Market Brief

As widely expected, the RBNZ maintained its official cash rate unchanged at 3.50% and revised lower its growth and inflation forecasts. The NZD is still seen overvalued, yet satisfactory at current levels. The kiwi lost 18.5% over the past 8 months against the US dollar. NZD/USD rebounded from 0.7200 to 0.7383 post-RBNZ. Sentiment should turn positive should 0.7385/0.7400 barriers are cleared before the week close. The negative impacts of baseless news on Fonterra’s baby milk contamination continues weighing on dairy exports.

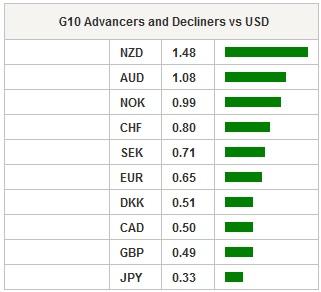

The USD appetite continues dominating the FX markets. The US 10-year yields finds support above 2%, while the DXY index tests 100 for the first time since March 2003. The rising risk is the Fed keeping its “patient” rhetoric at next week’s meeting. Then the relief rally should immediately reverse short-term dynamics in G10, high-beta and EM currencies that have been struggling at deepening oversold conditions since last week’s NFPs.

EUR/USD could hardly fall faster after Mario Draghi’s (unsurprising) comments on the QE. The pair hit 1.0495 overnight as buyers are obviously outweighed by fundamental and speculative shorts. With the broad target set to parity, traders should continue find opportunities in rallies to strengthen their short-EUR/USD positioning.

As suspected, 0.70 support remains challenging for EUR/GBP-bears. As the GBP-negative sentiment spills over the market on pre-election talks, GBP/USD eases to 1.4893, lowest since Jul’13. The bias remains on the downside with vanilla puts trailing below 1.4950/80 area. The key support stands at 1.4814 (Jul 9th 2013 low).

USD/CAD tested fresh 6-year highs (1.2799) as the WTI crude legged down to $47.33 in New York yesterday. The MACD (12, 26) stepped in bullish zone suggesting fresh interest in USD/CAD longs. Vanilla calls trail above 1.2650/1.27 and should give support before Friday’s labor data. The expectations are soft, therefore keeping the divergent BoC/Fed bets in charge for further loonie weakness verse USD.

In Brazil, the BCB minutes are due today and investors focus on bank’s comments about the accelerating consumer prices. The minutes will likely fall short of BCB hawks, while the central bank will doubtlessly leave the door open for further Selic rate hike given that it has little option other than conducting an aggressive, tight monetary policy to make sure to not lose control over the inflation diverging significantly from the BCB’s target. Indeed, the concerns on Rousseff’s ability to restore a fiscal discipline, the substantial depreciation in BRL combined to hawkish Fed expectations require tighter monetary policy, as the economic slowdown remains a major issue. There is the dilemma. The Congress postponed vote on the budget bill to March 17th.

Today traders focus on German, French and Spanish February Final CPI m/m & y/y, Swedish February Unemployment Rate, UK January Trade Balance, Euro-Zone January Industrial Production m/m & y/y, Canadian 4Q Capacity Utilization Rate and February Teranet/National Bank HPI m/m & y/y, Canadian January New Housing Price Index y/y, US February Retail Sales m/m, US March 7th Initial Jobless & February 28th Continuing Claims, Us February Import Price Index m/m & y/y, US January Business Inventories, US 4Q Household Change in Net Worth and US Monthly Budget Statement.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.