The Bond Charts that Matter

Bund Yields HoldingLower

Last week the Bunds postedan inside candle on the yield chart and are slowly creeping back down to the13.4bp mark from 2 weeks ago that we made in a sharp euphoric move as risk offsentiment grasped the markets. The key area to keep an eye on if we breach thislevel is the all-time low yield in Bunds at the 4.9bp mark. To the upside, wehave found resistance at the 29.4bp mark which is a key area ahead of theall-important 42.4 bp level that we breached at the end of last month.

Portuguese BondsTrading Within Inside Week

A very key market to keepan eye out for risk-sentiment is the Portuguese bond market which took a veryswift and aggressive shoot up in yields (down in price) during the bout ofvolatility 2 weeks ago. During this move we actually went through the inverseHead and Shoulders target to the upside and last week we left an insidecandle with low in yield at 3.127% and high at 3.559%. A breach of thelevel to the upside with continuation could spark some more risk off sentimentand widening of core-periphery spreads.

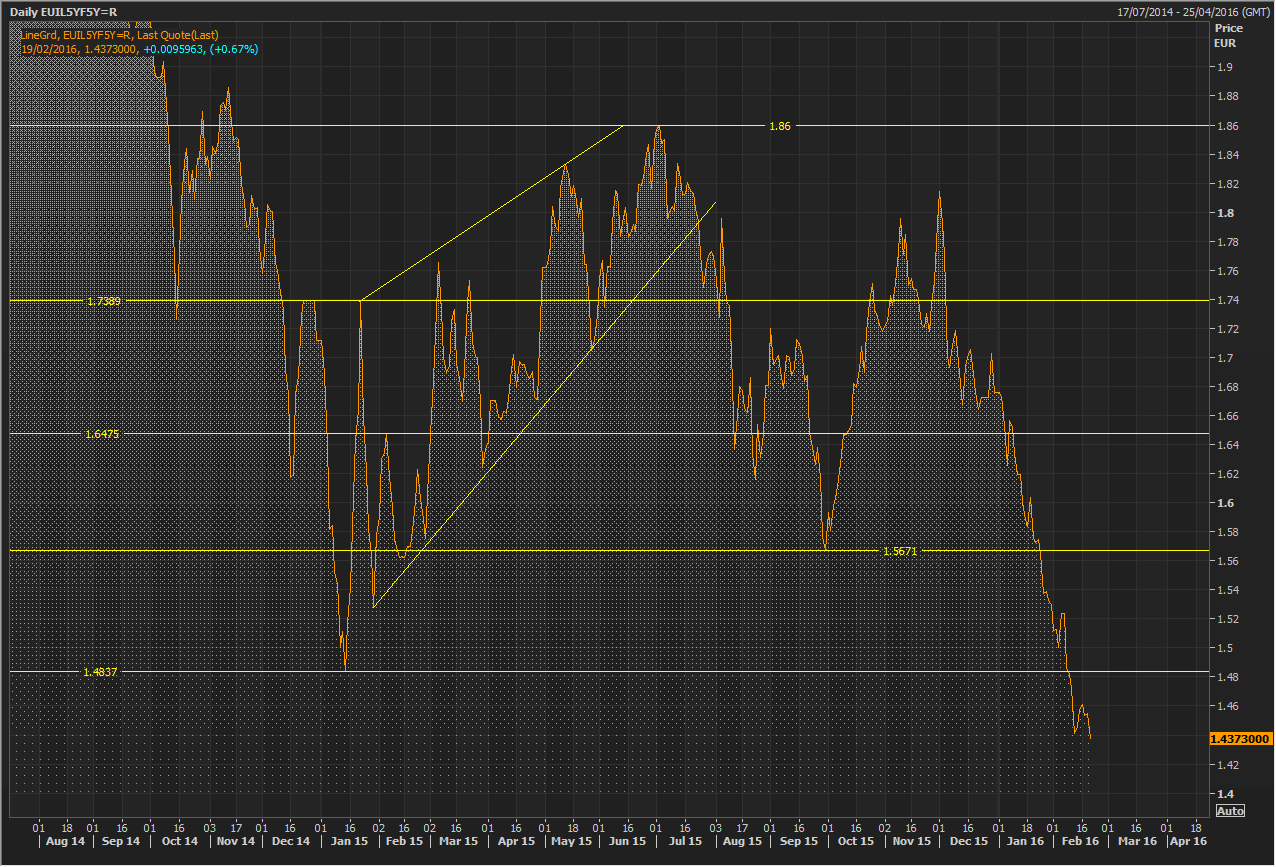

5y5y InflationSwaps Breaking Lower Aggressively

One of the ECB's preferredmeasures of inflation expectations in the medium term has been plumetting withno end in sight since the beginning of 2016. This is an occurance that willsurely be occupying the ECB's discussions on the Governing Council as the lastthing they want is for the market to believe the economy is falling into adeflationary spiral. This is a market to watch as ECB members could begin toget very vocal ahead of the March meeting in the scenario that it continues tofall this rapidly..

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.