Market Brief

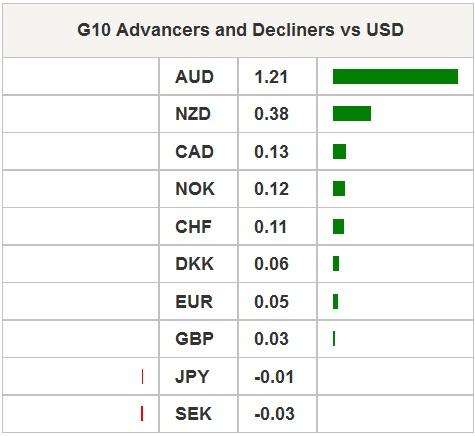

FX markets were stable in Asia trading, with the exception of AUD. As was universally expected the RBA held OCR at 2.0% and continue to see the current accommodative policy as appropriate. Yet, the accompanying statement took a hawkish turn when members stated that AUD was adjusting to declines in commodity prices, sheading the language for more depreciation. In reference to the currency, the statement said it was “adjusting to the significant declines in key commodity prices.” Local AUD yields jumped 3bps on the statement. Heavily sold AUDUSD quickly ran to 91.39 from 90.10 as short were squeezed. On the data, front Australian retail sales hastened 0.7% m/m in June, above estimates of 0.4% m/m and revised higher 0.4% m/m read in May. Finally, Australia’s trade deficit came in at A$2933mn in June slightly below expectations of deficit of A$3000mn. We will be watching developments in China carefully but favor carry-based trades in AUDJPY and AUDCHF. The positive AU economic data, specifically strong housing data, combined with today’s slightly neutral statement (shift from dovish) indicates that it’s unlikely that the RBA will cut rates further. However, the SNB and BoJ are not tightening anytime soon, while FX vol remains low.

Asian equity markets were mixed with the China seeing some well needed gains. Yet the gains were made on the back that new rules to restrict daily trading via short selling regulations. The Shanghai composite rose 3.015%, the Hang Seng increase 0.30% while the Nikkei fell -0.13%. EURUSD drifted between 1.0932 and 1.0967 picking up demand closer to European open. USDJPY continues to consolidate, stuck in a 20 pip range around the 124 handle. Currencies in EM were subdued as the USDCNY fixed 8 pips higher at 6.1177. Gold was unchanged around the $1087 level, as US rates were firm. European stocks are primed for a lower open.

In Japan, monetary base rose 32.8% y/y in July following a surge of 34.2% in June. Elsewhere, labor cash earnings fell 2.4%y/y in June below expected read of growth of 0.9% against revised increase of 0.7% in May. Despite recent comments indicating that no additional BoJ action is coming we suspect that in order to fuel the “Abe miracle” policy will remain at least ultra-accommodating. This should equate to a weaker JPY within the G10.

On the fridge, Puerto Rico has suspended depositing into the fund that is directed to pay bonds. This would be the first time Puerto Rico has defaulted on its debt obligations. Years for borrowing to convers budget short falls has pushed the island nations financial health over the edge. Governor Alejandro Garcia Padilla is seeking to restructure Puerto Rico’s $72bn of debt, halting monthly transfers of capital into the fund that repays $13bn of general obligations debt. We don’t see a high probability for risk contagion.

In the European session, traders are scheduled to see EU PPI, UK Housing Prices and construction PMI, Norway PMI and Russian CPI. The market anticipate that UK house prices to increase from -0.2% m/m to 0.4% m/m which should support GBP ahead of a busy Thursday.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.