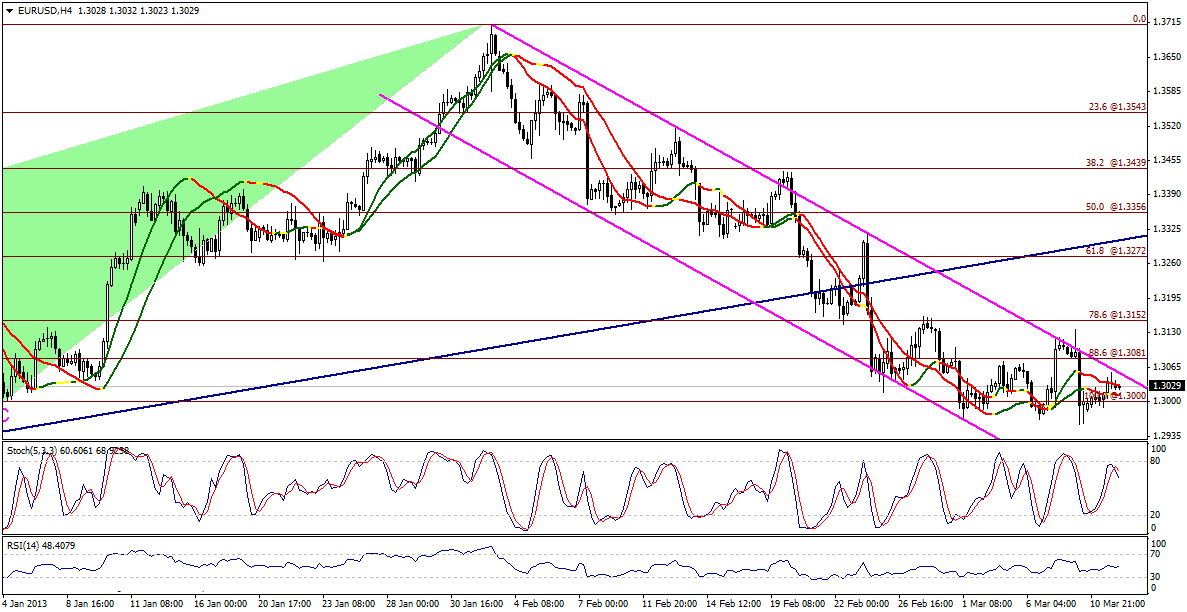

EUR/USD

The pair’s attempt to the upside yesterday was affected by key resistance level of the descending channel, holding below it. Linear Regression Indicators are still biased lower and Stochastic offers a negative crossover. Therefore, we might see a new attempt to the downside today and trading below 1.3080 will be considered negative.

The trading range for today is among the key support at 1.2905 and key resistance at 1.3200.

The general trend over short term basis is to the upside targeting 1.4375 as far as areas of 1.2990 remains intact.

Support 1.3000 1.2980 1.2965 1.2905 1.2805

Resistance 1.3035 1.3080 1.3100 1.3155 1.3170

Recommendation Based on the charts and explanations above, our opinion is selling the pair around 1.3035 targeting 1.2980, 1.2950 then 1.2905 and stop-loss with four-hour closing above 1.3080 might be appropriate

