Market Brief

Stability in Asia Equity Markets

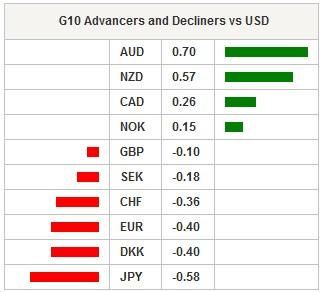

Asia regional equity indices were broadly higher with the exception of China. European stock futures are pointing to a higher open. After an extend period of contraction, China’s December trade data was stronger than expected with exports and imports declining less than anticipated and showing signs of improvement. While the numbers were not outstanding they were encouraging enough to support sentiment. However, recent trade data from other regional partners such as South Korea has not been so optomistic. From Japan November industrial machinery orders increased +2.8% y/y to Y309.635 bln. The Nikkei rose 2.88%, Hang Seng 1.73% while Shanghai composite fell another -2.45%. The USD & JPY came under selling pressure as risk appetite returned. Much maligned AUD and NZD lead the G10 leaders higher. In the regional EM currency space KRW, MYR and IDR were the big gainers verse safe haven currencies. USDCNY fixing virtually unchanged at 6.563. AUDUSD rallied from 0.6980 to 0.7049 as investors unwound extended shorts in the crosses. Solid supply can be seen at 0.7070 which will slow AUD bullish momentum. Also helping the commodity-linked currencies was the slight rise in crude prices off it 12 year low for the first time in 8 days. Brent crude front month is precariously lingering around $31.00 (WTI $30.70 after falling below $30 intraday), yet with legislation to end a 40-year-old ban on exporting U.S. crude in coming into effect downside risk are increasing.

China’s trade balance widened more than expected as exports were down -1.4% (-8.0% exp) while imports fell -7.6% (-11.0% exp). Clearly the trade surplus of $60.09bln, is not outstanding but a positive light in a very dark place. Interestingly, import volumes of major commodities increased in December on soft prices. Elsewhere, China December vehicle sales rose 15.4% y/y, passenger vehicles 18.3%. We continued to suspect that weakness in China equity markets are a function of miss-management of currency policy and regulators miss-steps rather than new signs of deep China economic troubles. Equity trading and China economic outlook will start to decouple while expectation for global contagion will fade.

With increased volatility the short end of the US yields curves has steady declined. US 2 years yields are now lower than the Fed raise inters rates in December. With evidence that two FOMC member (including NY Fed board ) did not vote for a rate hike combined with global markets disruption (feds third mandate) we suspect that the probably of a March rate hike has decline significantly. With the US economic calendar thin this week, the lack of supplementary data supporting the Feds gradual path will keep USD weaker. Finally, 4Q15 earnings season unofficially began this week, with expectations very low as EPS in expected to fall 5% and earnings growth to be negative again.

Trade will be watching EU industrial production and US beige book.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 17715.63 | 2.88 |

| Hang Seng Index | 19930 | 1.1 |

| Shanghai Index | 2949.6 | -2.42 |

| FTSE futures | 5921 | 0.77 |

| DAX futures | 10112 | 1.17 |

| SMI Futures | 8324.99 | 1.03 |

| S&P future | 1942.5 | 0.91 |

| Global Indexes | Current Level | % Change |

| Gold | 1080.44 | -0.53 |

| Silver | 13.78 | 0.02 |

| VIX | 22.47 | -7.34 |

| Crude wti | 31.08 | 2.1 |

| USD Index | 99.24 | 0.26 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SW Dec PES Unemployment Rate | 4,10% | 4,10% | SEK/07:03 |

| NO 4Q House Price Index QoQ | - | 1,20% | NOK/09:00 |

| EC Nov Industrial Production SA MoM | -0,30% | 0,60% | EUR/10:00 |

| EC Nov Industrial Production WDA YoY | 1,30% | 1,90% | EUR/10:00 |

| US 08.janv. MBA Mortgage Applications | - | -11,60% | USD/12:00 |

| CA Dec Teranet/National Bank HPI MoM | - | 0,20% | CAD/13:30 |

| CA Dec Teranet/National Bank HP Index | - | 177,69 | CAD/13:30 |

| CA Dec Teranet/National Bank HPI YoY | - | 6,10% | CAD/13:30 |

| US Dec Monthly Budget Statement | -1,00E+10 | 1,90E+09 | USD/19:00 |

| US U.S. Federal Reserve Releases Beige Book | - | - | USD/19:00 |

| NZ Dec ANZ Truckometer Heavy MoM | - | 0,70% | NZD/21:00 |

| NZ Dec Card Spending Retail MoM | 0,50% | 0,30% | NZD/21:45 |

| NZ Dec Card Spending Total MoM | - | 0,20% | NZD/21:45 |

| SZ 4Q Real Estate Index Family Homes | - | 447,5 | CHF/23:00 |

Currency Tech

EURUSD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0896

S 1: 1.0458

S 2: 1.0000

GBPUSD

R 2: 1.5529

R 1: 1.5242

CURRENT: 1.4520

S 1: 1.4321

S 2: 1.3657

USDJPY

R 2: 125.86

R 1: 123.76

CURRENT: 117.30

S 1: 115.57

S 2: 105.23

USDCHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9976

S 1: 0.9786

S 2: 0.9476

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.