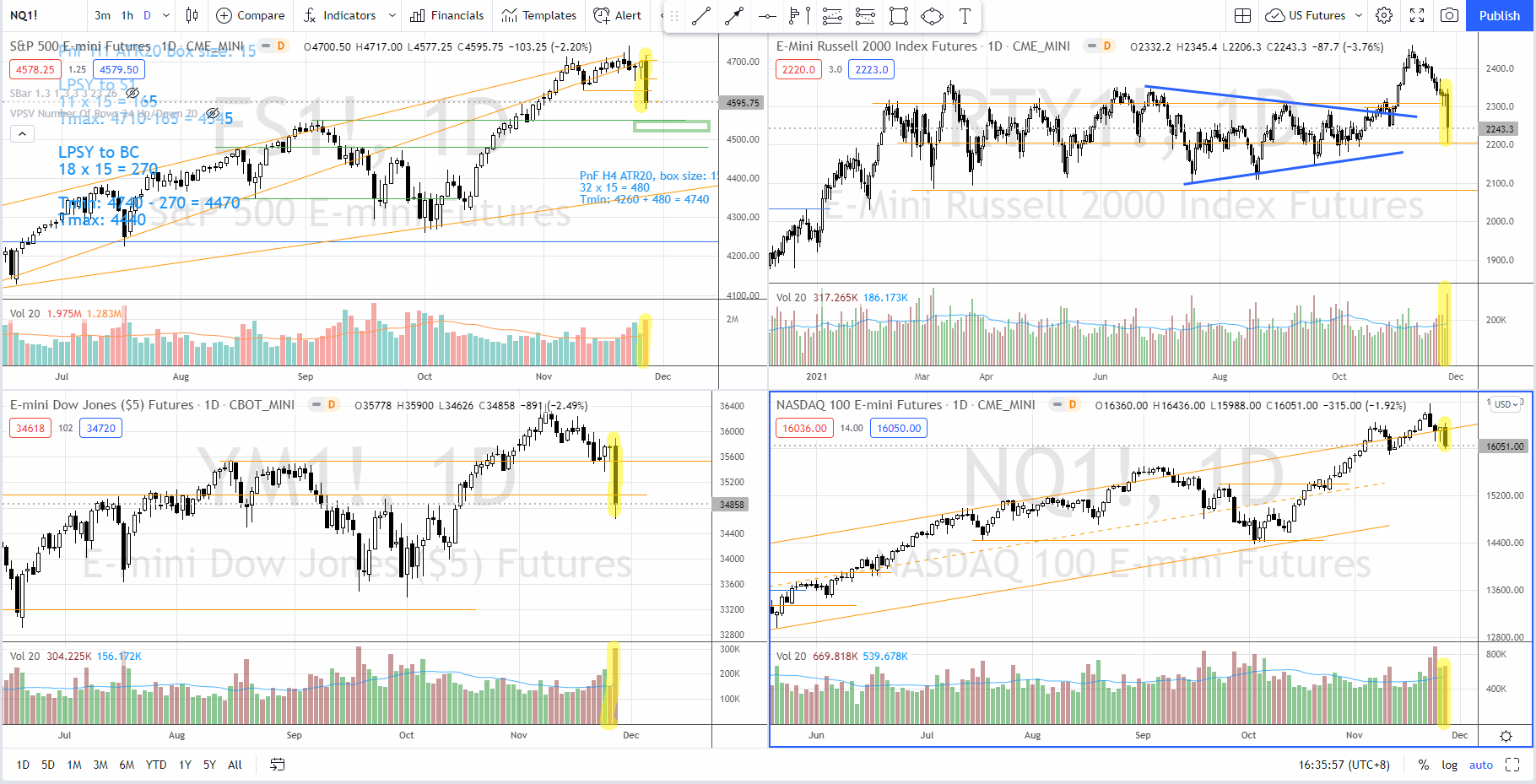

The black Friday selloff on 26 Nov 2021 triggered by the COVID-19 variant — Omicron was significant and certainly is a change of character in S&P 500, Dow Jones and Russell 2000. Nasdaq was the strongest despite dropping close to 2% and it still did not break the swing low support near 15900.

