EUR/USD Daily

Still slipping following break of the 1.0900 level though stretched intraday tools suggest the 1.0800 level should hold firm for now. Higher low sought for rebound later with resistance now at 1.0905 and 1.0981. Above the latter will return focus to the 1.1060 high. [P.L]

USD/CHF Daily

Strength to break the .9958 resistance clears the way to the parity level then 1.0034 resistance to retrace the drop from the 1.0328 high. Would need lift over the 1.1000/34 area to revive upside focus and see further strength to the 1.0100 level. Support now at .9865 then the .9786 low. [PL]

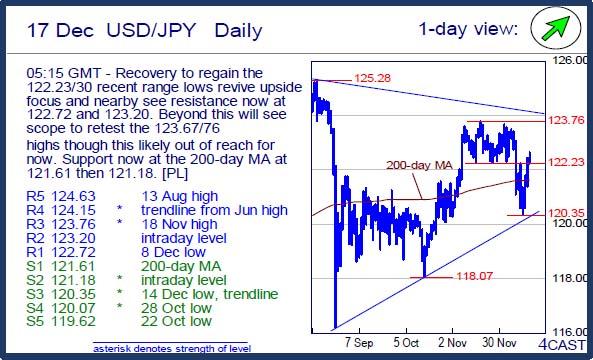

USD/JPY Daily

Recovery to regain the 122.23/30 recent range lows revive upside focus and nearby see resistance now at 122.72 and 123.20. Beyond this will see scope to retest the 123.67/76 highs though this likely out of reach for now. Support now at the 200-day MA at 121.61 then 121.18. [PL]

EUR/CHF Daily

Inability to hold the 1.0800 level keep pressure on the downside to reach 1.0761 low. Below this will expose the 1.0737/13 lows to retest. Break of the latter will trigger a top pattern at the 1.1050 high and see deeper pullback. Resistance now at 1.0845 and 1.0877. [PL]

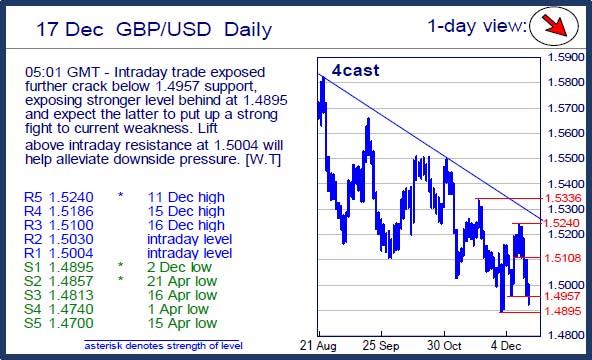

GBP/USD Daily

Intraday trade exposed further crack below 1.4957 support, exposing stronger level behind at 1.4895 and expect the latter to put up a strong fight to current weakness. Lift above intraday resistance at 1.5004 will help alleviate downside pressure. [W.T]

EUR/GBP Daily

Slightly exceeded the .7304 resistance but still struggling to sustain break of the .7300 level. Clearance needed to target .7374 then the .7400 level. Beyond this is the .7493, Oct high, but out of reach for now. Setback see support starting at .7215 then the higher lows at .7193 and .7164. Would take break to swing focus lower. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.