NFP Quick Analysis: Slow hiring downbeat for the dollar, good for gold, no silver lining

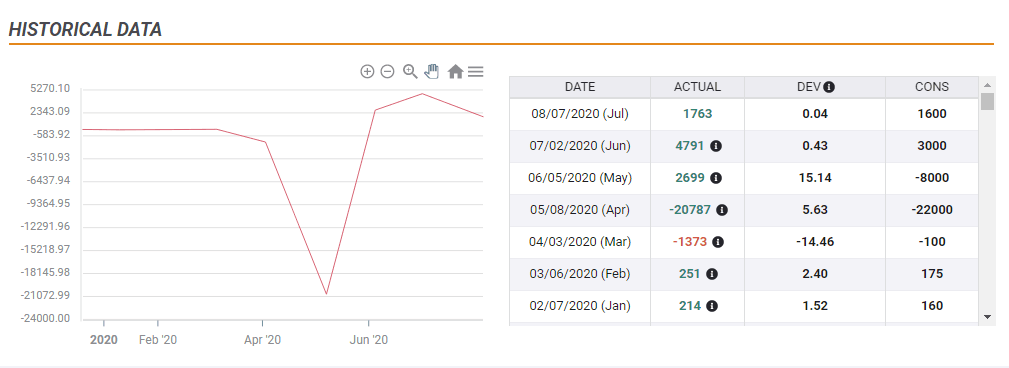

- The US economy gained 1.763 million jobs in July and the unemployment rate stands at 10.2%.

- Coronavirus' impact has proved devastating, pointing to a painful recession.

- Urge to add stimulus could be countered by another reason to worsen Sino-American relations.

A V-shaped recovery? White House adviser Larry Kudlow still touted a rapid bounce as late as two weeks ago – but the shape of the labor market already looks like an L or Nike swoosh. The sharp fall due to coronavirus is turning from a temporary shutdown into more permanent job losses.

America gained 1,763 million jobs in July, 1.462 million in private payrolls, both better than expected – but a significant deceleration from June's 4.791 million jobs. The relatively robust increase in government positions is due to a summer seasonal adjustment – which is different this year as teachers were already laid off earlier and not in July.

Overall there still are some 10 million people who have not returned to work. Job restoration is slowing down.

The unemployment rate fell to 10.2%, albeit alongside a drop in the participation rate to 61.4%. The more relevant U-6 Underemployment Rate – or "real unemployment rate" stands at 16.5%.

While coronavirus figures may be improving in August, the effects of that second wave are already causing secondary, more long-term layoffs. Businesses that managed to pull through via adjustments to how they work, their workers – and government support – are beginning to throw the towel.

The current broad dollar downtrend could continue as other countries seem to be moving up and not down.

Gold has room to extend gains amid speculation of further monetary and fiscal stimulus.

Political implications and markets

Will this NFP nudge politicians to push through the next large stimulus package? Republicans seem not to have grasped the magnitude of the disaster and they may now get their act together – facing voters in three months.

On the other hand, they may look at the fact that job gains beat market estimates of 1.5 million and go onto their recess without striking an accord. That would be even worse.

The failure to prevent a cliff for the unemployed – the end of federal unemployment benefits worth $600/week for those out of work – is already taking its toll. Perhaps now, there is a high chance for a deal that will be bigger than originally intended.

Nevertheless, politics are a double-edged sword.

President Donald Trump – already losing his economic edge over Biden – has escalated tensions with China by acting against TikTok and WeChat. He may now additional steps to divert attention from the economy and push China harder.

Beijing has already said that the US must create a "more favorable environment" for sustaining the trade deal – hitting it may be in peril. Markets have mostly brushed off Sino-American tensions as long as the accord – signed only in January – seemed safe.

Danger to the trade deal could further weigh on markets.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.