As highlighted in the daily chart above, the spread of Friday’s candle (highlighted in yellow) is easily the top 3 biggest in this year. If we focus on the up wave since 13 Oct, Friday’s bar is certainly considered as a change of character bar, which stops the uptrend from 13 Oct, at least into a trading range (or a reversal to the downside).

Price Structure Context

Context is probably the most important thing we need to look into when analyzing the chart. According to the candlestick pattern books, shooting star or bearish engulfing is bearish, right? Wrong!

If you experience in your trading journey and found that candlestick pattern only works some of the time, it is time to pay attention to the context and the volume on top of the pattern.

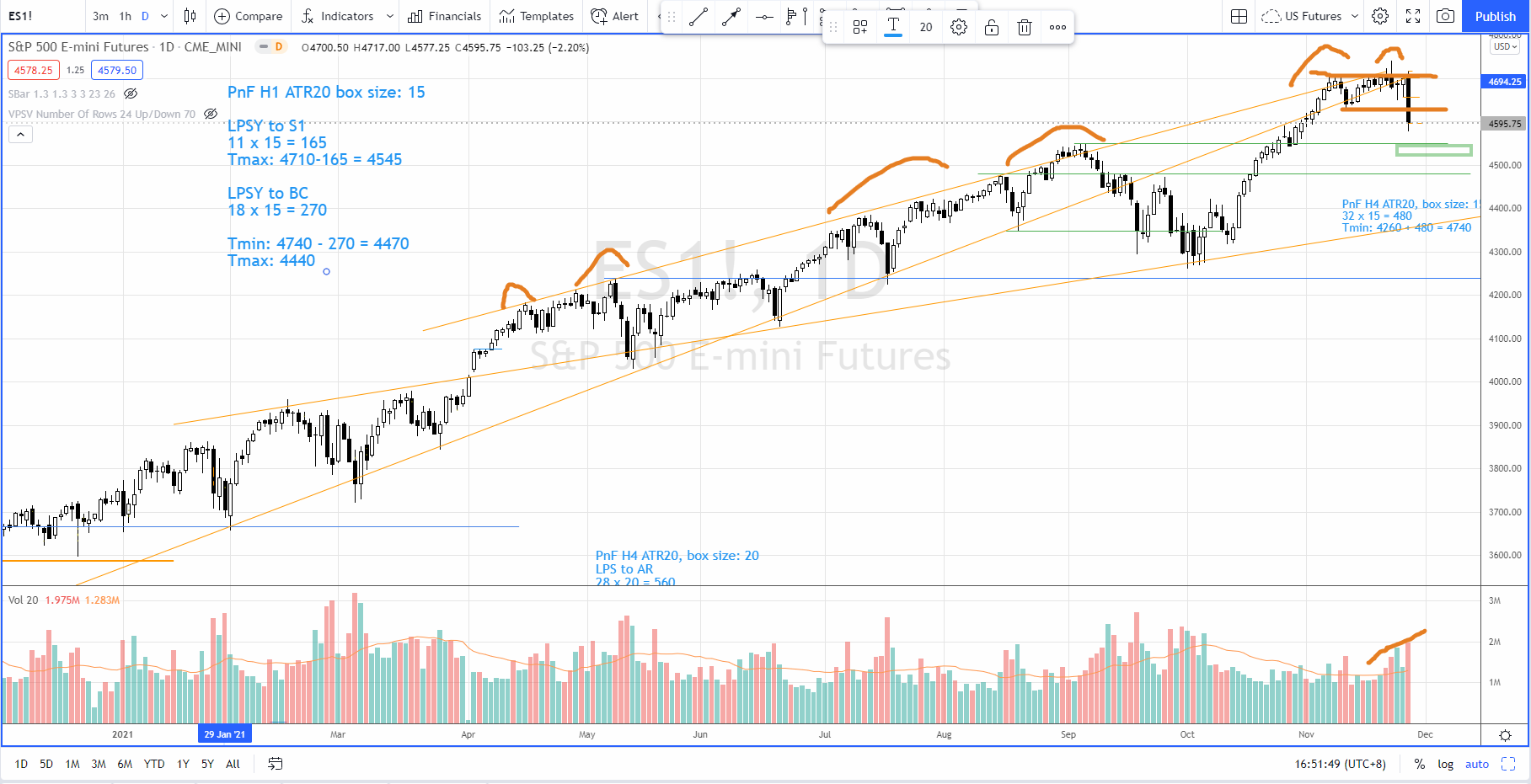

Let’s take a closer look at the S&P 500 daily chart below:

Since 13 Oct, S&P 500 had a climatic rally bumping into overbought of the up channel. Subsequently it formed a trading range. On 22 Nov (last Monday), there was an up thrust happened where the price failed to commit above the resistance level formed by the swing high with increasing supply.

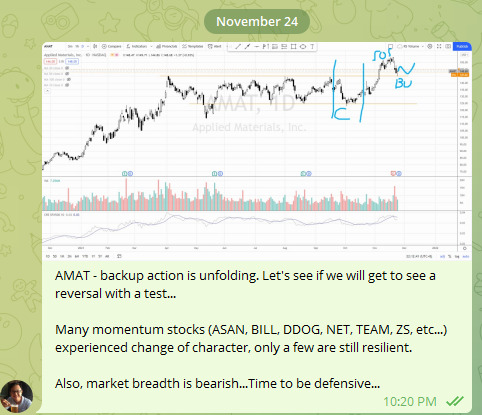

Despite on the next two days, S&P 500 did not have follow through to the downside (even formed demand tails), there were many leadership stocks such as AEHR, ASAN, BILL, DDOG, NET, TEAM, ZS, etc… experienced a steep selloff acted as a change of character on 22 Nov, as mentioned in my private Telegram post — time to be defensive.

