Bitcoin price drops, but holders with 100 to 1000 BTC continue to buy up

- Bitcoin price has been slowly proceeding toward lower boundaries of range to test support.

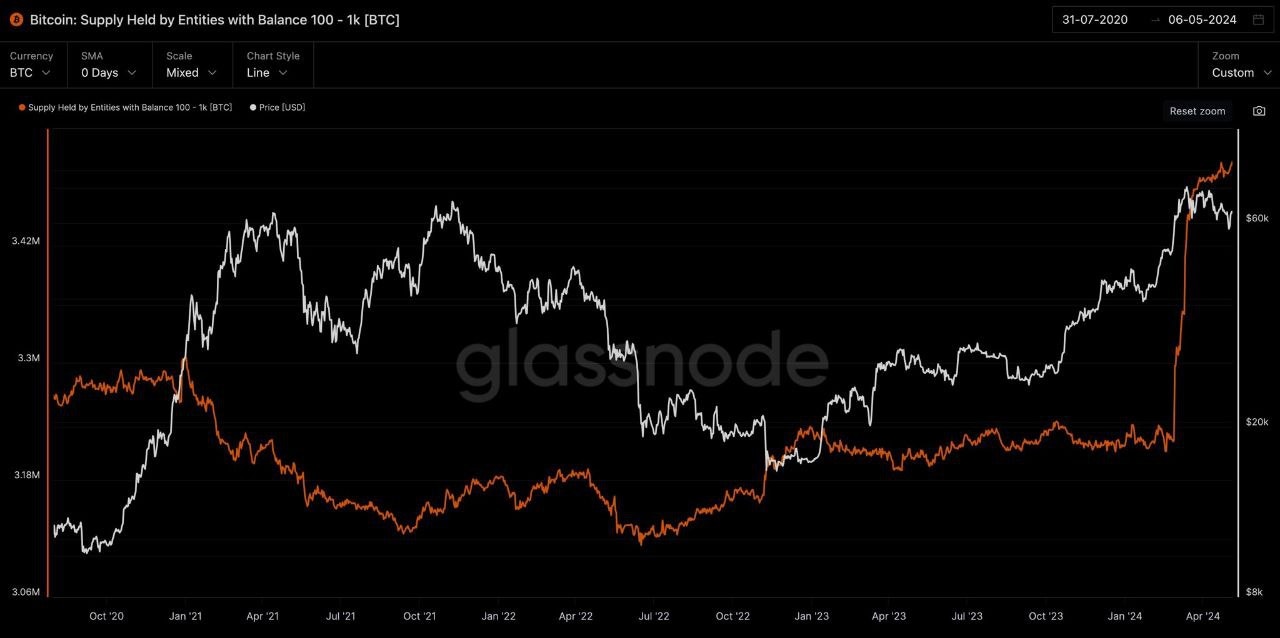

- Holders with between 100 and 1000 BTC are buying more.

