Outlook:

Payrolls is not the only thing on the agenda today but it might as well be (we also get merchandise trade). The forecast range is 165,000 to 240,000 with a median of 195,000, according to Market News. “The unemployment rate is seen unchanged at 4.9% in February, with a range of 4.8% to 5.0% and average hourly earnings were expected to rise by 0.2%, with a range of flat to 0.3% there. As a reminder, in January, average hourly earnings rose by a greater-than-expected 0.5%. Backward revisions to prior months and the participation rate will also be taken into consideration.”

Average hourly earnings will be watched carefully, but High Frequency Economics criticizes the Bureau of Labor Statistics for miscounting bi-monthly payment periods when the second payment falls after the end of the data collection period. If raises occur on the 15th, what gets reported is the amount paid on the 1st. We have no idea if this is an important flaw. Heaven knows, there are plenty of flaws in the payrolls data process.

When a currency price moves in the direction opposite to where the data clearly and strongly point, the only explanation is position adjustment by the big players. Yesterday’s move up in the euro is one of those strange days. Market News calls it a short squeeze. “Those who did not go short euros earlier this week have been waiting for a rally to $1.0950/$1.1000, so it may be tough going on the topside, in the near-term. A decisive break above $1.1000 will target the Feb. 26 highs near $1.1068, with the 200-day moving average coming in ahead of that at $1.1046.”

When a currency price moves in the direction opposite to where the data clearly and strongly point, the only explanation is position adjustment by the big players. Yesterday’s move up in the euro is one of those strange days. Market News calls it a short squeeze. “Those who did not go short euros earlier this week have been waiting for a rally to $1.0950/$1.1000, so it may be tough going on the topside, in the near-term. A decisive break above $1.1000 will target the Feb. 26 highs near $1.1068, with the 200-day moving average coming in ahead of that at $1.1046.”

Those with deep pockets who want a juicy high to go short can panic weak shorts out of their positions. This includes many retail traders and most opportunists, including the algo crowd. The reasoning is “to hell with the fundamentals, go with the flow.”

Or is there something deeper going on? Those who believe the Fed made a “policy error” with the first rate hike in December think yields have lower to go. Recession is not priced in—yet. If it were, the 10-year would lie around 1%. Yikes! Then there is a contamination story. You don’t have to think the Fed is wrong to seek normalization to see that negative rates in European and Japan are pulling rates lower everywhere. Why should the US be immune? This is the thinking at Goldman, who says "The JGB market has been pulling global yields down with material and growing vigor. According to our work, U.S. Treasuries continue to exert upward pressures on global bond yields, but with a strength that has not been able to match that of Japan."

It’s a tug of war and the ECB holds the key. "If the ECB cuts the deposit rate deeper and accelerates the pace of monthly bond purchases, fears of 'Bund scarcity' will intensify, flattening the yield curve, and augment the bond bullish forces at play in global rate markets. [But] if the ECB were to decide to alter the technical parameters of QE, this could have the opposite effect and steepen the yield curve." We find this kind of talk completely confusing. Is this how global fund managers think? Is it a sane and intelligent way to think? Contamination and contagion are strange phenomena, to be sure. But we thought yield curves had more internal integrity. The implication is that inflation could be rising in the US but the yield curve would refuse to steepen as it should because it is being held hostage to low and negative rates elsewhere.

But what about that seemingly rising inflation? The WSJ writes (cautiously) about the return of the inflation trade. The breakeven rate—between 10-year inflation protected notes and regular ones--rose to 1.55% yesterday, the highest in 2 months. The TIPS spread is about as useless as Fed funds futures, but never mind—it shows something. “Widely scrutinized by investors and policy makers as a read on market inflation expectations and the outlook for global growth, the rate hit a seven-year low of 1.2% on Feb. 11, marking the low point of the early 2016 global-growth scare. A rate of 1.2% means investors expect inflation of that level over coming years.”

There are a lot of problems with TIPS, including what may be a shortage—they are only 9% of total issuance. This affects liquidity. So even if traders see inflation lurking in today’s payrolls, they will not be rushing to buy TIPS.

