Market Brief

Japanese retail sales unexpectedly accelerated to 2.7% in month to September, significantly beating 0.9% expectations (vs. 1.9% a month ago); large retailers’ sales slowed to 0.5% however, from 1.6% a month ago. The BoJ Governor Kuroda said that the inflation is half-way to goal as sales tax effect fades, adding that the BoJ will not hesitate to ease more if needed. USD/JPY and JPY crosses traded mixed in Tokyo, Nikkei stocks retreated 0.38%. USD/JPY couldn’t make it higher than 108.00, the bull momentum did not pick-up amid yesterday’s close at 107.92. We see further test of 108.00-offers if breached should signal a short-term bullish reversal for a close above 108.00 (MACD pivot). EUR/JPY sees resistance at daily Ichimoku base line (137.18). Given the weak EUR enthusiasm, offers at 50/100 dma (137.56/66) should cap the bull attempts.

EUR/USD sees support at its 21-dma (1.2692) since the ECB announced the purchase of 1.704 billion euros of covered bonds last week; this is twice as much as the market estimates (appr. 800 million euros). Starting from yesterday, the ECB will announce the amount of its purchases on weekly basis. According to ECB Vice President Constancio, there is a pool of 600 billion covered bonds and 400 billion ABS adequate for the ECB purchases. This picture does not hint at a potential QE and therefore gives support to EUR/USD pre-FOMC (Wed). Trend and momentum indicators are positive, the short-term resistance is eyed at 1.2853/1.2886 (area including Fib 23.6% on May-Oct sell-off, 50-dma & Oct 15th high). The support is placed at 1.2571/1.2614.

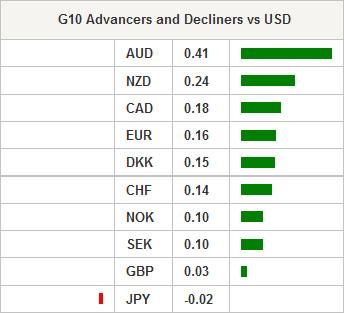

Among the G10 peers, NOK and CAD clearly suffer from the persistent slide in oil prices. The WTI hit a fresh low of $79.44 in New York yesterday. The bias in oil markets remains negative, suggesting the strengthening of the bull market in USD/CAD and USD/NOK. The recent macro developments should temper the EUR/CAD bears. The MACD (12, 26) is now flat. A daily close above 1.4265 should keep the bias on the upside.

Today, Riksbank gives policy verdict and is expected to cut the bank rate from 0.25% to 0.10% to temper the deflationary fears due to moderate Euro-zone growth and ultra-lose ECB policy. USD/SEK tests 7.30+ offers; trend and momentum indicators predict the end of the bearish consolidation period. A rate cut in line with expectations should be that trigger to push USD/SEK to the critical resistance of 7.3285 (mid-2012 high), while a lower cut should bring some downside correction, now that USD/SEK nears the 30-day upper Bollinger band. Support is eyed at 7.2000/7.2155 (psychological level / 21-dma). EUR/SEK rallied hard to 9.2817 after the ECB’s 1.7bn covered bond purchases announcement and will likely get support at 9.18/25 zone given the dovish Riksbank follow up. Important resistance is eyed at 9.40.

The economic calendar today: German September Import Price Index m/m & y/y, Spanish August Total Mortgage Lending and House Mortgage Approvals y/y, Swedish September PPI and Retail Sales m/m & y/y, Norwegian 3Q Industrial Confidence, Italian October Business Confidence and Economic Sentiment, US September Durable Goods Orders, US August S&P/CaseShiller House Price Index, US October Consumer Confidence and Richmond Fed October Manufacturing Index.

Swissquote Sqore Trade Ideas:

www.swissquote.com/fx/news/sqore

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.