Outlook:

The closely-read Fed minutes of the January meeting shows a higher degree of uncer-tainty about global conditions but the implications are “unclear.” The WSJ reports the Fed used the word “uncertain” or “uncertainty” 14 times in the minutes. “Downside risk” is named four times and upside risk not mentioned at all. The rise in equities is as good a barometer as any that the Fed is seen not doing any more tightening anytime soon. The minutes say it's "prudent to await more information before taking the next tightening step," interpreted as meaning the Fed will be on hold in March and April, implying June is the first possible date. We get new forecast dots at the March meet-ing, by the way.

The economy is giving the Fed some fuel to keep hikes on the table. Industrial production rose 0.9% in Jan, the best number in years and never mind that the Arctic cold forced more energy consumption. Then the Bureau of Labor Statistics released something called PPI-Final Demand for Jan, a measure the mainstream press declined to report but something eagle eyes in the fixed income market latched onto. This measure rose 0.1% m/m in Jan from -0.2% in Dec and while still down 0.2% y/y, the core final de-mand was up 0.4% m/m and 0.6 y/y.

Market News reports “These strong readings will raise the stakes for this Friday's release of the Con-sumer Price Index.” The RBS analyst said you can have disinflation/deflation in goods but still get over-all inflation if demand and higher wages push service sector prices up. After all, the US has a service economy. Well, maybe. Some folks think a focus on final demand PPI is clutching at straws.

The ECB is just as worried about a possible recession and about market turmoil las the Fed. In Europe, the minutes (named an “account”) of the Jan 21 ECB policy meeting show support for Draghi’s “no lim-its” approach. "Reassurance was needed to be given that the Governing Council had a variety of instru-ments at its disposal to respond to circumstances and that there was no limit to how far it was willing to deploy instruments within its mandate.”

Bloomberg reports “There was also ‘wide agreement’ that ECB communication should avoid ‘complacency on the deteriorating price outlook while also avoiding conveying an unduly gloomy mes-sage’ that could be self-fulfilling.” The governing council think the financial sector turmoil was due to “misperceptions about ongoing supervisory activities.” And when inflation does return, the ECB will let it go up more than we now think. “It appeared logical from a medium-term perspective for the Govern-ing Council, after a prolonged period of undershooting of its inflation aim, to consider a limited period of overshooting in future.”

Overall, we see an unusual pall of gloom in the Fed minutes and an equally unusual glow of optimism in the ECB “account.” The Europeans are already talking about letting inflation overshoot. What do they know that the rest of us do not?

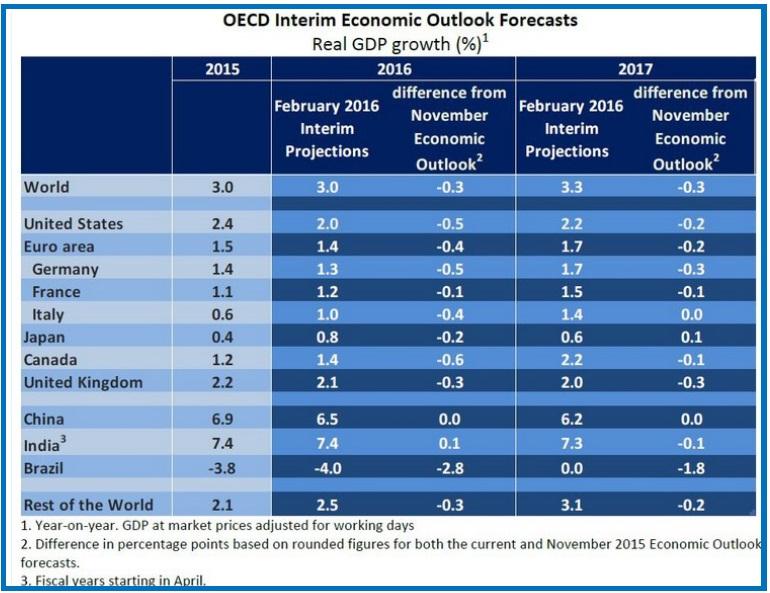

The OECD takes the gloomy road. Today it cut the world growth forecast by 0.3% from the Nov esti-mate to 3%. See the table. The US is now seen as getting only 2% growth this year. The forecast for Canada is worse, 1.4% from 2% in Nov. The OECD says “Financial stability risks are substantial.