Finally, we say the battle between “secular stagnation” and robust recovery is about to have a winner. It may take a while—maybe months. That’s the problem—the gloomsters have been running the show for so long, with backing from some Feds like Bullard, that we don’t know how to evaluate good data. Good data looks aberrant. We read somewhere that payrolls at 195,000 this time, after 151,000 last time, is still less than 200,000, as though it takes payrolls over 200,000 to define a recovery. This is utter nonsense. Of course we expect payrolls to fall off as the labor market gets saturated. It has been rising for eight years, for heaven’s sake. The point is that we don’t know how to appreciate what we do have because our mindset is skewed to gloom.

Besides, even if we have doubts about the US economy, the picture in the eurozone is clear. The eurozone has risks all over the place—monetary risks (will more QE work? It seems to have diminishing returns). It has political risks—Brexit and immigrants inspiring nativist politics, not to mention messy elections in Spain and Ireland. Growth and employment are nearly zero, and so is inflation. Draghi is the proverbial little boy with his finger in the dike. Quick, which economy would you rather invest in, the US or the eurozone? After this strange interlude of short squeezing, we expect the euro to reflect all these risks.

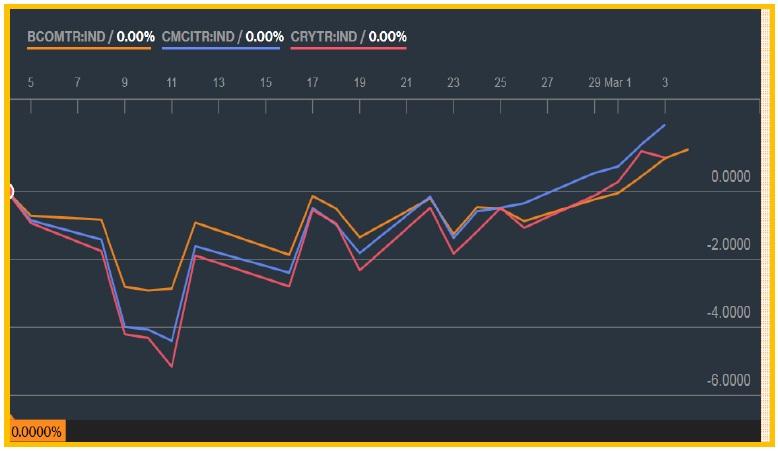

Funny enough, a recovery in commodity prices does seems to have a negative effect on the dollars. We rant and rave against this stupid correlation, but it does exist. And see the chart of three commodity indices from Bloomberg. They each show a steady rise over the past month. The implication is that the dollar has a soft tone because of commodity prices regardless of how awful things are in the eurozone.

So we have fundamentals supporting the dollar, meaning relative real economic performance, but short-term positioning and maybe intermarket effects removing that support.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 113.73 | SHORT USD | WEAK | 02/04/16 | 117.57 | 3.27% |

| GBP/USD | 1.4132 | SHORT GBP | STRONG | 02/17/16 | 1.4349 | 1.51% |

| EUR/USD | 1.0981 | SHORT EURO | STRONG | 02/23/16 | 1.1011 | 0.27% |

| EUR/JPY | 124.88 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 1.04% |

| EUR/GBP | 0.7770 | LONG EURO | STRONG | 10/23/15 | 0.7194 | 8.01% |

| USD/CHF | 0.9916 | LONG USD | WEAK | 03/01/16 | 1.0002 | -0.86% |

| USD/CAD | 1.3434 | SHORT USD | WEAK | 02/01/16 | 1.4031 | 4.25% |

| NZD/USD | 0.6752 | LONG AUD | STRONG | 02/01/16 | 0.6478 | 4.23% |

| AUD/USD | 0.6752 | LONG AUD | STRONG | 01/25/16 | 0.6980 | -3.27% |

| AUD/JPY | 83.93 | LONG AUD | NEW*WEAK | 03/03/16 | 83.57 | 0.43% |

| USD/MXN | 17.9309 | SHORT USD | WEAK | 02/23/16 | 18.1208 | 1.05% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.