Outlook:

To repeat a nugget reported above, the US reported CPI up 0.1% m/m in Jan when -0.1% was forecast, ho-hum. But core CPI rose 2.2% y/y, even though the Fed prefers the personal consumption index and the Dec reading, the latest available, is a mere 1.4% y/y.

Whether we like core CPI or PCE, both measures of inflation are rising, not falling. In Japan, core CPI is up 0.10% and not rising. In the eurozone, core inflation will likely be 1.1% (from 0.9%), according to the flash estimate, and thus rising by a tiny amount.

If we look at core inflation alone as a barometer of likely central bank responsiveness, the Fed doesn’t get much push from the inflation number but it doesn’t get inspired to back-pedal, either. And both Japan and eurozone should be inspired to do more stimulus. In a nutshell, the divergent-policy basis for the dollar rally is still alive and kicking. Unless you like the Cleveland Fed, which says its inflation expectation index shows a drop in Feb to 1.71% from 1.86% in Jan. Expectations matter. They matter almost as much as the actual numbers because so much about inflation is self-fulfilling.

It would be interesting to know how much about GDP is self-fulfilling. At the moment, we’d have to say very little. But last week the Atlanta Fed GDPNow estimate for Q1 came in at 2.6%, a little lower than 2.7% the week before but still a very nice number, especially in contrast to the eurozone, where Reuters today cites an economist seeing 0.4% for eurozone Q1 GDP. This is more like it—the US economy more robust and resilient than the eurozone economy. We might also say Mr. Draghi has his work cut out for him. After all, the US is farther along the whole QE stimulus process and coming out the other side, while the ECB program is only a few months old.

This week is a big week for US data, with the next revision of GDP for Q4 coming on Friday, along with PCE. Before then, it’s mostly housing statistics—Case-Shiller December home prices, existing home sales and Jan new home sales, and the FHFA Dec home price index. We also get durables on Thursday.

The housing data is sure to reflect weather, adjusted or not—December was warm and Jan was a nightmare of cold, snow and tornadoes. Net-net, the US economy is probably not in bad shape and with any luck, we can stop reading gloomy newspaper stories about the probability of recessions and about secular stagnation.

Across the pond, Brexit is about to become a big deal now that the referendum date was set (June 23). Britain got the concessions it was seeking but the “LeaveEU” crowd have a good point about over-regulation—thousands and thousands of pages of them and more every year—and Brussels’ lack of respect for national sovereignty. But losing free access to the European market would be an economic blow to UK exporters, although the UK runs a giant deficit with Europe so perhaps the losers in Brexit are UK consumers.

Just as when Britain joined the EU (1973) and later decided to keep the pound instead of accepting the euro (1998), there are valid economic and political arguments on both sides. We wrote at length on the UK keeping the pound in 1998 (we said it would). This time the polls and the betting point to the UK staying in, but we are not so sure. The ornery streak is wide and deep. The Dunkirk finest hour is living history. And the Brits are confident they can do better on their own, especially if Brexit triggers a rejiggering of The System, including taxation, fiscal boosts to local investment, etc.

In a way, the sentiment behind Brexit has a central point in common with the popularity of Trump in the presidential race—throw the bums out and start over.

The consensus view is that sterling will suffer from Brexit. Sterling fell from 1.4404 at the Sunday open to 1.4232 in the first hour and thence to a low of 1.4121 so far today. But this is a knee-jerk reaction. We can just as easily see capital flow to sterling as the ECB takes rates more negative. The pro-Union side has yet to enter with all guns blazing. It’s interesting that Grexit would have been a forcing out while Brexit is voluntary. There is silly talk about Denmark following Britain, too. We will get some confusing commentary that fails to differentiate between the EU and the EMU. The EU is really a customs union on steroids, hence the thousands of pages of regulations. We are sure to hear Thatcher misquoted—the EMU is folly.

The Brexit saga is going to be interesting. London Mayor Johnson backs Brexit, which skeptics say is his way of announcing candidacy for PM, but note that the FTSE 100 is higher. When the LeaveEU crowd seems to be winning, sterling will suffer, as we saw overnight. At a guess, any firming on the Stay crowd winning will not be symmetrical. Longer-run, leaving the EU is not necessarily sterling-negative if there is new domestic investment to replace outflows and imports. But just because trade preference is removed doesn’t mean tariffs and other impediments naturally follow. Removing the cost of compliance with EU regs might itself be a boon. And the UK can easily become a safe haven from Europe. Sterling might be seen as a stronger reserve currency, not a weaker one. Bottom line, don’t make a long-term bet against the pound on Brexit.

