Market Brief

In a surprise move the PBoC lowered borrowing costs, by cutting the 1-year lending rate by 25bps to 4.60% and the 1-year deposit rate by 25bps to 1.75%, and trimmed the reserve requirement ratio by 50bps to 18%, effective September 6. Initially, the move didn’t prevent Chinese stock markets from sliding lower as the Shanghai Composite fell 3.80% in early Asian trading while the Shenzhen Composite dropped 4.40%. Optimism gradually returned, however, in the second part of the day with Japanese shares jumping 3.20%. In South Korea the Kospi index surged 2.57% while in Hong Kong the Hang Seng edge down 0.46%. Overall, traders had a hard time determining whether Chinese shares had to stabilise or to keep sliding, it was a very volatile session with equity returns swinging from red to green. In the end, Shanghai fell 1.30% and Shenzhen 3.05%.

Yesterday in New York, US equities sacked the rebound in US dollar as all major indexes were trading in negative territory, with the S&P 500, Down Jones and Nasdaq down 1.35%, 1.29% and 0.44%, respectively. Nevertheless, futures on the S&P are up 0.76% in Asia this morning. In Europe, futures are broadly lower this morning with Euro Stoxx 50 down 2.01%, DAX down 1.94%, Footsie down 1.68%, CAC 40 down 1.70% and SMI down 1.48%.

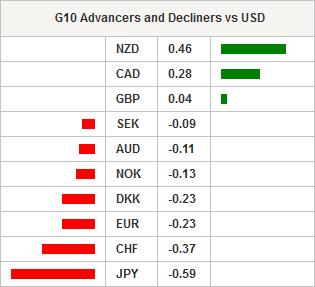

In the FX market, the US dollar is slowly recovering from yesterday late session’s sell-off. The greenback is up 0.37% against the Swiss franc, 0.60% against the Japanese yen and 0.23% against the single currency. USD/CHF found a strong support at 0.9258 (Fib 50% on January-March rally) and is now heading toward the resistance standing at 0.9463 (Fib 38.2%). EUR/USD is stabilising around 1.15, slightly below the key 1.1514 level (Fib 50% on December- March debasement).

In New Zealand, the trade deficit widened to NZ$649mn in July versus NZ$600mn median forecast as import surged to NZ$4.85bn, well above market expectation of NZ$4.40bn. On the other hand, export increased to NZ$4.20bn compared to the downwardly revised figure of NZ$4.14bn the previous month. The news drew a muted response from NZD/USD a it has been trading in a narrow range between 0.6465 and 0.6560.

In Japan, services PPI surprised markets to the upside with a reading of 0.6%y/y versus 0.4% consensus. USD/JPY is edging higher this morning, after having found a strong support around 118.30 (low from March 26). The head of the New York Fed, Bill Dudley, will be speaking today on the regional and local economic situation, however the conference will be follow by a Q&A session and we may get some interesting question about the Fed monetary policy.

Today traders will be watching unemployment rate from Norway; MBA mortgage applications and durable goods orders from the US; total outstanding loans and weekly currency flow from Brazil.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.