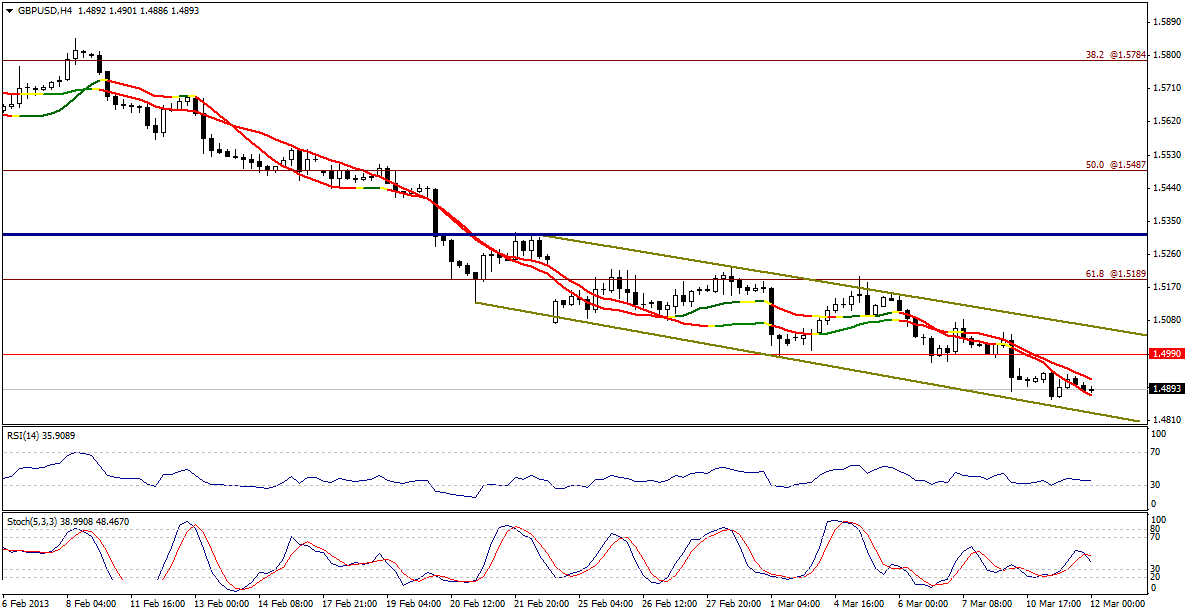

GBP/USD

The pair is still trading negatively within the descending channel as we see it stable between Linear Regression Indicator 34 and 55 that are trading negatively as well. Stochastic offers a negative crossover that might lead a new attempt to the downside. Stability below 1.4990 supports extending negativity during today’s session.

The trading range for today is among key support at 1.4710 and key resistance at 1.5035.

The general trend over short term basis is to the downside targeting 1.4225 as far as areas of 1.6875 remains intact.

Support 1.4850 1.4825 1.4810 1.4765 1.4710

Resistance 1.4925 1.4965 1.4990 1.5035 1.5080

Recommendation Based on the charts and explanations above, our opinion is selling the pair below 1.4925 targeting 1.4850, 1.4810 then 1.4765 and stop-loss with four-hour closing above 1.4990 might be appropriate

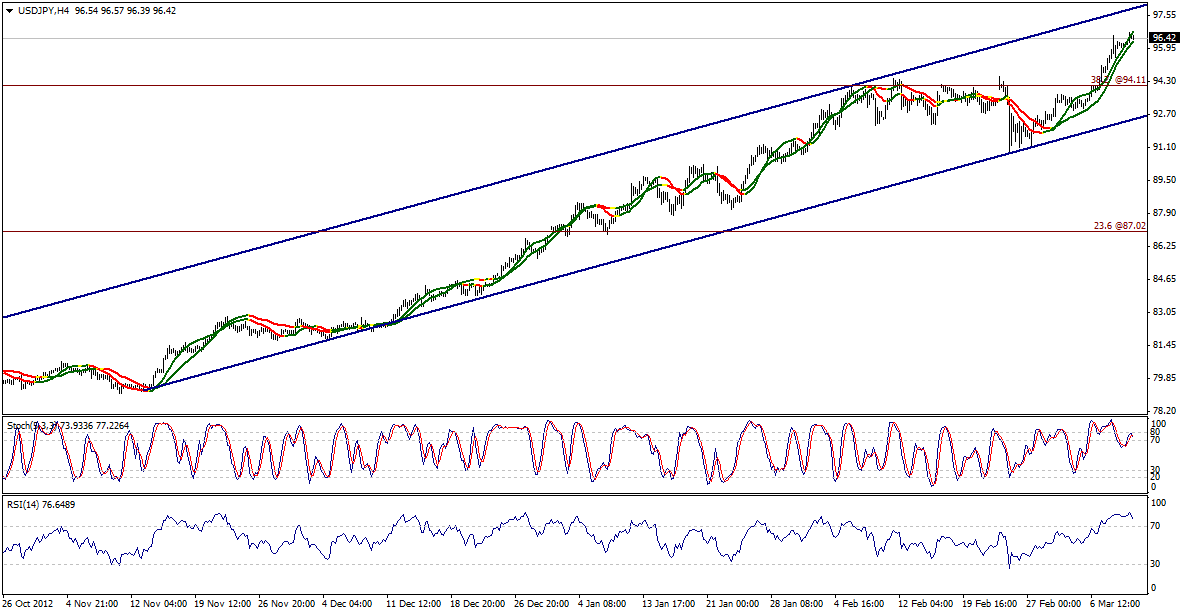

USD/JPY

The pair is trading positively ignoring the negative signals on momentum indicators, which is normal in light of stability above Linear Regression Indicator 55. The positive bias remains intact and trading above 95.50 levels might extend the bullish move. The pair should breach 96.70 levels represented in 161.8% Fibonacci shown on graph to confirm extending the upside move.

