US employment figures are finally out, giving the EUR a onetime chance to recover the ground lost since the year started: the US created just 74K new jobs, and while unemployment rate decreased to 6.7%, closing in on the 6.5% FED’s threshold to consider raising the Fed funds rate, dollar fell down across the board.

Why? Because the decreasing unemployment rate, is a consequence of the labor force participation rate tumbling to 62.8%, its worst level since January 1978. And despite the FED has been firmly ignoring the number, market players can’t see how, now, the Central Bank will be willing to continue removing facilities programs.

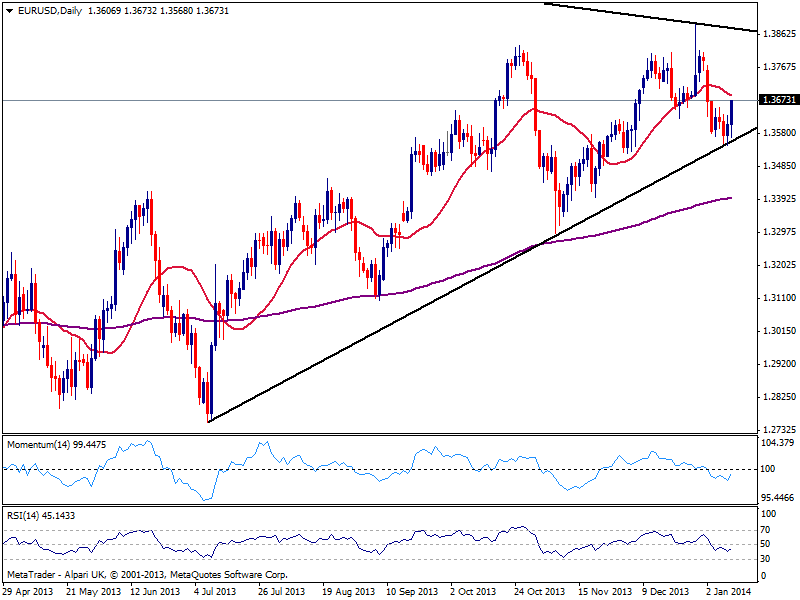

The EUR then, can blossom again, particularly as this week low against the dollar found support to the tip in a still bullish 20 SMA. Also, the daily chart shows price managed to held this week above a daily ascendant trend line coming from past July low at 1.2754, now around 1.3560. In this same time frame, indicators hold below their midlines, albeit lost their downward potential and turned higher, approaching their midlines, while 20 SMA offers now dynamic resistance around 1.3690: this is then the first level to overcome to confirm more EUR/USD gains, looking for a probable retest of the monthly descendant trend line coming from its all time high of 1.6038, now around 1.3860.

As for the downside, as long as the mentioned ascendant trend line holds, buyers will dominate the scene, maintaining the buy-the-dips game alive.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.