Market Brief

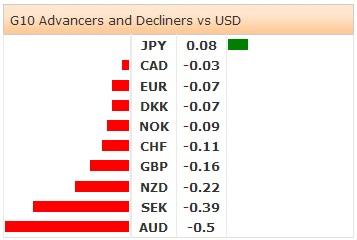

The Chinese industrial production grew by 6.9% y/y, much worse than expected on year to August (vs. 8.8% exp. & 9.0% last); the retail sales increased 11.9% (vs. 12.1% exp. & 12.2% last). The Asian equities mostly started the week in red, the EM currencies underperformed against the USD. USD/CNY rebounded from 6.1309, and tests the 21-dma (6.1428). The soft data clearly boost expectations for further PBoC stimulus, thus should further weigh on the Yuan. The key support stands at 6.1264 (Fib 38.2% level on January-May rally).

AUD-complex opened with heavy selling pressures on Chinese news. AUD/USD gap opened at 0.9017 (vs. Friday’s close at 0.9038) and sold-off to 0.8984 for the first time in 6 months. Given the oversold conditions (RSI at 24%, 30-day lower BB at 0.9096), we believe a correction is underway before the FOMC meeting (Sep 16-17th). NZD/USD extended weakness to 0.8124 in the shadow of AUD sell-off. The key support is placed at 0.8052 (Feb 4th low), level at which the 2014 gains will be fully pared. AUD/NZD rebounded from 1.1040 (Fib 50% on Nov’13 – Jan’14 drop). The selling pressures in AUD keep the antipodean cross biased negatively. Besides the FOMC meeting, the NZ event risks should also be taken into consideration this week as Sep 20th national elections may result in new challenges for the RBNZ.

USD/JPY and JPY crosses had a smooth start to the week due to Tokyo holiday. USD/JPY traded in the tight range of 107.15/37. Presumed offers at 107.50 (Jap exporters, optionality) kept the upside limited in the absence of fresh news. Higher US yields remain supportive of USD/JPY in the overbought territories (RSI at 82%). The FOMC meeting will be closely monitored. As investors are decidedly aligned toward a hawkish tone from the Fed, any dovish comment should halt the USD/JPY rally. The event risk is high.

EUR/USD consolidates weakness below 1.3000-resistance. The pair will likely stabilize pre-FOMC. As the negative momentum fades, a re-test of 1.2980/1.3000 zone is possible. The EUR-complex is likely to continue getting some support from further unwinding of EUR-funded carry trades as carry strategists will prefer to stay in the sidelines to avoid the event risk on the FOMC. Stops are eyed above 1.3000, while option barriers are placed at 1.3050+.

We are heading into an important week for the UK. On September 18th, Scotland will vote whether to stay in the UK or to leave. The political situation remains tense. Last week’s technical correction brought GBP/USD toward 1.6280; the morning star bet resulted in short-term profit. Heading into this event-full week, trend and momentum indicators are perfectly flat. The GBP-complex remains too sensitive to news/polls on Scottish referendum; the short-term moves are sharp and unpredictable. We stay in the sidelines. Regarding the option strikes, 1.6300 seems the pivot level of the week. Offers trail below, bids dominate above this level.

This Monday, traders watch Swiss August Producer and Import Prices m/m & y/y, Euro-Zone July Trade Balance, US September Empire Manufacturing, Canadian August Existing Home Sales, US August Industrial Production and Capacity Utilization and US August Manufacturing (SIC) Production.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.