Next report will be publish in Monday

Outlook:

We get some fresh data today but probably not earth-shaking. The GDP revision at 8:30 am ET is expected to be pared down to 1.9% from 2.1% last month. Existing home sales (Nov) are probably steady after a 3.4% dip in October.

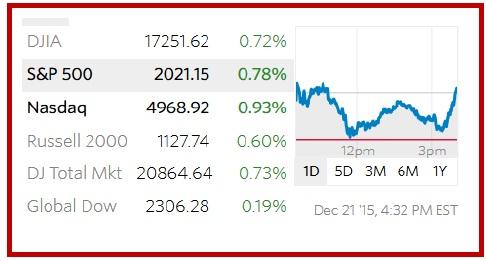

Equities (WSJ)

Commodities/Futures (WSJ)

10-Year Notes (WSJ)

We can hope that cross-market contagion (of mindless hysteria) never really got a foothold. Despite Brent oil hitting an 11-year low yesterday, the S&P closed at a gain and bourses in both Asia and Europe mostly followed the US higher. You’d think equity traders would have learned by now to take oil price roller-coastering in stride, but there are always a few Nervous Nellies who imagine that an oil price drop must mean faltering demand and thus looming recession. Well, no. OPEC’s commitment to maintaining supply suffices, especially when the US will produce to the last penny of marginal profit.

Given the equity market’s sensitivity to oil, get ready for a blowout when some familiar oil name fails.

But until then, a drop in the price of oil is as good as a tax cut for consumers and many sectors. It’s not a stretch to imagine Amazon will do better than it had expected with all that free FedEx shipping on Amazon Prime. The TV blares that US gasoline costs under $2/gallon again, but none of those folks live in Connecticut ($2.45). Still, deregulation of electric utilities is delivering benefits—the monthly electric bill fell last month for the first time ever.

The bigger underlying issue with low energy costs is that they are a drag on the inflation central banks are trying to nudge upward. This, in turn, takes us straight back to the dot-plots and by how much the market’s expectations vary from the Fed’s. The market sees two hikes next year and the Fed sees four. Strangely, Market News reports that two big New York names see the next hike in March—Goldman Sachs and JP Morgan. Goldman said "We expect growth to remain above trend and employment gains to remain well above the 'breakeven' rate. Most importantly, inflation is likely to rise... Looking beyond March, a standard reaction function coupled with the Fed's economic projections calls for a roughly 125bp increase in FF.”

JP Morgan also sees a March hike based on a rise in core PCE along with labor market gains. It sees old data falling out of the calculation, especially the weird drop in medical costs last year, so that core PCE rises from 1.3% now to 1.5% early next year and then 1.8% for the year as a whole. Plus, unemployment will fall to 4.8% and do it in Q1. This is (arguably) “too low.”

We never argue with big-shot economists at big banks but let’s just note that if PCE does rise in Q1 for one-time, special-circumstances reasons, the bond market will not be impressed. If we are hoping for a dollar-supportive rise in yields and a steepening yield curve from this projection, we might be disappointed. Bond markets are very good, maybe too good, at discounting one-time effects. They are also stubborn as mules. Once having learned the Fed over-estimates an effect, they need a kick in the rear to believe in the effect ever again. Besides, bond traders likely don’t do the grocery shopping.

Re-allocations among equities and bonds doesn’t stop with the BoA/ML managers’ report. Today Reuters reports a survey of European asset managers showing they cut exposure to the US, showing unwill-ingness to believe the rate hike means the US economy is on a solid recovery path. Managers cut holdings of US equities by 1% to 36.5%. They also cut exposure to equities generally, not just in the US, by 2.5% to 45.2% (for a “global balanced” portfolio). One analyst says "(U.S.) rate hikes are occurring way too late in a cycle that is already ebbing. If the Fed hikes more than twice in the first half of 2016, it might trigger a downturn in the second half, with potential financial tensions in equity and credit markets."

Really?

If they don’t like equities, they must like bonds. Allocations to bonds rose to 39%, the highest since July 2013 and from 35.5% at the start of 2015. But not European bonds, where holdings fell to 50.3%, the lowest since last Jan. They do like both equities and bonds in the UK.

