EUR/USD Daily

Bounce from the 1.0778 low seen consolidating drop from the 1.0976 high of last week to reach the 1.0860 resistance. Regaining the latter will revive upside focus and see return to 1.0940 then the recent range highs at 1.0970/85. Failure to hold the 1.0778 low will expose 1.0711 low to retest. [PL]

EUR/CHF Daily

Stepping higher to break the 1.1000 level and follow-through will see scope to retest the 1.1050, Sep high. Support now at 1.0940 then the 1.0900 level seen sustaining the bullish up-leg from the 1.0756, Dec low. Only below the 1.0900 level will weaken and swing focus to the downside. [PL]

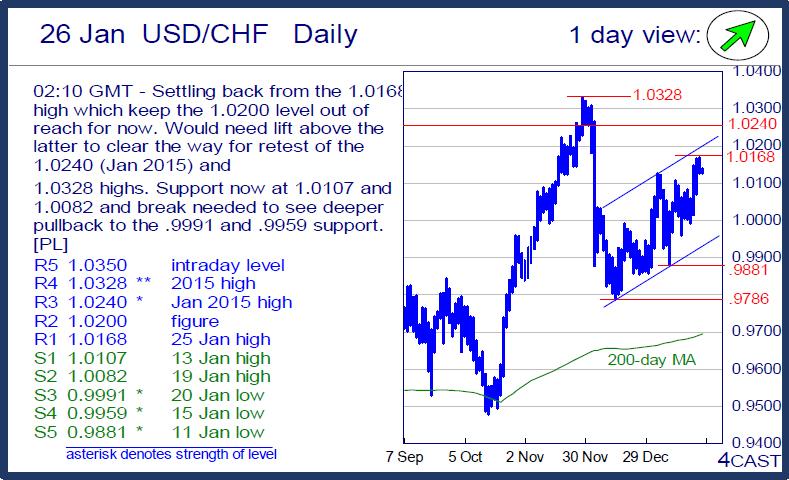

USD/CHF Daily

Settling back from the 1.0168 high which keep the 1.0200 level out of reach for now. Would need lift above the latter to clear the way for retest of the 1.0240 (Jan 2015) and 1.0328 highs. Support now at 1.0107 and 1.0082 and break needed to see deeper pullback to the .9991 and .9959 support. [PL]

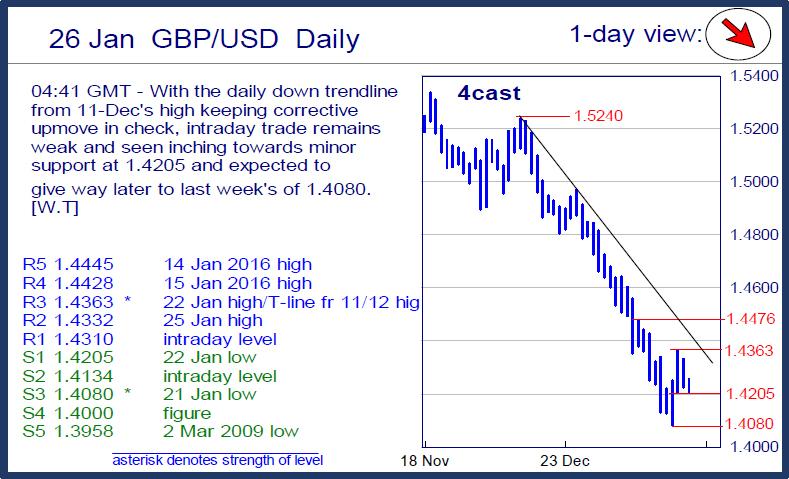

GBP/USD Daily

With the daily down trendline from 11-Dec's high keeping corrective upmove in check, intraday trade remains weak and seen inching towards minor support at 1.4205 and expected to give way later to last week's of 1.4080. [W.T]

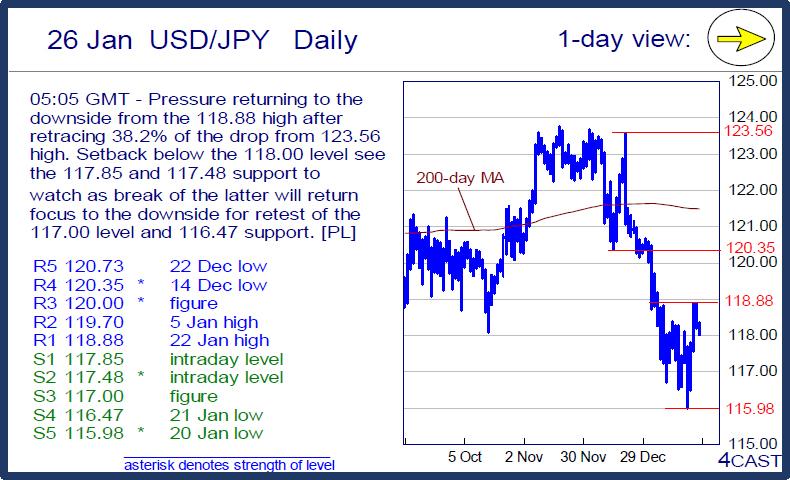

USD/JPY Daily

Pressure returning to the downside from the 118.88 high after retracing 38.2% of the drop from 123.56 high. Setback below the 118.00 level see the 117.85 and 117.48 support to watch as break of the latter will return focus to the downside for retest of the 117.00 level and 116.47 support. [PL]

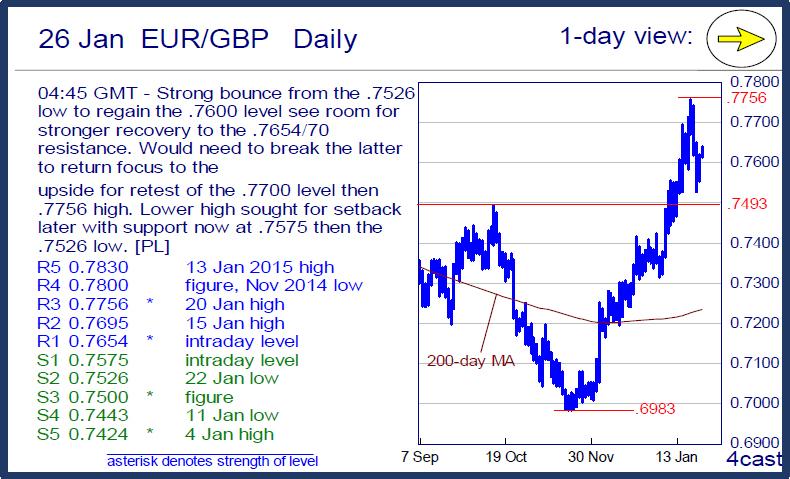

EUR/GBP Daily

Strong bounce from the .7526 low to regain the .7600 level see room for stronger recovery to the .7654/70 resistance. Would need to break the latter to return focus to the upside for retest of the .7700 level then .7756 high. Lower high sought for setback later with support now at .7575 then the .7526 low. [PL]

-------Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.