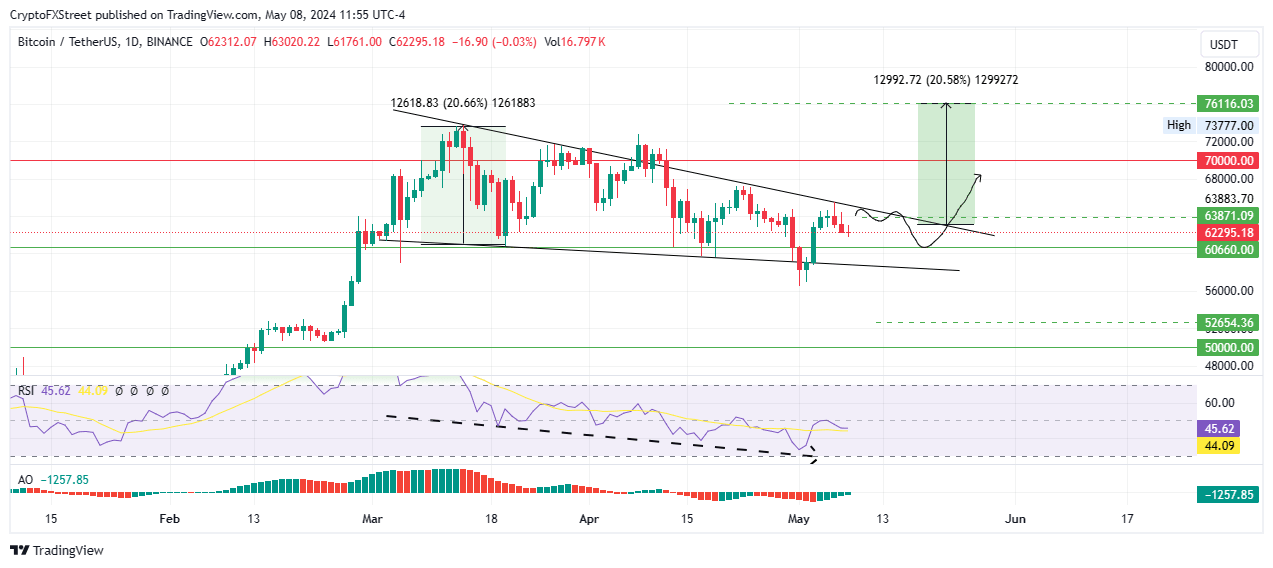

- A falling wedge pattern suggests 20% upside potential for Bitcoin price.

Bitcoin (BTC) price action continues to show a lack of participation from new traders, steadily grinding south in the one-day timeframe, while the one-week period shows a horizontal chop. Meanwhile, data shows that some holder segments continue to buy up.

Cryptocurrency prices FAQs

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Daily digest market movers: Holders with 100 to 1000 Bitcoin balances are buying up

Bitcoin price action is leaning toward the south but is confined within a falling wedge pattern. Characterized by two converging trendlines that slope downward as they gradually narrow the price range, this technical formation is encouraging holders with between 100 and 1000 BTC balances to buy more.

Bitcoin supply held by entities with balance 100 to 1K BTC

There appears to be a lack of significant market participation from new buyers, while so-called “hodlers” fail to see this cycle over yet. It is likely that the market could see more grind time between the established trading range.

The move to buy among the entities could mean diversifying their portfolio or averaging down their cost basis by purchasing more Bitcoin during price dips. This strategy can help them reduce their average purchase price over time.

Meanwhile, the BTC exchange-traded funds (ETFs) front continues to shape and accelerate price action. Wintermute, a leading global algorithmic trading firm in digital assets, has announced that it will be establishing its presence massively in Asia, specifically in Hong Kong.

This will come by way of a strategic partnership where Wintermute collaborates with OSL and HashKey to provide liquidity for Hong Kong's newly-launched spot BTC and Ether ETFs.

Wintermute's involvement aims to attract both institutional and retail investors by enhancing market liquidity, which is crucial for the ETFs' operation.

Technical analysis: Bitcoin price primed for a possible 20% upside potential

Bitcoin price is still grinding in a falling wedge pattern, with potential for a 20% rally upon successful breakout. However, based on the outlook of the momentum indicators, we could see more downside before this happens, ideally before BTC fills the bullish reversal technical formation.

The Relative Strength Index (RSI) continues to record lower lows since around mid-March, hinting at further downside momentum. The position of the Awesome Oscillator (AO) in negative territory also accentuates this stance, typically signifying a bearish trend in the market. These show that the downward trend may persist in the near term.

Accordingly, Bitcoin price could continue the fall to the $60,660 support level or lower, providing another buying opportunity in the $50,000 range.

BTC/USDT 1-day chart

On the other hand, if the $60,660 level continues to hold as a support, Bitcoin price could make a bounce here before a break above the upper trendline of the pattern. A decisive candlestick close above $63,871 following the breakout could set the tone for a 20% upswing to the profit target of the falling wedge at $76,166.

In a highly bullish case, Bitcoin price could extend to take back the $73,777 peak.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.