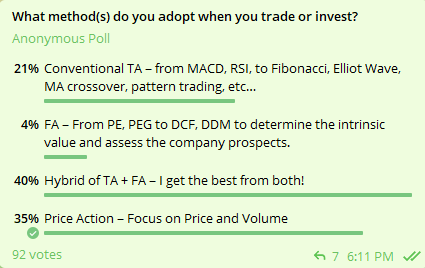

Here is the polling results (started yesterday) from TradePrecise members regarding the method adopted for trading or investing:

- 40% adopted the hybrid approach where they combine the technical analysis and the fundamental analysis.

- 35% focus on the price and volume, which is awesome!

- 21% prefers the conventional TA such as the indicators, MA, Fibo, pattern trading, etc…

- Only 4% are true blue investor to focus on the intrinsic value and company prospects.

Let me share with you my experiences and challenges on some of the above methods.

Black Box System

After I graduated from the University, I started “investing” in a well-known fund focused on both local and international equities because my housemate told me that his portfolio with that fund had been growing at 15–20% every year for the last 2 years.

3 years later, my portfolio with the fund had gone down by 30% due to the bear market.

I thought instead of depending on those fund managers, I should equip myself with the necessary knowledge so that I can manage and grow my hard-earned money.

After attending dozens of “free previews” of the investing/trading workshops, I was drawn by one proprietary system because of its simplicity and was definitely suitable for newbie like me to follow the signal — buy arrow and sell arrow.

In fact, I made some money for a few months with the black box system but subsequently found that it didn’t work anymore as I was losing money. I didn’t really know the reason until later — because the market environment had changed from trending to a choppy trading range.

Lesson learned: Though Black Box system could work with certain market condition; it is best to know how the system works in order to understand the limitations.

Technical Indicators

I decided to start learning the indicators from various workshops and really master some of them such as the RSI, MACD, Bollinger Band, Fibonacci, etc…

I did have some success using the indicators but again I found that most of the time my entry and exit were late. I kept adjusting the parameters so that they can “react faster” with more accuracy and eventually…

I was overwhelmed with the indicators and ended up with even more questions and frustrations.

Lesson learned: Indicators are derived from either price or/and volume hence It is normal to have lagging experience when using the indicators.

Pattern Trading

That led me to pattern trading (cup and handle, double bottom, inversed head and shoulders…) with candlesticks (bearish engulfing, hammer, morning start, island reversal, etc..). I even bought the “physical cheat sheets” so that I can always refer to without memorizing those patterns.

I was pretty good at spotting the pattern and the candlesticks and my trading results really improved. Just when I thought I found the holy grail in trading, the patterns started to fail from time to time…

Not every descending triangle went down…

Not every hammer indicated a reversal…

Despite I had no idea why the patterns or candlestick failed, I could survive using the risk management, yet I kept wondering there must be a missing piece.

Lesson learned: More works are needed to crack the code for pattern trading and candlesticks and risk management is key when dealing with bad trades or failures.

Value Investing

While searching for the missing piece for pattern trading, I further enhanced myself with value investing. I picked up the knowledge on interpreting the profit & loss statement, balance sheet and cash flow statement to spot the red flags, using discounted cash flow (DCF) to derive the intrinsic value, etc…

I also put a lot of focus on the future prospects of the companies, followed every single piece of news regarding new project, contracts, potential JV, new plant, etc…

I had quite a number of the profitable trades by combining the TA with the FA, mostly for the up trending stocks where the news driven catalysts just spiked the share price higher.

The theory of value/growth investing makes perfect sense…

Until it clashed with my technical analysis.

Some companies are always “undervalued” and cash rich while the stock prices are stuck in a trading range for years without much volume.

Some of the potential “growth companies” had a great turnaround story supported by huge JV projects with great upside potential. Yet their share price has been trending down.

The worst part was I removed my stop loss when I was in a losing position because I “think” the future prospects of the stocks are just too good to miss out.

Some of those losing trades turned out a big hit!

Lesson learned: Always have a plan (including the entry, exit and % of risk taken) and stick to it. Risk management is the key when it comes to investing or trading. Do not let a small percentage of your trades ruin your whole account. The market is always there and you are welcomed to get in anytime. There is a huge difference between “value investing” and get “hooked on” a growth story.

I will elaborate more on the missing piece for trading and investing tomorrow.

Meanwhile, watch the video below to find out how I use the missing piece to identify market leaders with huge upside ahead.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.