Market Brief

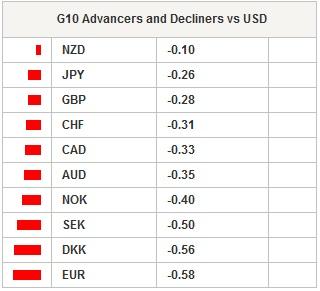

The USD remains broadly in demand in Asia this morning after Wall Street ended in green. The S&P gained almost 1%, the Dow Jones 1.17% while the Nasdaq climbed 1.27%; futures are also up this morning. After a tough previous week, the greenback reversed the trend as the EUR lost -0.58%, the JPY is down -0.26%, the CAD edged down -0.33% while the AUD retreated by -0.35%. The released of RBA’s minutes last night triggered a move lower in the Aussie, the Bank said the respond of housing market to a rate cut is uncertain; they preferred to remain on hold and to wait for more economic data. However, the RBA is in favour of further monetary easing, we therefore expect a rate cut in May from 2.25% to 2%.

In Asia, equities are broadly higher this morning following New York’s lead. The Hang Seng is up more than 2% to 27,643pts, the Nikkei gained 1.20% while the Shanghai Composite is up 0.80% to 4,250, erasing partially the losses from Friday.

USD/JPY trend gains momentum since Monday as the pair validated a break of the 119.20 resistance (Fib 23.6% on March sell-off) and turned it into a support. On the upside, USD/JPY will find some buying interests above 119.74 (Fib 38.2%) but it first has to break this resistance. One can also find a resistance at 120.18/30 (Fib. 50% and multi high) and a support around 118.60 (multi low).

AUD/USD has been widely sold-off since Monday morning and has lost 140pips so far. The Aussie is currently sitting on the 0.7688 support (Fib. 38.2% on Feb-Mar sell-off) and looks determined to break it to test the next support standing at 0.7629/50 (Fib 23.6% and multi high). In case where the AUD/USD finds fresh boost, the nearest resistance can be found at 0.7736 (Fib 50% and high from April 9).

In Europe, equity futures are blinking green on the screen as main indices are still trying to erase losses from last Friday. Euro Stoxx 50 is up 0.40%, the Footsie is flat (+0.09%), German equities rises 0.53% while the SMI is up 0.36%. EUR/USD bears are overwhelming buyers as the pair is heading to 1.0685 (Fib 61.8% on March rally) after breaking the 1.0730/55 support (Fib 50% and low from early April). We expect the euro to remain offered, even though erratic moves are expected in reaction to developments of the Greek situation and the release of the German ZEW later this morning.

USD/CHF had some trouble breaking the 0.9481 support (low from April 3) and is now heading again to 0.9595, the following resistance (multi high and low). EUR/CHF continues sliding discreetly toward the parity. The pair is getting closer to a key level, the high from January 20 (1.0225). A break of this level would open the way to the parity, at least.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.