The GBP/USD pair once again failed to close above 1.5749 (23.6% Fib R of 1.5169-1.5928) on Tuesday, despite rising to an intraday high of 1.5775 in the early US session. The Q1 UK final GDP print was revised higher to 2.9% year-on-year; which was way above the expected upward revision of 2.5%. However, the upward revision was mainly due to the methodological changes rather than outstanding economic performance. Consequently, the GDP was ignored by the markets. In the early US session, a brief sell-off in the USD across the board also saw the GBP/USD pair rise to a high of 1.5775, only to fall back below 1.5749 and suffer a bearish daily close at 1.5685.

Moreover, the USD strengthened across the board after Greece defaulted on its loan repayment to the IMF as the last minute talks failed to end in a deal. German Chancellor Angela Merkel opposed talking up a deal before the July 5 referendum. It is worth noting that the US dollar has strengthened during both – risk-on and risk-off rallies since last week or so.

Ahead in the day, we have UK June manufacturing PMI scheduled for release (expected 52.5, previous 52.0). A better-than-expected print could help the cable re-test the strong resistance at 1.5749. However, no positive surprises or a weaker-than-expected report would quickly lead to a downside breakout from the week long range of 1.5667-1.1.5750.

At the moment, the pair is trading at 1.57, with the hourly and 4-hour RSI hovering below 50.00 levels. The 5-DMA at 1.5710 is likely to cap the immediate gains. On the hourly time frame, the pair has repeatedly failed to take out the 200-MA resistance, while the downside has been capped around 1.5667 levels. Given, the repeated failure to take out the hourly 200-MA and close above 1.5749, the pair could witness a sell-off that could lead to a break below the support at 1.5667 and push the spot down to 1.5606 (23.6% Fib R of 1.4564-1.5928). On the higher side, a re-test of 1.5649 could be seen, although the outlook stays bearish so long as the pair fails to see a daily close above 1.5749.

EUR/USD analysis: Focus on Greek referendum opinion polls, bearish below 1.1130

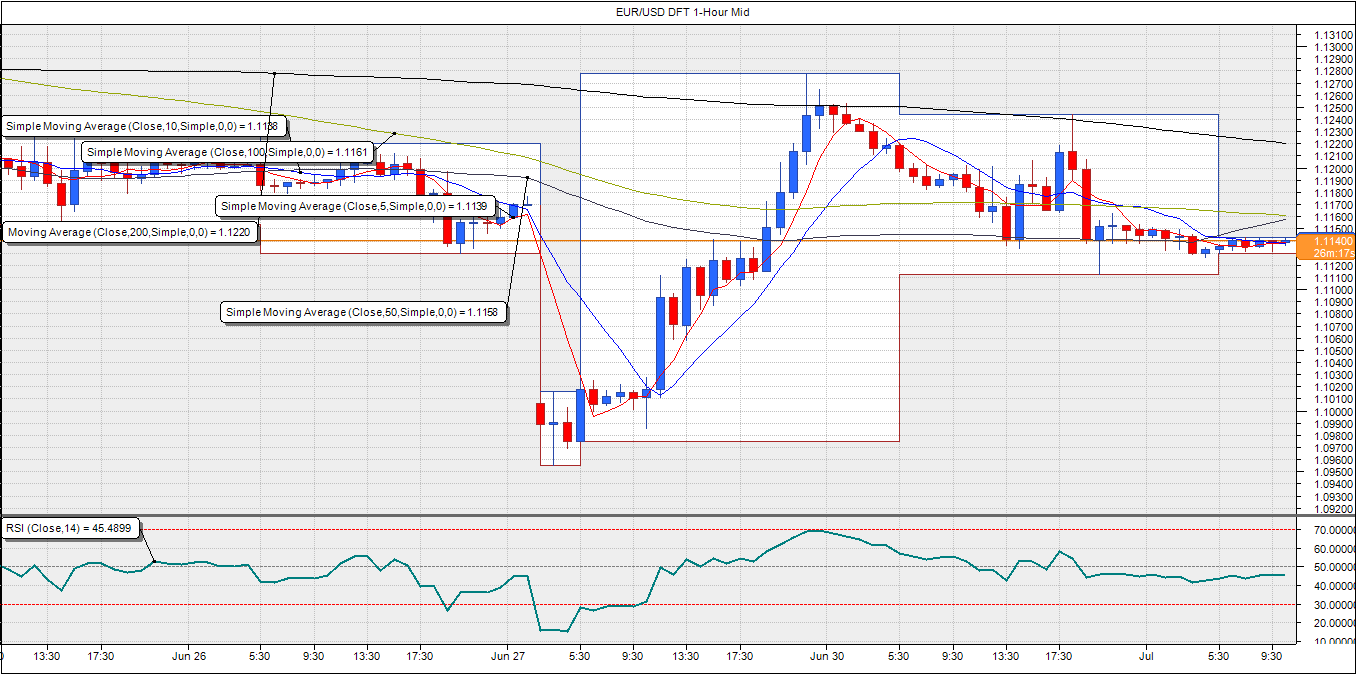

The EUR witnessed another volatile trading session on Tuesday as proposals/counter proposal continues to fly back and forth between Greece and its international creditors as both parties made a last ditch effort to avoid the default. However, German chancellor Angela Merkel said that Germany would not negotiate on a new bailout agreement for Greece before its referendum which is planned for Sunday. Greece, thus, defaulted on its IMF loan repayment. The pair clocked a high of 1.1244 before end the day lower at 1.1134.

Merkel’s stance has put the focus entirely on the referendum opinion polls. The latest one conducted by prorata polling institute for efimerida ton synatkton newspaper, with responses before bank closure shows yes 30%, no 57%, don't know 13%, while responses after bank closure have seen yes 37%, no 46%, don't know 17%. The opinion polls showing increasing support for a ‘No’ vote is likely to push the pair below the support at 1.1130.

Apart from the opinion polls, the investors would also look towards the manufacturing PMI reports scheduled for release across the Eurozone. But, the data is likely to be overshadowed by the noise surrounding Greece referendum.

At the moment, the pair is trading around 1.1140. A bullish/bearish view via technical charts is unlikely to be a success, given the EUR/USD is scattered all over the place amid repeated rumours, official confirmation/denials regarding the Greek issue. Still, a note of critical support/resistance levels would come in handy. The immediate support is seen at 1.1130 (June 26 low), under which a next major support is seen at 1.1082 and 1.1050 (Mar 26 high). A failure to take out the immediate resistance at 1.1158 (hourly 50-MA) could open doors for a test of the support levels. On the other hand, a break above 1.1161 (hourly 100-MA) could see the pair re-test the stiff resistance of the hourly 200-MA at 1.1220.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.