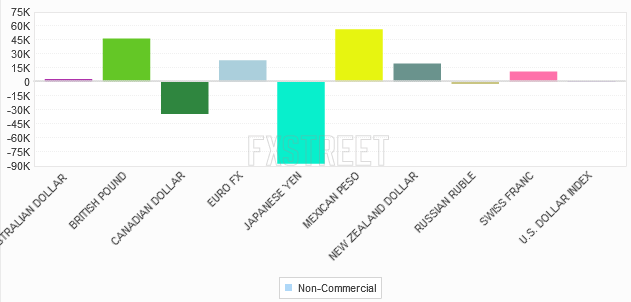

The latest data for the weekly Commitments of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that the ongoing bearish JPY position continues to be the broader theme. It also displayed that there is another theme of bullish sentiment towards the European currencies GBP, EUR and CHF which were the strongest of the majors. The dollar-bloc seemed to tire with neutral sentiment towards AUD, CAD and NZD, and also USD where speculators decreased their overall bullish bets to a flat position.

It has been about a 10k contract reduction in EUR to display the net long 23k contracts has now. Despite being the second largest gross long position among the majors, this closing of EUR long positions was one of the largest weekâ€overâ€week change the most recent of a three week straight dropping of the net positioning. A combination of low inflation rates and a relatively high exchange rate and the ECB's reaction to it, appears to have been the main culprit.

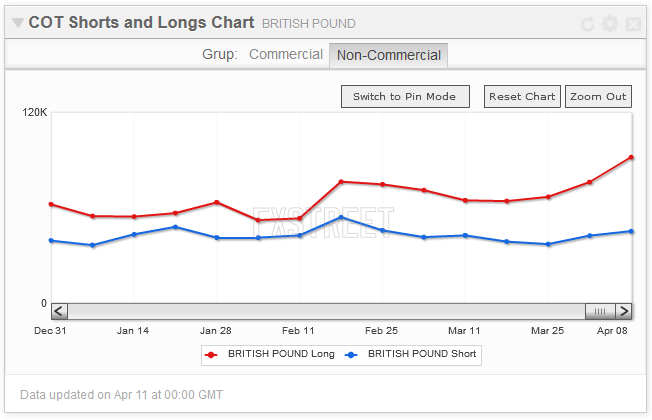

The biggest long exposure belongs now to the GBP which saws continued buying during the past four weeks. The long exposure is now paring the peaks of December 2012 (27.6k) and March 2011 (34.7k) in the futures only data series. A record figure is seen in the gross long number among non-commercials which is now at 91.6k experiencing a +15k acceleration in the most recent data.

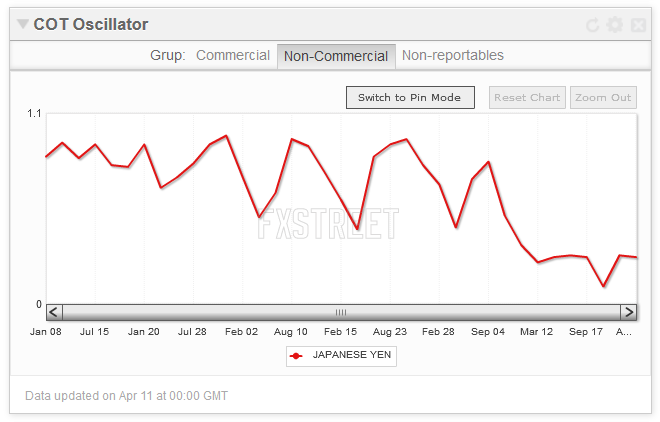

Both long and short JPY positions were scaled back due to risk aversion up to the time of data release but not so much as to threaten the support located at the 101.00 figure. The gross short yen positions is similar to the previous week (1st April) and prints -87.4k contracts. Still, the yen's gross short position is the largest among majors. The negative bias may be reduced in the next CFTC report if the USD/JPY reports a direct loss of immediate support due to current risk aversion climate. FXStreet's COT oscillator shows the building of a base and an intent of leaving the oversold zone.

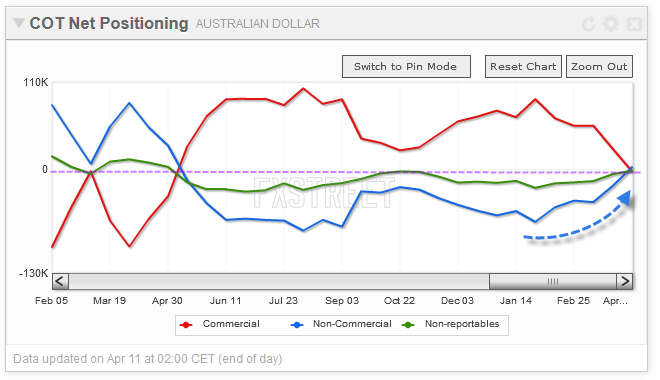

The net speculative Australian dollar futures position climbed to the long side (3.3k contracts from -4.8k) and so technically the bias turned bullish for the first time since May 2013.; But still this is a small position which does not necessarily imply a continuation of the current upward move.

According to CFTC, speculators are also reducing the net short in the Canadian dollar futures with a similar move as the Australian dollar, but the net positioning is still in the negative (-34.3k)

(Import the charts used in this report to your MyStudies suite of indocators)

What does it mean for traders? Accordingly to FXstreets weekly poll, the consensus forecasts on a 3-month horizon is for depreciation. However, the position data from CFTC is telling us the opposite, creating here an interesting dynamic to trade the EUR/USD. On the other side it is tempting to look for the greenback's losses to accelerate given the technical damage inflicted on the dollar and the recent decline in US interest rates.

The shift out of EUR to GBP can also be used to trade the EUR/GBP cross in the short-term, but don't loose attention to the fact that the theme is about European currencies right now. The net long at GBP is making a new high coupled with an OI which continues to grow. Although this can be considered a confirmation of trend strength, the exchange rate failed to rise above the high at 1.6820, a case for divergence between the data, which would imply an appreciation of the cross rate.

About Commitments of Traders

The weekly Commitment of Traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers, non-commercials (also called speculators) and nonreportable traders (usually small traders/speculators). The report is published every Friday and shows futures positions data that was reported as of the previous Tuesday.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.