Good Morning Traders,

As of this writing 4:40 AM EST, here’s what we see:

US Dollar: Down at 88.275 the US Dollar is down 51 ticks and is trading at 88.275.

Energies: January Crude is up at 57.78.

Financials: The Mar 30 year bond is up 6 ticks and trading at 144.29.

Indices: The Mar S&P 500 emini ES contract is up 60 ticks and trading at 2023.25.

Gold: The February gold contract is trading up at 1198.70 and is up 42 ticks from its close.

Initial Conclusion

This is not a correlated market. The dollar is down- and oil is up+ which is normal but the 30 year bond is trading higher. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are up and Crude is trading up which is not correlated. Gold is trading higher which is correlated with the US dollar trading down. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

Asia traded mainly higher with the exception of the Shanghai exchange which traded down fractionally. As of this writing all of Europe is trading higher.

Possible Challenges To Traders Today

Unemployment Claims is out at 8:30 AM EST. This is major..

Flash Services PMI is out at 9:45 AM EST. This is not major..

Philly Fed Manufacturing Index is out at 10 AM EST. This is major.

CB Leading Index m/m is out at 10:30 AM EST. This is major.

Natural Gas Storage is out at 10:30 AM EST. This could move the Nat Gas market.

Currencies

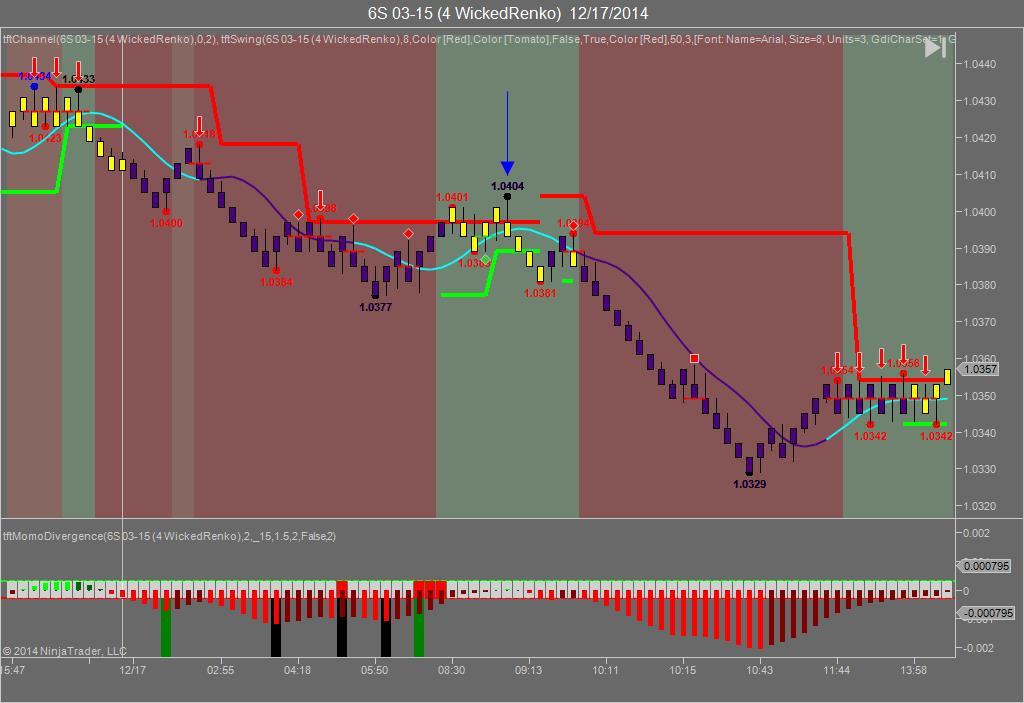

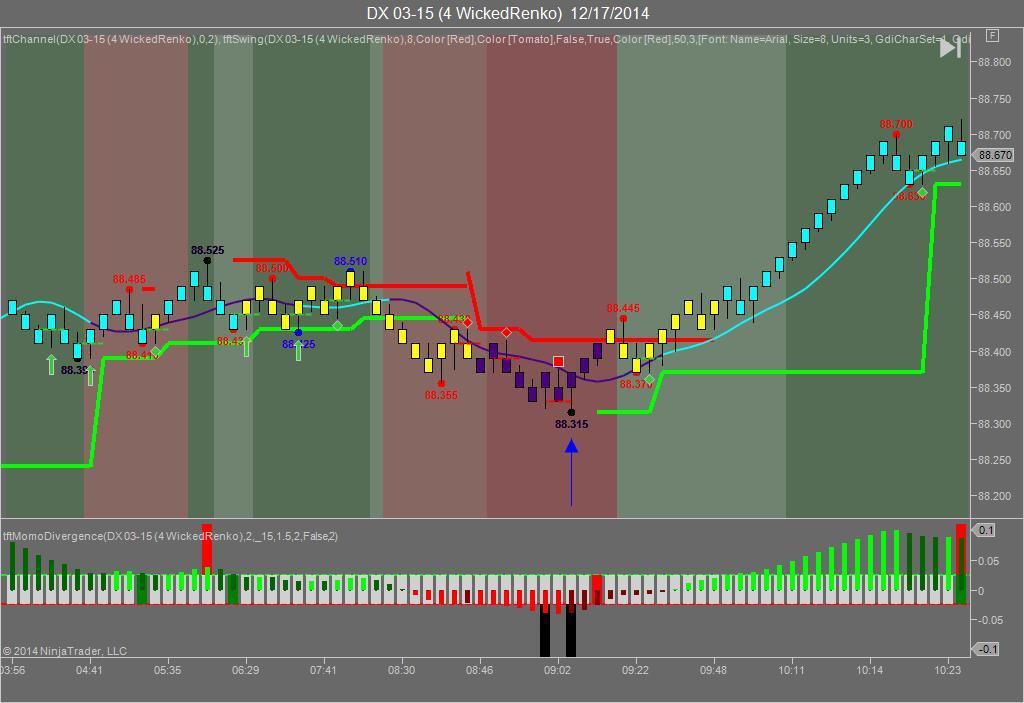

Yesterday the Swiss Franc made it’s move at around 9:10 AM EST after the economic news was reported. The USD hit a low at around that time and the Swiss Franc hit a high. If you look at the charts below the USD gave a signal at around 9 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a low at 9 AM EST and the Swiss Franc hit a high. