Market Brief

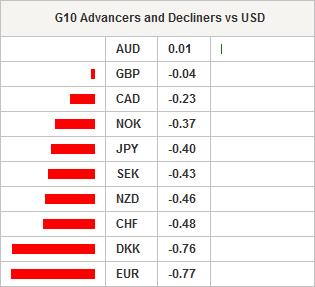

Just like her colleagues from the Federal Reserve, Janet Yellen reiterated her call for a rate before the end of the year. To support her view, Fed’s chairwoman argued that the recent weakness in US inflation levels is primary due to low energy prices and weak import prices due to a strong dollar. That was all it took to wake dollar bulls up. The dollar index jumped 0.41% to 96.30 as the single currency suffered the biggest sell-off among G10 currencies. EUR/USD dropped 0.65% before stabilising around 1.1170. Janet Yellen also added that she was confident that inflation will return to 2% over the next few years and that, therefore, the prudent strategy is to start increasing rates gradually before reaching the Fed’s target.

Yesterday morning, USD/NOK jumped 2.72% to 8.50 as the Norges Bank cut the deposit rate by 25bps to 0.75% on growth concerns. Moreover, the Norwegian central bank left the door wide open for further rate cut, arguing that the economy is getting severely hit by persistently low crude oil prices.

Japan’s August inflation report was released earlier this morning and it wasn’t pretty. Despite Kuroda’s boundless optimism, Japan falls back into deflation as the country’s core inflation gauge fell 0.1%y/y from 0% a month earlier. After a promising start in 2013, the economy is running out of steam and seems unable to return to growth without the central bank’s extra push. We therefore expect that the BoJ will increase the size of the stimulus at its annual meeting. We remain bullish USD/JPY on the medium-term, however we do not rule out a temporary strength of the JPY on the short-term.

As a result, Japanese shares rose substantially in Tokyo with the Nikkei and the Topix in dex jumping 1.76% and 1.88% respectively. Elsewhere in the region, Chinese mainland shares kept sliding lower, The Shanghai Composite fell another 1.86% while its tech-heavy counterpart, the Shenzhen Composite is sending a strong bearish signal as the 50dma is crossing the 200dma to the downside. The gauge is down 3.11%. In Hong Kong, the Hang Seng edged up 0.23% while in South Korea the Kospi index fell 0.22%.

The Brazilian real jumped 4.44% against the USD dollar, its biggest rally in seven years, as Governor Tombini said he was ready to use “all instruments” to put an end to the real’s ongoing massive sell-off. USD/BRL fell from 4.2478 to 3.9507 in São Paulo as Tombini and Joachim said that the BCB would use its FX reserves to protect the real.

Today traders will be watching annualized final Q2 GDP, Q2 PCE, Markit PMIs and University of Michigan sentiment index from the US.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 17880.51 | 1.76 |

| Hang Seng Index | 21144.44 | 0.23 |

| Shanghai Index | 3084.3 | -1.86 |

| FTSE futures | 6026.5 | 1.76 |

| DAX futures | 9614 | 2.11 |

| SMI Futures | 8401 | 1.53 |

| S&P future | 1931.5 | 0.66 |

| Global Indexes | Current Level | % Change |

| Gold | 1146.87 | -0.62 |

| Silver | 15.11 | -0.28 |

| VIX | 23.47 | 6.06 |

| Crude wti | 45.33 | 0.94 |

| USD Index | 96.31 | 0.33 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SP Jul Total Mortgage Lending YoY | - | 21.80% | EUR/07:00 |

| SP Jul House Mortgage Approvals YoY | - | 26.30% | EUR/07:00 |

| SP Aug PPI MoM | - | 0.10% | EUR/07:00 |

| SP Aug PPI YoY | - | -1.30% | EUR/07:00 |

| SW Aug Household Lending YoY | - | 7.10% | SEK/07:30 |

| EC Aug M3 Money Supply YoY | 5.30% | 5.30% | EUR/08:00 |

| EC Aug M3 3-month average | 5.20% | 5.10% | EUR/08:00 |

| BZ sept..22 FIPE CPI - Weekly | 0.48% | 0.47% | BRL/08:00 |

| IT Aug Hourly Wages MoM | - | 0.10% | EUR/08:00 |

| IT Aug Hourly Wages YoY | - | 1.20% | EUR/08:00 |

| UK Statement from the BOE's FPC on September 23rd Meeting | - | - | GBP/08:30 |

| BZ Sep FGV Construction Costs MoM | 0.15% | 0.80% | BRL/11:00 |

| BZ Aug PPI Manufacturing MoM | - | 0.68% | BRL/12:00 |

| BZ Aug PPI Manufacturing YoY | - | 7.62% | BRL/12:00 |

| US 2Q T GDP Annualized QoQ | 3.70% | 3.70% | USD/12:30 |

| US 2Q T Personal Consumption | 3.20% | 3.10% | USD/12:30 |

| US 2Q T GDP Price Index | 2.10% | 2.10% | USD/12:30 |

| US 2Q T Core PCE QoQ | 1.80% | 1.80% | USD/12:30 |

| UK BOE's Gareth Ramsay Speaks in London | - | - | GBP/13:00 |

| US Fed's Bullard to Speak on Monetary Policy in St. Louis | - | - | USD/13:15 |

| US Sep P Markit US Composite PMI | - | 55.7 | USD/13:45 |

| US Sep P Markit US Services PMI | 55.6 | 56.1 | USD/13:45 |

| US Sep F U. of Mich. Sentiment | 86.5 | 85.7 | USD/14:00 |

| US Sep F U. of Mich. Current Conditions | - | 100.3 | USD/14:00 |

| US Sep F U. of Mich. Expectations | - | 76.4 | USD/14:00 |

| US Sep F U. of Mich. 1 Yr Inflation | - | 2.90% | USD/14:00 |

| US Sep F U. of Mich. 5-10 Yr Inflation | - | 2.80% | USD/14:00 |

| EC ECB's Weidmann Holds Press Conference in Florence | - | - | EUR/17:15 |

| US Fed's George Speaks on Economy, Policy in Omaha, Nebraska | - | - | USD/17:25 |

| BZ Aug Formal Job Creation Total | -74900 | -157905 | BRL/18:00 |

| IN Aug Eight Infrastructure Industries | - | 1.10% | INR/22:00 |

Currency Tech

EURUSDR 2: 1.1561

R 1: 1.1330

CURRENT: 1.1140

S 1: 1.1017

S 2: 1.0809

GBPUSD

R 2: 1.5819

R 1: 1.5659

CURRENT: 1.5235

S 1: 1.5165

S 2: 1.5089

USDJPY

R 2: 125.86

R 1: 121.75

CURRENT: 120.60

S 1: 118.61

S 2: 116.18

USDCHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9808

S 1: 0.9513

S 2: 0.9259

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.