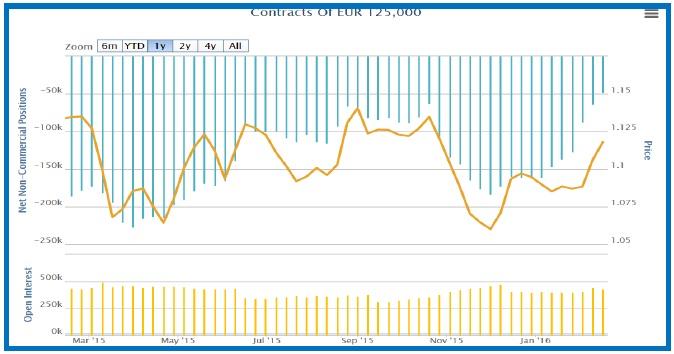

As for our expectation that the euro would bounce back, we got it wrong, at least so far. We don’t know how many new euro longs can be squeezed out but the latest Markit PMI may start a stampede. See the Commitment of Traders chart (from Oanda). Traders were getting less short, from 182,845 contracts on Dec 1 when the euro was 1.0680 to only 48,205 contracts last Tuesday when the euro was 1.1180. We don’t much like the COT report but perhaps this time we should watch it to see the shorts resume.

The Markit economist told the press "Not only did the survey indicate the weakest pace of economic growth for just over a year, but deflationary forces intensified. Economic growth is likely to slow below 0.3 percent in the first quarter unless we see a sudden uplift in March, which on the basis of the forward-looking components of the PMI seems unlikely. "In fact, growth looks more likely to slow further than accelerate."

This has important central bank implications. The ECB is likely to become more aggressive on March 10 and to say so ahead of the meeting, warning the market. And the Fed might be emboldened by decent data, including the GDPNow estimate of GDP at 2.6% in Q1, to speak out in favor of additional hikes, if not right away. The central question is how the fixed income crowd responds to this new growth divergence. So far it disagrees with the Fed, hence Fed funds futures pointing to no new hikes. And the 10-year spread is a lousy 1.577%.

How low can the Bund go? We may be old-fashioned, but we say negative returns are inherently a Bad Thing. You might as well stamp a Grim Reaper symbol on the whole economy. Investment requires a positive rate of return. It’s the reward for taking risk. To pay to have your money held safely in a bank is a return to medieval times when usury was forbidden and Dutchmen had a wooden trunk at the top of the stairs to hold your coins (and a big hairy guy to guard the trunk). It seems obvious that the only thing holding investors in negative rate situations is the rulebook requiring them to hold certain asset classes. Otherwise, money flows to the highest rate of return adjusted for risk, including inflation. This must favor the higher yielders that are not failed states or crisis states (like Brazil). We fail to see how this can fail to benefit Australia, the UK and the US.

So, no correction, at least not until the US says or does something the world sees as horribly negative. Just about every Fed under the sun speaks this week and G20 begins this coming weekend, so there is plenty of room for error.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 113.19 | SHORT USD | STRONG | 02/04/16 | 117.57 | 3.73% |

| GBP/USD | 1.4158 | SHORT GBP | WEAK | 02/17/16 | 1.4349 | 1.33% |

| EUR/USD | 1.1064 | LONG EURO | WEAK | 02/04/16 | 1.1182 | -1.06% |

| EUR/JPY | 125.23 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 0.76% |

| EUR/GBP | 0.7814 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 8.62% |

| USD/CHF | 0.9949 | SHORT USD | STRONG | 01/04/16 | 0.9979 | 0.30% |

| USD/CAD | 1.3765 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 1.90% |

| NZD/USD | 0.6666 | LONG NZD | WEAK | 02/02/16 | 0.6486 | 2.78% |

| AUD/USD | 0.7190 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 3.01% |

| AUD/JPY | 81.38 | SHORT AUD | WEAK | 02/17/16 | 81.62 | -3.71% |

| USD/MXN | 18.1059 | LONG USD | WEAK | 12/07/15 | 16.7258 | 8.25% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.