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a shorting opportunity on the Swiss Franc, as a trader you could have netted 20 plus ticks on this trade. Remember each tick on the Swiss Franc is equal to $12.50 versus $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we said our bias was neutral as we always maintain a neutral bias on FOMC Day. Today we aren’t dealing with a correlated market and will maintain a neutral bias.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday we said our bias was neutral as we always maintain a neutral bias on FOMC Day. The markets didn’t disappoint with the Dow rising 288 points for the best trading day of 2014. The Nasdaq and S&P also posted strong gains as well. So what did the market like? The Fed did change their language from “considerable time” to “we can be patient”. During the follow up press conference Janet Yellen appeared as cool as ever and stated that she doesn’t see the Fed doing anything relative to rate hikes for the next couple of sessions. But at the same time she also stated that most Fed members see rate hikes in 2015 which we all knew was coming anyway. Some panelists on CNBC stated that they didn’t think the Fed would raise until the 3rd Quarter of 2015; I’m inclined to agree with that as the Fed under Janet Yellen won’t be too quick to pull the trigger on rates as she knows that once that occurs, there’s no turning back. What happens will be predicated on the economic picture at that time. As I mentioned earlier this week, Bill Gross has even stated that the Fed may not be able to raise rates in 2015 due to deflation, the state of the economy at that time, etc. Look at what happened in Russia this week, no one wants deflation and the inflation picture is virtually nonexistent in the US.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.