The trading range for today is among key support at 95.40 and key resistance at 98.10.

The general trend over short term basis is to the upside targeting 100.00 as far as areas of 84.00 remain intact.

Support 96.00 95.75 95.40 95.00 94.85

Resistance 96.70 97.10 97.85 98.10 98.95

Recommendation Based on the charts and explanations above, our opinion is buying the pair above 96.00 targeting 96.70, 97.10 then 97.85 and stop-loss with four-hour closing below 95.40 might be appropriate

USD/CHF

The pair dropped and is trading below 50% correction at 0.9495 levels weakening positivity without cancelling it. Momentum indicators are trading in overbought areas but Linear Regression Indicators remain positive. Hence, we hold on to our positive expectations with stability above 0.9375.

The trading range for today is among key support at 0.9375 and key resistance at 0.9610.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

Support 0.9465 0.9425 0.9400 0.9375 0.9350

Resistance 0.9495 0.9515 0.9570 0.9600 0.9655

Recommendation Based on the charts and explanations above, our opinion is buying the pair above 0.9465 targeting 0.9495, 0.9570 then 0.9610 and stop-loss with four-hour closing below 0.9375 might be appropriate

USD /CAD

Despite the pair’s attempt to the upside yesterday, it remained limited below 1.0355 levels which is the Potential Reversal Zone of the bearish harmonic Bat Pattern that might trigger a bearish correction. Negativity is still valid but the pair has to stabilize below 1.0265 levels to strengthen this possibility.

The trading range for today is between the key support at 1.0140 and the key resistance at 1.0445.

The general trend over short term basis is to the upside with steady daily closing above levels 0.9800 targeting 1.0485.

Support 1.0290 1.0265 1.0215 1.0200 1.0185

Resistance 1.0355 1.0385 1.0420 1.0445 1.0475

Recommendation Based on the charts and explanations above, our opinion is selling the pair below 1.0355 targeting 1.0205, 1.0185 then 1.0140 and stop-loss with four-hour closing above 1.0310 might be appropriate

AUD/USD

The pair moved to the upside again and settled above key resistance of the descending channel and also above Linear Regression Indicators. Therefore, the upside move might extend today but the pair should hold above 1.0300. A breakout below 1.0200 levels might trigger a negative technical formation that will take the pair lower once again.

The trading range for today is among key support at 1.0135 and key resistance at 1.0415.

The general trend over short term basis is to the downside with steady daily closing below levels 1.0710 targeting 0.9400.

Support 1.0245 1.0225 1.0200 1.0185 1.0165

Resistance 1.0300 1.0355 1.0375 1.0415 1.0430

Recommendation Based on the charts and explanations above, our opinion is buying the pair above 1.0245 targeting 1.0300, 1.0355 then 1.0415 and stop-loss with four-hour closing below 1.0200, and in case of stop-loss, sell the pair below 1.0200 targeting 1.0165, 1.0135 and 1.0100 and stop-loss above 1.0245 might be appropriate

NZD/USD

The pair rose yesterday in response to oversold signals on Stochastic. Meanwhile, trading is still stable below Linear Regression Indicator 55 keeping the possibility of negativity valid. The suggested bearish move depends on the breakout of the medium-term ascending channel shown on graph.

The trading range for today might be among key support at 0.8100 and key resistance at .8355.

The general short-term trend is expected to the upside with daily steady daily closing above 0.8130 targeting 0.8845.

Support 0.8225 0.8200 0.8190 0.8160 0.8135

Resistance 0.8275 0.8310 0.8355 0.8385 0.8400

Recommendation Based on the charts and explanations above, our opinion is selling the pair below 0.8275 targeting 0.8225, 0.8190 then 0.8155 and stop-loss with four-hour closing above 0.8310 might be appropriate

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.