Some emerging markets are particularly vulnerable to sharp exchange-rate movements and the effects of high domestic debt.” This is not new but has yet to manifest itself as a potentially conta-gious crisis.

The OECD has 6.5% growth for China this year, while Goldman has 6.4%. Bloomberg reports the Gold-man China expert (in China) advises that panic over China is misplaced. “Some people are making ex-treme arguments to say the whole machine is not working. That’s not what we see. Overall, the plane is moving in the direction it should be and it’s broadly under control."

The PBOC is going to conduct open market operations daily from now on. And “Policy makers have stepped up support for the economy, with the central bank Thursday guiding interest rates lower by of-fering to reduce the medium-term borrowing cost it charges lenders, according to a person with direct knowledge of the matter. The nation’s chief planning agency has also made more money available for local infrastructure projects.” The advisor says “The downward trajectory of growth is set to continue in the next two years, but there’s no reason to panic because policy makers have both ample scope to sup-port growth and can also unleash new growth drivers. When growth slows, ‘policy makers will come up with something.’”

Okay, let’s say we can set China aside for the moment. The real story in FX is the Fed vs. the ECB, any-way. The Fed is looking cowardly while the ECB is running full-tilt toward stimulus, i.e, rates going more deeply negative on March 10. And yet at the end of it, the ECB thinks it can let inflation over-shoot. We say this is an odd thing for the famously anti-inflation Europeans to say. The BBK must be gnashing its teeth.

Yesterday we wondered if the divergent-policy theme can keep the dollar up when the Fed is not help-ing, so to speak, with a rising rate outlook. We didn’t get a euro bounce out of the Fed minutes as we expected but the ongoing ranginess indicates a breakout must be in the cards at some point. It might be a further euro downside breakout instead of the expected upside, but ranginess can’t last long—can it?

Late yesterday Fed hawk Bullard said it would be "unwise" for the Fed to continue raising interest rates given declining inflation expectations and recent equity market volatility. The key assumptions underly-ing higher rates are being undermined. This is a far stronger statement than the minutes show. We are growing increasingly worried about the too-strong dollar. It’s inconsistent with the history of the dollar. Once risk appetite gets sorted out a bit more, we expect a fall. The hodgepodge of factors is just delay-ing the moment of truth.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 113.93 | SHORT USD | STRONG | 02/04/16 | 117.57 | 3.10% |

| GBP/USD | 1.4349 | SHORT GBP | NEW*WEAK | 02/17/16 | 1.4349 | 0.00% |

| EUR/USD | 1.1129 | LONG EURO | STRONG | 02/04/16 | 1.1182 | -0.47% |

| EUR/JPY | 126.80 | SHORT EURO | WEAK | 02/11/16 | 126.19 | -0.48% |

| EUR/GBP | 0.7756 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 7.81% |

| USD/CHF | 0.9931 | SHORT USD | STRONG | 01/04/16 | 0.9979 | 0.48% |

| USD/CAD | 1.3679 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 2.51% |

| NZD/USD | 0.6633 | LONG NZD | WEAK | 02/02/16 | 0.6486 | 2.27% |

| AUD/USD | 0.7164 | LONG AUD | WEAK | 01/25/16 | 0.6980 | 2.64% |

| AUD/JPY | 81.62 | LONG AUD | NEW*WEAK | 02/17/16 | 81.62 | 0.00% |

| USD/MXN | 18.1904 | LONG USD | STRONG | 12/07/15 | 16.7258 | 8.76% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.