EURUSD

Pullback from yesterday’s 1.1614 peak found footstep at 1.1468, just ahead of good support at 1.1461 (Fibo 38.2% of 1.1213/1.1614 upleg, reinforced by rising 5SMA. Narrow consolidation (1.1468/1.1509 range) is underway, with spike to 1.1527, showing limited upside attempts for now.

Reversal of daily Slow Stochastic from overbought zone, generates bearish signal and shows more room for extended correction.

Loss of 1.1461 handle, could trigger fresh easing towards 1.1400 (round-figure support) and 1.1367 (Fibo 61.8% of 1.1213/1.1614, reinforced by daily 10SMA, where extended dips should be contained, to keep overall bulls intact.

Conversely, fresh strength above 1.1527 high, would ease immediate bearish pressure, while return above 1.1558 (Fibo 61.8% of 1.1414/1.1468 downleg), is needed to neutralize near-term bears and signal higher low formation.

Meantime, the pair may stay in extended near-term consolidation, awaiting US jobs data for stronger signals.

Res: 1.1509; 1.1527; 1.1558; 1.1580

Sup: 1.1461; 1.1414; 1.1396; 1.1367

GBPUSD

Correction from Tuesday’s peak at 1.4768, extended to 1.4459, where temporary support was found. Subsequent bounce shows signals of fading, keeping 1.4575 breakpoint (former consolidation top / Fibo 38.2% of 1.4768/1.4459 downleg) intact for now.

This keeps downside risk in play for further correction of 1.4088/1.4768 rally, which may extend to next strong supports at 1.4386/75 (daily Kijun-sen / 20SMA) and 1.4296 (Fibo 61.8%) in extension.

Sustained break above 1.4575 is needed to sideline downside threats.

Res: 1.4540; 1.4570; 1.4650; 1.4700

Sup: 1.4459; 1.4400; 1.4375; 1.4330

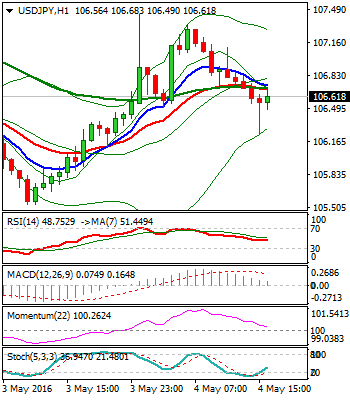

USDJPY

The pair trades in extended consolidation which keeps the price within narrow range, despite spikes to 105.53 and 107.44, which proved to be short-lived.

Overall structure remains bearish and favors fresh bearish resumption after prolonged consolidation, signaled by few long-legged Doji candles.

Bearish action through next support at 105.18 (15 Oct 2014 trough), could extend towards 100.80 (weekly higher base), in the coming sessions.

Alternative scenario needs bounce through session high at 107.44 and close above 108 barrier (near Fibo 38.2% of 111.87/105.53 downleg) to neutralize downside pressure.

Res: 107.44; 107.60; 108.00; 108.70

Sup: 106.23; 105.53; 105.20; 104.10

AUDUSD

The pair remains under pressure and posted marginally lower low today, following yesterday’s sharp fall that generated strong bearish signal on long red daily candle. In addition, fresh weakness probes below daily higher base / daily Ichimoku cloud top at 0.7490/75, with close below here, to signal further bearish extension of short-term pullback from 0.7833 (21 Apr peak).

Next strong support at 0.7448 (Fibo 38.2% of 0.6825/0.7833 rally) is in near-term focus.

However, extended consolidation could be anticipated on hesitation at 0.7475 pivot.

Good resistances lay at 0.7600/33 (Fibo 38.2% of 0.7833/0.7459 / daily 10/30SMA’s bear-cross).

Res: 0.7515; 0.7546; 0.7600; 0.7633

Sup: 0.7459; 0.7448; 0.7400; 0.7327

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.