One of the persistently named factors in the gloomy outlook continues to be China, where the annual year-end Central Economic Work Conference resulted in a murky report, summarized by the Xinhua news agency. The statement says the government will be more “proactive and flexible,” whatever that means. It will also make its fiscal policy more “forceful” as the deficit is reduced. Analysts say the plan opens the door to more rate cuts and cuts in reserve requirements.

The WSJ reports “The blueprint focuses on reducing industrial overcapacity, slashing costs for businesses, cutting unsold property inventory and fending off financial risks.” The FT notes state-owned enterprises will not be privatized, as in the UK, but rather reorganized. One unnamed official said the economy will follow an L-shaped path, not a V-shaped one. Eeek.

Where does the dollar go once we get past the position adjustment following the Fed hike? We probably have to admit that the hike was so thoroughly telegraphed for so long that it was more than fully priced in. The current retreat we are seeing is probably “sell on the news” but with a dollop of possible recession later in 2016, i.e., lack of confidence in the Fed’s economic projections. The dollar index rose 3.3% in November and has fallen 1.8% in December as of Monday, according to the FT. How long will it take to return to the highest high of 100.5 seen in November, the highest since April 2003?

We say not that long. The doom-and-gloom crowd that sees the Fed as having done too little, too late and another recession looming next year are just that—a doom-and-gloom crowd in which everyone talks to everyone else and gloom becomes self-reinforcing. Yes, the US recovery is not as robust as past recoveries but it’s not chopped liver, either. A growth rate around 2% is better than a growth rate barely over zero, as in Europe.

We are amazed to find ourselves defending the Fed’s projections. Who are these fancy-pants Europeans to diss the Fed? One possible source of error is to overvalue the too-strong dollar as killing industry dead in its tracks. Industrial exports are not as important in the US economy as in the European economy. The US still has a competitive advantage in two biggies, high tech and food. Yes, food.

And if we do start getting some inflation, even if it’s a one-time special-circumstances kind of thing, these managers will be changing their tune. A burst of enthusiasm for the US economy would be helpful in driving yields up and the dollar along with it. We probably won’t get parity at year-end, as so long forecast, but we will almost certainly get it in the first quarter. Keep your powder dry.

Tidbit: We forgot to mention yesterday that TreasSec Lew appeared on Sunday morning TV, with UK Chancellor of the Exchequer Osborne, to announce that the finance ministers of the UN security council members (including Russia) had agreed to work together to dismantle ISIS’ access to the global financial system. Lew said it takes military action to deprive them oil to sell but it takes financial system action to deprive them of money. We thought it was an important announcement but then didn’t find it reported as important in any of the usual places. Maybe there is skepticism that it can be done as long as black and gray markets are so prevalent in the region. Maybe news from the UN is never “news.”

Tidbit 2: Norway wants to give Finland a mountain so that its highest point is actually the top of the mountain they both share. This is a gift ahead of year-long preparations next year for the 100-year anniversary of Finland’s independence in 1917. Man is not always vile.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 121.04 | LONG USD | WEAK | 10/23/15 | 120.45 | 0.49% |

| GBP/USD | 1.4882 | SHORT GBP | STRONG | 11/06/15 | 1.5137 | 1.68% |

| EUR/USD | 1.0928 | LONG EURO | WEAK | 12/08/15 | 1.0858 | 0.64% |

| EUR/JPY | 132.30 | LONG EURO | WEAK | 12/04/15 | 133.59 | -0.97% |

| EUR/GBP | 0.7343 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 2.07% |

| USD/CHF | 0.9912 | SHORT USD | WEAK | 12/08/15 | 0.9973 | 0.61% |

| USD/CAD | 1.3937 | LONG USD | STRONG | 10/28/15 | 1.3235 | 5.30% |

| NZD/USD | 0.6816 | LONG NZD | WEAK | 12/04/15 | 0.6641 | 2.64% |

| AUD/USD | 0.7232 | SHORT AUD | WEAK | 12/18/15 | 0.7137 | -1.33% |

| AUD/JPY | 87.52 | SHORT AUD | WEAK | 12/10/15 | 88.80 | 1.44% |

| USD/MXN | 17.1045 | LONG USD | STRONG | 12/07/15 | 16.7258 | 2.26% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.