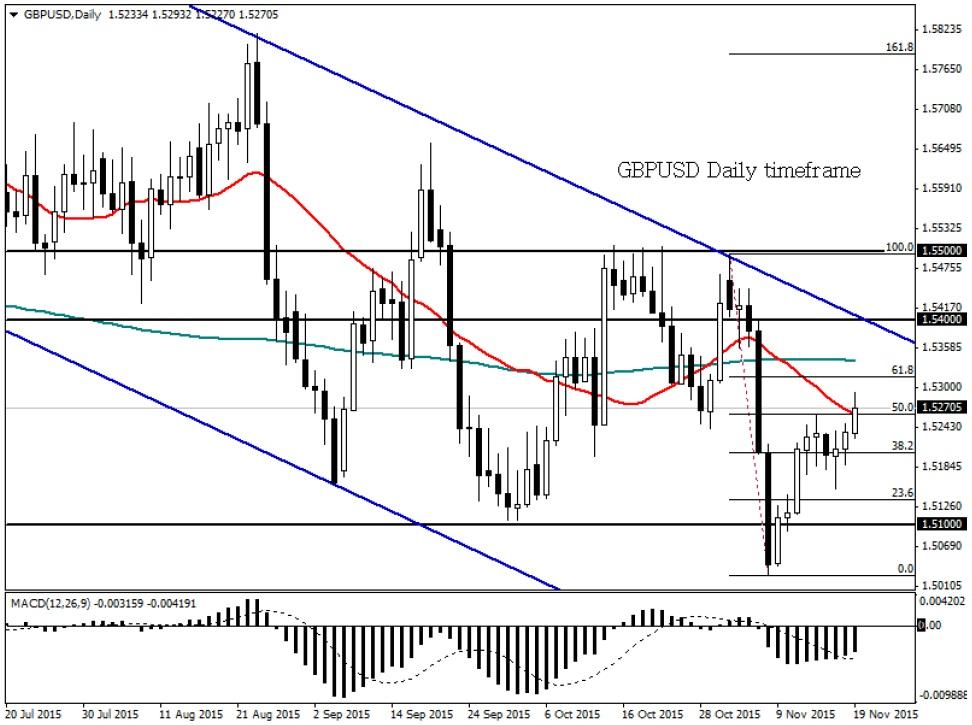

Currency spotlight – GBPUSD

The GBPUSD has hit a weekly high at 1.529 despite last week’s mixed UK labor report which unearthed some concerns about the potential slowdown in economic momentum in the UK economy. The BoE has remained hesitant towards committing itself to raising UK rates and this may punish the Sterling in the longer term. The GBPUSD remains fundamentally bearish and this relief rally may extend to the 61.8% Fibonacci retracement level around the 1.53 area before sellers send prices back down.

Looking at the daily timeframe, this pair is technically bearish with prices finding some resistance across the Fibonacci levels. The 1.53 area is also below the 200 daily SMA which should offer an opportunity for sterling bears to take control again.

GBPNZD

The GBPNZD is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. The previous 2.3350 resistance may act as a dynamic support which should send prices towards 2.4000.

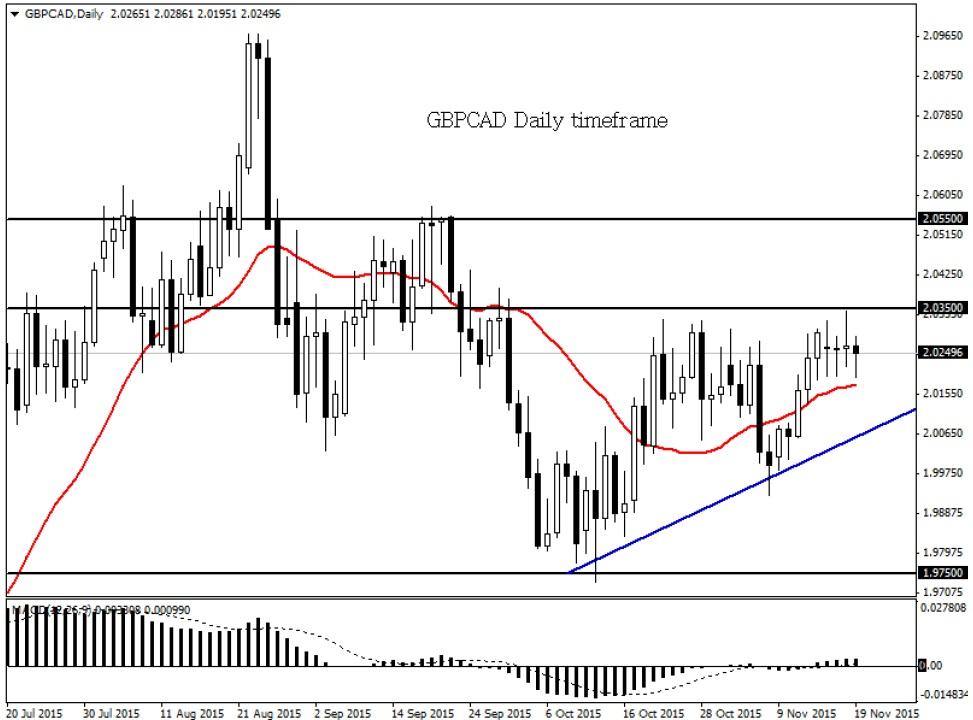

GBPCAD

The GBPCAD is turning technically bullish on the daily timeframe on the condition that prices breakout above 2.0350. This may invite an opportunity for buyers to send prices towards 2.0550.

EURJPY

This pair remains technically bearish on the daily timeframe as long as prices can keep below the 133.00 resistance. The candlesticks trade below the daily 20 SMA and the MACD has crossed to the downside. A breakdown below 131.00 may open a path to the next relevant support at 129.50.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold price pullback on Fed hawkish tilt amidst lower US yields, weaker US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.