Market Brief

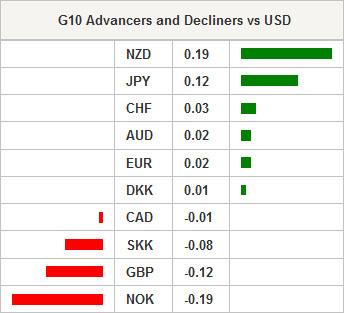

Risk appetite returned in the Asia session as global bond yields and asset volatility both easied. The Nikkei led the regional equity indices by rallying +2.64%, the Hang Seng rose +1.22, yet Shanghai was unable to follow dropping +0.66%. The fall was due to speculation that the PBoC is likely to keep interest rate unchanged despite signals of economic deceleration (although GDP and Industrial production came in higher than anticipated yesterday). Instead the chinese central bank will rely on economic reforms rather than traditional interest rate driven monetary policy. USDJPY fell back to 106.80 from earlier highs at 107.10 as the Nikkei rallied over 15k. Elsewhere, Japan PM advisory Honda stated that the additional VAT should be delayed till Apr ’17, due to the economic risk. In other Japanese data Sept trade deficit Y958.3bln, Y777bln expected, exports +6.9% y/y, imports +6.2%, +6.8% and +3% expected. AUDUSD was range bound between 0.8760 and 0.8800 with volatility increaseing around the CPI release. The RBA cut their mean estimated to CPI +0.4% qoq, +2.5% yoy. In addition Australia Sept Westpac leading index fell to 97.92 from 97.97 while Aug Conference Board LEI -0.2% to 128.9.

BoE Minutes

The policy debate within the BoE is clearly heating up. The risk-on environment pushed GBP/USD above the 21-dma (1.6148). Despite strengthening momentum, GBP-bulls remain sidelined before BoE minutes due today, expectations are somewhat dovish. Given the recent developments, traders should stand ready for any dovish shift in the BoE view. The fading forward rate agreements on 3m/6m contracts reveal rising bets for a delay in the first BoE rate hike. The MPC SONIA suggests a delay as far as August-September 2015. The minutes will confirm whether the anxieties are funded or not. The MPC members are expected to have voted 7-2 for keeping the BoE bank rate unchanged at the historical low of 0.50%. Some participants certainly defended the view that the rate hike should start earlier (former expectations favored February 2015) and should rise gradually. Among BoE hawks, Martin Weale, who voted for rate increase in August and September MPC meetings as he finds it appropriate to “anticipate the wage growth”. “The margin of spare capacity is shrinking rapidly” argues Weale “and all logic suggests that that ought to lead to an increase in inflationary pressures”. Others members most likely kept the cautious tone given the slack in the labor market, weak growth in wages and soft inflation dynamics. The dove-hawk balance will be at GBP-traders radar.

US CPI

In the US, headline CPI is expected to rise to 0.1% is September with the yoy figures holding steady at 1.7%. Core CPI is expected to rise 0.2% which follows August flat reading. The upwards trending inflation should help relieve some concern that the fed is likely to delay the end of asset purchases this week and give the USD a bullish tone.

SQORE

Swissquote SQORE Trade Idea:

G10 Currency Trend Model: Sell AUDUSD at 1.8817

For trade details or more great trade ideas,

visit Swissquote SQORE platform: sqore.swissquote.com

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.