XAU/USD pair – Daily Chart

Gold prices in terms of US dollar (XAU/USD) traded both side on Wednesday, finally ending the day lower at 1202.27. Gold prices remain resilient above 1200 levels, giving a sustained close above that level over the past one week. XAU/USD dipped briefly below 1200 threshold as the US dollar hit a fresh twelve year high. However, gold bulls quickly took charge and regain 1200 levels after US jobs data missed market expectations. Moreover, a risk-off sentiment amid falling major currencies and global equities also boosted the safe-haven demand for gold, keeping XAU/USD underpinned.

Currently, the pair trades higher at 1204.34 levels and faces stiff resistance at 10-DMA located at 1205.77 levels. Gold prices are expected to remain buoyed largely on risk-aversion with the daily RSI ticked upwards at 40.05 backing the case for an upside in the making. A break above 10-DMA, the pair may face immediate upside barrier at 5-DMA located at 1206.34 levels. Beyond 5-DMA, the pair may sail smoothly towards the confluence of 20-DMA and 100-DMA around 1215 levels, forming a dense resistance there. The persistent strength in the US dollar may cap the upside and XAU/USD is expected to bounce-off 1215 levels and fall back to crucial support at USD 1200 levels. Overall, the pair is likely to remain underpinned above 1200 levels ahead of US unemployment claims figures and further upside for the pair is likely with a break above 100-DMA.

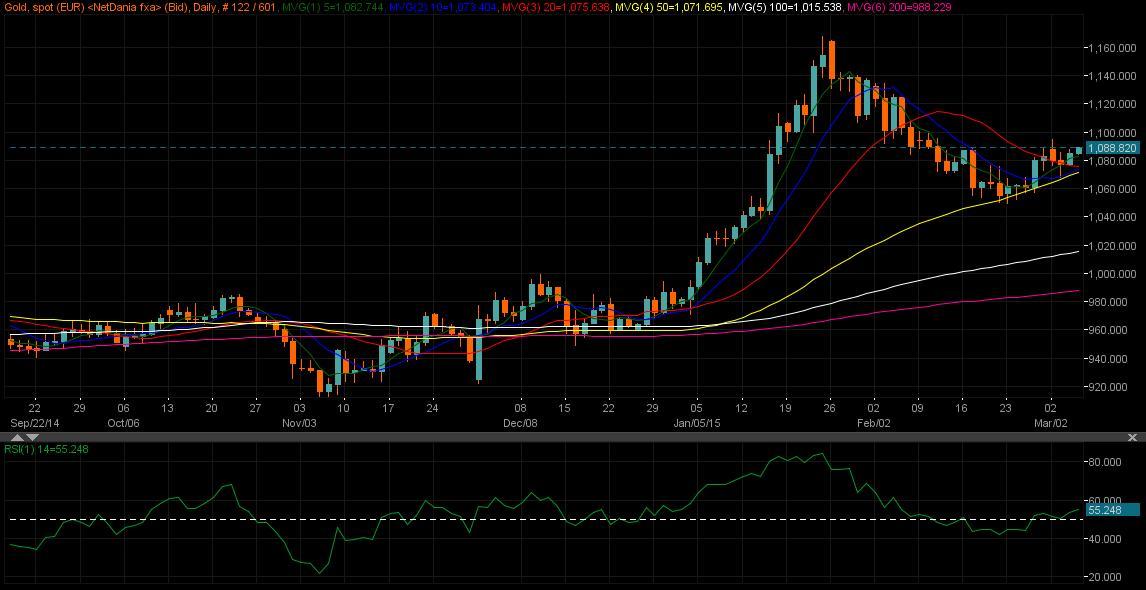

XAU/EUR pair – Daily Chart

Gold prices in terms of Euro (XAU/EUR) finished higher on Wednesday at 1085.07 levels, holding above the critical support at 20-DMA placed at 1076.35. XAU/EUR advanced as the euro tumbled to fresh twelve year lows against the greenback at 1.1060 levels, as traders remained wary on the implementation of the QE program ahead of ECB meeting later today. Moreover, a set of mixed PMI readings across the Euro area economies and also the EMU retail sales numbers dented investors’ sentiment, adding further pressure on the Euro.

Currently, the pair trades near fresh highs at 1088.91 levels, firmly bid above 5-DMA located at 1082.73 levels. XAU is likely to climb higher as the euro is expected to test 1.100 psychological levels ahead of German industrial production and ECB Meeting due later in the day. The daily RSI standing at 55.21 levels in the bullish terrain also suggests more room for upside. The pair is likely to test previous highs at 1095 levels and beyond that test next resistance at 1100- psychological levels and XAU bulls may dominate thereon. Overall, a generalized intraday upside bias persists so long as pair holds above 20-DMA. Also, the shared currency is expected to be pressured as traders remain on the edge and may prefer to hold the reserve currency before the ECB Meeting.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.