Outlook:

Sentiment on the Fed hike in December has shifted from “maybe” to “yes.” The FX market is taking its clues from the fixed income gang, which has taken the 10-year steadily upward since the Oct 28 Fed statement. It opened on a gap yesterday and closed at 2.220%, from 2.174% Monday morning, and is quoted at 2.213% this morning. More relevant, perhaps, is the 2-year, with the US at 0.77% (a multi-week high) and the German 2-year at -0.33%.

The probability of the Dec hike, based on Fed funds futures, has inched up from 34% a week ago to 47% on Monday and 52% yesterday, according to the CME.

Notice that the rising pro-hike sentiment is based on practically nothing, or rather, the absence of any horrible data. This allows sentiment to feed off itself, even before payrolls on Friday. And it drives the FX market to go shopping for a good place to buy dollars. A logical place would be a breakout past the recent lowest low, 1.0896 from Fed day last week. So far this morning the euro has flirted with the 1.0900 level, managing 1.0912. But as the short-term chart shows, the euro is oversold at this level and we probably need to entertain the idea of a last-ditch bounce upward before a crash through the old low.

Then we can watch for the series of earlier lows to find the next place for the move to pause.

Market News writes “Traders maintained their view that the euro will test $1.0800 in coming weeks, with potential to extend to $1.0500 by year-end if interest rate differentials between the U.S. and eurozone continue to widen.” So far the Bund is cooperating. The yield has dipped from 0.600% and above to 0.565% yesterday and 0.560% this morning. That puts the differential at 2.157%. We have long held the view that the dollar has to offer a bigger premium than that, on the order of 2.50-3.00%, because of the historical bias against the dollar (some of it justified). If we get a very high pay-rolls numbers on Friday and that solidifies the rate hike idea in the form of higher yield, we may be well on our way to a differential that convinces a greater proportion of traders.

So far this changing sentiment is built on almost nothing except itself. Aside from the DAX, equity mar-kets are higher everywhere. The WSJ says “stocks rise ahead of Yellen” as though we should expect Yellen to say something decisive about the putative Dec rate hike, But her testimony is on a different subject altogether and Fed chairmen never let the cat out of the bag prematurely, least of all to those nit-wits in Congress.

What we can take away from headlines like this is that the market prefers a decisive Fed instead of a wimpy one, even though we don’t actually have any new decisions yet, just the idea that a decision is likely. The idea that the US economy is strong enough to withstand a tiny rate hike has also encouraged commodity traders, including oil, even in the absence of any new supply/demand information. And an increasing number of analysts are admitting they overdid fear of the China slowdown.

All this goes to show the power of normalization, but it also shows that these nascent rallies are built on practically nothing. Boy, payrolls had better be good on Friday or we will be in for a mini-crash. Meanwhile, Mr. Draghi is busy injecting caution into the mix. Market News reports that yesterday, Draghi repeated the ECB will re-examine the degree of QE that will be needed at the next meeting in December, and also said “despite domestic resilience in the Eurozone economy, its recovery faced downside risks owing to the China-led slowdown in emerging markets.” Wait a minute—the Fed just removed worry about global conditions and the ECB is adding them back? Draghi speaks again today and tomorrow.

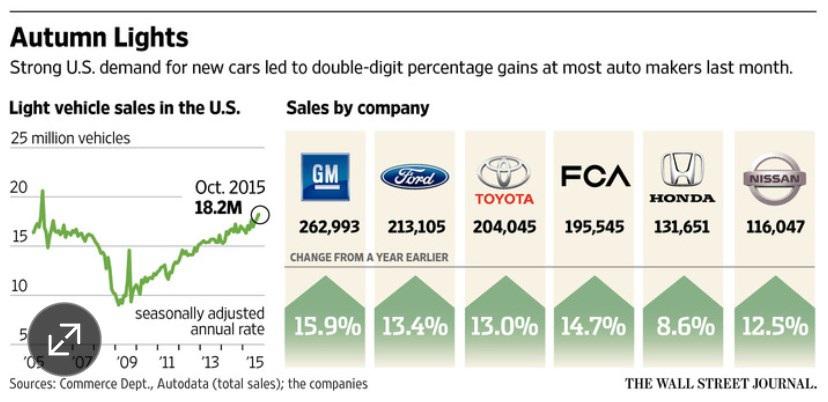

After showing the dismal sub-par wage growth in the US, here’s a contrary indicator—auto sales. The average Joe is not getting a raise but is buying a new car, anyway. Auto manufacturers and dealers are offering incentives, to be sure, but it takes confidence about the future to push a buyer over the edge. And as we know from housing data, new and existing home sales have been robust and inventories of unsold homes is shrinking. Some behavioral economist somewhere can explain this puzzle—the con-sumer is buying big-ticket items likes houses and cars while wage growth is stagnant.

One of the releases today is the September trade balance (8:30 am ET), forecast far lower at $41 billion from $48.3B in August. Some say this information could be a game-changer—a falling deficit implies higher growth and a rising one is a drag on Q4 GDP. We say bah! to that. Far more inter-esting will be the ADP estimate of private sector payrolls. The current forecast of the forecast is 180,000 (from 200,000 in Sept). ADP undershot in Aug and Sept, but never mind—even a number under 200,000 for the combined private and public sectors will be okay. We must expect job growth to decel-erate at this stage in the recovery cycle. Somewhat slower job growth does not preclude a hike in De-cember—unless it’s truly awful, like under 100,000.

Finally, the US doesn’t have to be the sole engine of growth in the world. Abe has commanded a new 5-year plan for Japan that will bring capital investment and wage growth. China and Taiwan will meet this Saturday for the first official meeting since 1949. China is releasing the 5-year plan in dribs and drabs, making it harder for critics to find inconsistencies (and untruths).

The wisdom of markets should not be brushed off. Equities are higher in various markets for their own reasons—Japan because of the privatization, among other things, and China because of the new trading link to Hong Kong to be completed this year—but never mind the reasons. The Fed sees that a week af-ter saying a December hike is on the table, equity markets are rising, not crashing. The Fed is safe from being accused of starting a market rout. Bond traders are, at last, beginning to believe the Fed will act. This was the toughest nut to crack.

We are entering a virtuous circle in which normalization is perceived as a Good Thing and that very per-ception strengthens the case for the Fed to do it. The euro may be toast.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 121.17 | LONG USD | WEAK | 10/23/15 | 120.45 | 0.60% |

| GBP/USD | 1.5411 | LONG GBP | WEAK | 10/08/15 | 1.5346 | 0.42% |

| EUR/USD | 1.0926 | SHORT EUR | STRONG | 10/23/15 | 1.1115 | 1.70% |

| EUR/JPY | 132.39 | SHORT EURO | STRONG | 10/23/15 | 133.88 | 1.11% |

| EUR/GBP | 0.7090 | SHORT EURO | STRONG | 10/23/15 | 0.7220 | 1.80% |

| USD/CHF | 0.9897 | LONG USD | WEAK | 10/23/15 | 0.9735 | 1.66% |

| USD/CAD | 1.3066 | LONG USD | STRONG | 10/28/15 | 1.3235 | -1.28% |

| NZD/USD | 0.6641 | SHORT NZD | NEW*WEAK | 10/05/15 | 0.6641 | 0.00% |

| AUD/USD | 0.7192 | SHORT AUD | STRONG | 10/29/15 | 0.7087 | -1.48% |

| AUD/JPY | 87.14 | LONG AUD | WEAK | 10/08/15 | 86.06 | 1.25% |

| USD/MXN | 16.4054 | SHORT USD | NEW*WEAK | 11/03/15 | 16.4054 | 0.00% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.