Market Brief

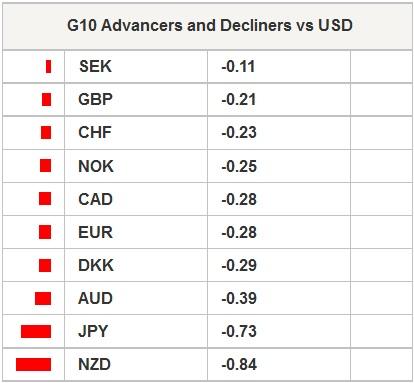

The USD was better bid against its G10 and EM peers in Asia, the risk appetite remains moderate. The Chinese GDP grew at the pace of 1.5% in 4Q, missed already weak market estimates (1.7% q/q exp. & 1.9% last). The GDP growth on year remained stable at 7.3% (vs. 7.2% exp.). An IMF economist said that the slower China growth will have adverse effect on trading partners as the IMF revised down its 2015 growth forecasts from 3.8% to 3.5%.

Gloomy macro news from China weighed on AUD overnight. AUD/USD legged down to 0.8160 (slightly above its 21-dma, 0.8148), the positive trend loses pace. Trend and momentum indicators remain marginally positive, yet offers at 0.8250/70 area need to be cleared for fresh upside attempt. Important resistance remains at 0.8316/20 (50-dma/October – January downtrend base).

JPY crosses were better bid in Tokyo, alongside with Nikkei stocks (+2.07%). USD/JPY advanced to 118.53, yet found sellers above the Ichimoku cloud top (118.48). The base and conversion line flattens before the BoJ decision. As we expect the BoJ to maintain the status quo, the accompanying statement, especially comments on the inflation target, should give fresh direction to JPY-complex from Wednesday. We are looking for a break above the Ichi cloud for fresh bull trend, while a step below 115.50/57 (Fibonacci 50% on Oct-Dec rally/December low) should trigger further slide to 112.45/113.50 area (Nov 3rd low/Ichi base). EUR/JPY recovers to 137.26. Given the broad EUR-negative sentiment, resistance is presumed at 138.00/138.27 (optionality/Fib 23.6% on December-January sell-off).

EUR/USD consolidates weakness with traders looking to sell the rallies before the ECB decision. As the ECB is expected to pull the trigger on QE by Thursday, the expectations of a sizeable action should keep the downside pressures tight on the EUR/USD despite oversold conditions (RSI at 22%). Decent option barriers trail below 1.17 for today, more vanilla puts abound below 1.16 from tomorrow. EUR/GBP holds ground above 0.76 with MACD comfortably negative, signaling the bias remains on the downside. Danish Central bank cut its CD rate by 15 basis points and stated that it has tools to defend the peg verse EUR.

Else, Turkey Central Bank gives policy verdict today. The lower oil and commodity prices, the expectations for further cool-off in inflation, the negative rates in Switzerland, the anticipations for further expansion in the Euro-zone, the surprise action in India (based on similar motives), combined to political pressures should lead to lower CBT to take advantage of the situation on rates. We expect 25 basis points cut in benchmark repo rate at today’s meeting. USD/TRY moves higher, a daily close above 2.3370 (MACD pivot) should signal a challenge of 2.3540 (January 5th high).

Today’s economic calendar : German December PPI m/m & y/y, Italian November Trade Balance, Euro Are 3Q Government Deficit, ZEW Survey on Current Situation and Expectations in Germany in January, ZEW Survey for Expectations in the Euro-zone in January, Canadian November Manufacturing Sales m/m and US January NAHB Housing Market Index.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.