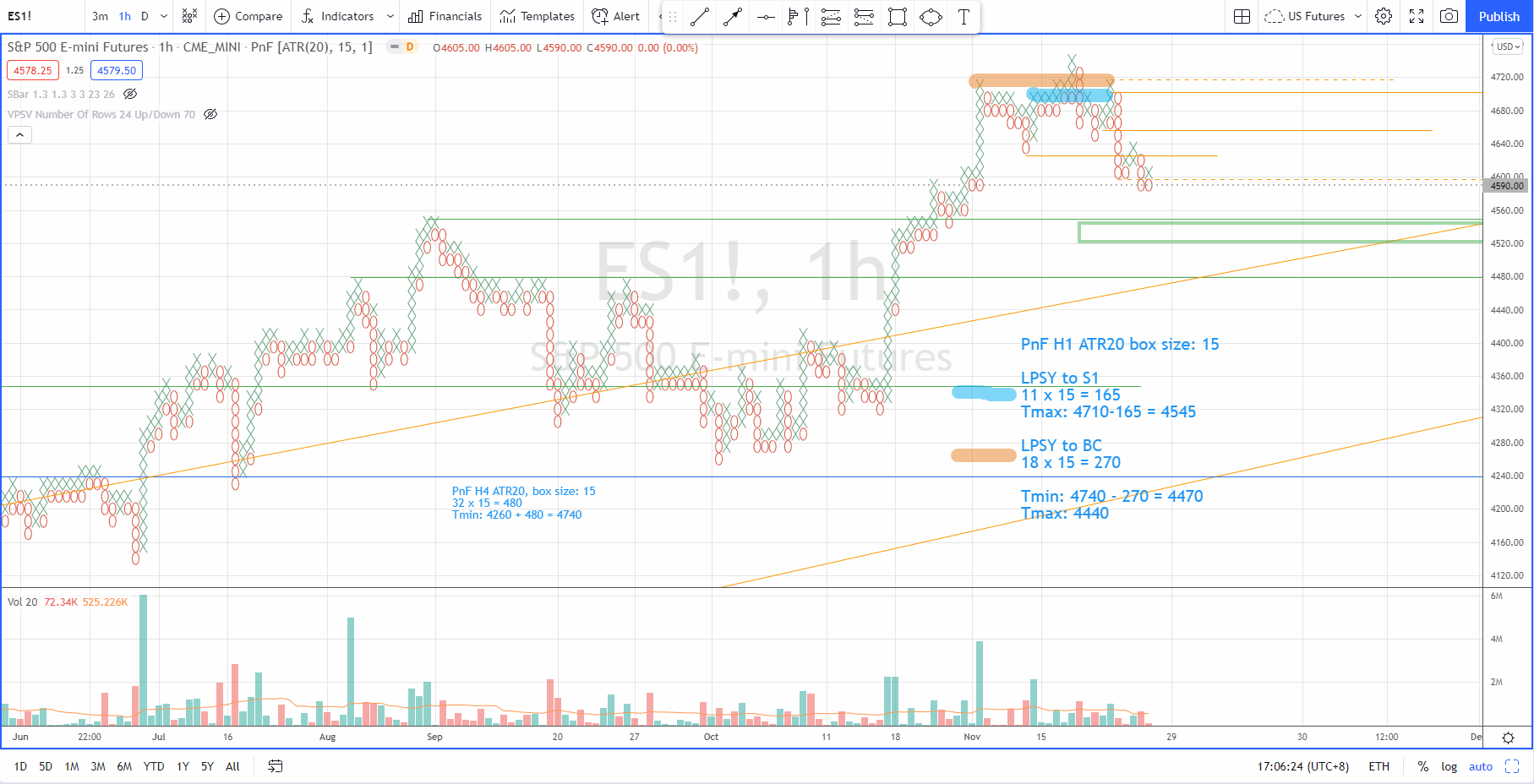

Distribution Price Targets on P&F Chart

Last Friday’s bearish bar broke below the swing low support around 4620 with increasing of supply even it was a short trading session. This small trading range with tell-tale signs of distribution characteristics has some causes built for larger downward price targets, as shown in the Point and Figure (P&F) chart below.

I would not be surprise if there is more panic selling on Monday since the demand was poor on last Friday and there was fuel in the tank for more downside price targets based on the P&F price targets projection. The first target is 4545, which coincides with the axis line where the previous resistance become support. The second target is around 4440–4470, which is near the previous Wyckoff accumulation structure.

Should the bearish momentum carry the S&P 500 to the price target zone, we need to judge the rebound from there in terms of the price action characteristics and the volume.

As the price is unfolding, it is key to pay attention to the volume together with the behaviors of the price action to anticipate the next direction. This is the only way to judge if it is just a normal market correction or the start of a bear market.

I have locked in some profits and took some losses with early exit on 23–24 Nov and I will continue to tighten the stop for other positions to hold more cash and lighten the portfolio. Most important, we need to stick to our trading plan with proper stock risk management in order to stay in the game for long. Watch the video below to find out more on position sizing and how to manage the risk in the stock market:

Safe trading.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD turns negative near 1.0760

The sudden bout of strength in the Greenback sponsored the resurgence of the selling pressure in the risk complex, dragging EUR/USD to the area of daily lows near 1.0760.

GBP/USD comes under pressure and challenges 1.2500

GBP/USD now rapidly loses momentum and gives away initial gains, returning to the 1.2500 region on the back of the strong comeback of the US Dollar.

Gold retreats from highs on stronger Dollar, yields

XAU/USD trims part of its initial advance in response to the jump in the Dollar's buying interest and the re-emergence of the upside pressure in US yields.

XRP tests support at $0.50 as Ripple joins alliance to work on blockchain recovery

XRP trades around $0.5174 early on Friday, wiping out gains from earlier in the week, as Ripple announced it has joined an alliance to support digital asset recovery alongside Hedera and the Algorand Foundation.

Week ahead – US inflation numbers to shake Fed rate cut bets

Fed rate-cut speculators rest hopes on US inflation data. After dovish BoE, pound traders turn to UK job numbers. Will a strong labor market convince the RBA to hike? More Chinese data on tap amid signs of slow Q2 start.